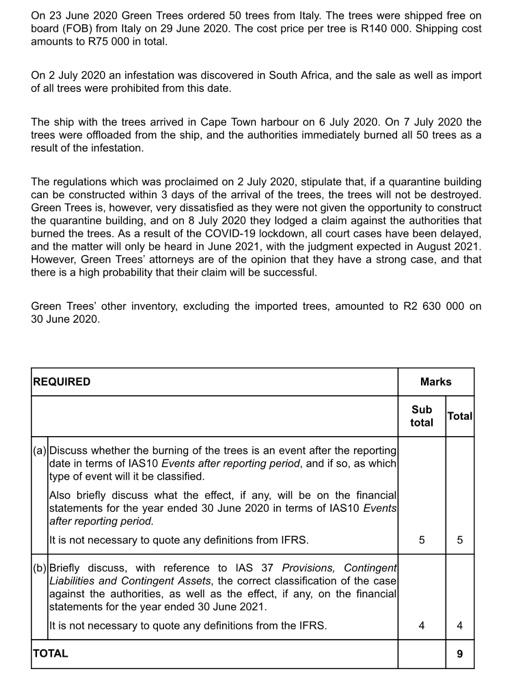

On 23 June 2020 Green Trees ordered 50 trees from Italy. The trees were shipped free on board (FOB) from Italy on 29 June 2020. The cost price per tree is R140 000. Shipping cost amounts to R75 000 in total. On 2 July 2020 an infestation was discovered in South Africa, and the sale as well as import of all trees were prohibited from this date. The ship with the trees arrived in Cape Town harbour on 6 July 2020. On 7 July 2020 the trees were offloaded from the ship, and the authorities immediately burned all 50 trees as a result of the infestation The regulations which was proclaimed on 2 July 2020. stipulate that, if a quarantine building can be constructed within 3 days of the arrival of the trees, the trees will not be destroyed. Green Trees is, however, very dissatisfied as they were not given the opportunity to construct the quarantine building, and on 8 July 2020 they lodged a claim against the authorities that burned the trees. As a result of the COVID-19 lockdown, all court cases have been delayed, and the matter will only be heard in June 2021, with the judgment expected in August 2021. However, Green Trees' attorneys are of the opinion that they have a strong case, and that there is a high probability that their claim will be successful. Green Trees' other inventory, excluding the imported trees, amounted to R2 630 000 on 30 June 2020. REQUIRED Marks Sub total Total (a) Discuss whether the burning of the trees is an event after the reporting date in terms of IAS 10 Events after reporting period, and if so, as which type of event will it be classified. Also briefly discuss what the effect, if any, will be on the financial statements for the year ended 30 June 2020 in terms of IAS10 Events after reporting period. it is not necessary to quote any definitions from IFRS. (6) Briefly discuss, with reference to IAS 37 Provisions, Contingent Liabilities and Contingent Assets, the correct classification of the case against the authorities, as well as the effect, if any, on the financial statements for the year ended 30 June 2021. it is not necessary to quote any definitions from the IFRS. 5 5 4 TOTAL On 23 June 2020 Green Trees ordered 50 trees from Italy. The trees were shipped free on board (FOB) from Italy on 29 June 2020. The cost price per tree is R140 000. Shipping cost amounts to R75 000 in total. On 2 July 2020 an infestation was discovered in South Africa, and the sale as well as import of all trees were prohibited from this date. The ship with the trees arrived in Cape Town harbour on 6 July 2020. On 7 July 2020 the trees were offloaded from the ship, and the authorities immediately burned all 50 trees as a result of the infestation The regulations which was proclaimed on 2 July 2020. stipulate that, if a quarantine building can be constructed within 3 days of the arrival of the trees, the trees will not be destroyed. Green Trees is, however, very dissatisfied as they were not given the opportunity to construct the quarantine building, and on 8 July 2020 they lodged a claim against the authorities that burned the trees. As a result of the COVID-19 lockdown, all court cases have been delayed, and the matter will only be heard in June 2021, with the judgment expected in August 2021. However, Green Trees' attorneys are of the opinion that they have a strong case, and that there is a high probability that their claim will be successful. Green Trees' other inventory, excluding the imported trees, amounted to R2 630 000 on 30 June 2020. REQUIRED Marks Sub total Total (a) Discuss whether the burning of the trees is an event after the reporting date in terms of IAS 10 Events after reporting period, and if so, as which type of event will it be classified. Also briefly discuss what the effect, if any, will be on the financial statements for the year ended 30 June 2020 in terms of IAS10 Events after reporting period. it is not necessary to quote any definitions from IFRS. (6) Briefly discuss, with reference to IAS 37 Provisions, Contingent Liabilities and Contingent Assets, the correct classification of the case against the authorities, as well as the effect, if any, on the financial statements for the year ended 30 June 2021. it is not necessary to quote any definitions from the IFRS. 5 5 4 TOTAL