Answered step by step

Verified Expert Solution

Question

1 Approved Answer

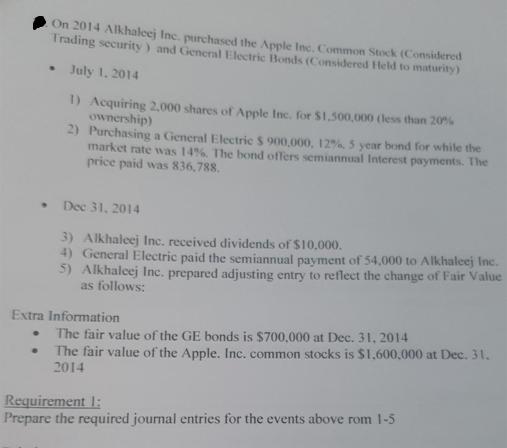

On 2014 Alkhaleej Inc. purchased the Apple Inc. Common Stock (Considered Trading security) and General Electric Bonds (Considered Held to maturity) July 1, 2014

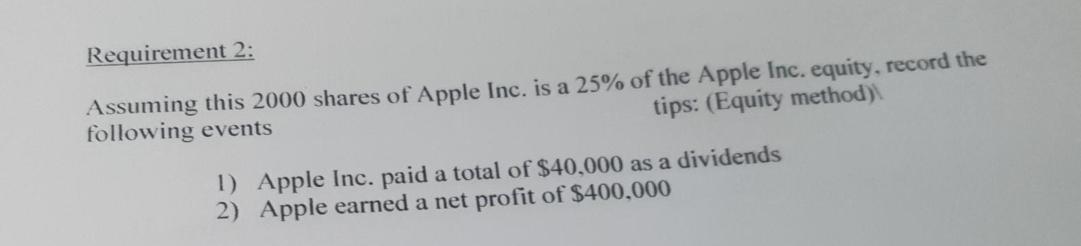

On 2014 Alkhaleej Inc. purchased the Apple Inc. Common Stock (Considered Trading security) and General Electric Bonds (Considered Held to maturity) July 1, 2014 1) Acquiring 2,000 shares of Apple Inc. for $1,500,000 (less than 20% ownership) 2) Purchasing a General Electric $ 900,000, 12%, 5 year bond for while the market rate was 14%. The bond offers semiannual Interest payments. The price paid was 836,788. Dec 31, 2014 3) Alkhaleej Inc. received dividends of $10,000. 4) General Electric paid the semiannual payment of 54,000 to Alkhaleej Inc. 5) Alkhaleej Inc. prepared adjusting entry to reflect the change of Fair Value as follows: Extra Information The fair value of the GE bonds is $700,000 at Dec. 31, 2014 The fair value of the Apple. Inc. common stocks is $1,600,000 at Dec. 31. 2014 Requirement 1: Prepare the required journal entries for the events above rom 1-5 Requirement 2: Assuming this 2000 shares of Apple Inc. is a 25% of the Apple Inc. equity, record the tips: (Equity method) following events 1) Apple Inc. paid a total of $40,000 as a dividends 2) Apple earned a net profit of $400,000

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTTION Requirement 1 Journal Entries for Events 15 Acquiring 2000 shares of Apple Inc for 1500000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started