Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 24 May 2021, a futures speculator opens a short position on 13 contracts of an ASX Trade24 Australian 10-year Treasury bond futures with

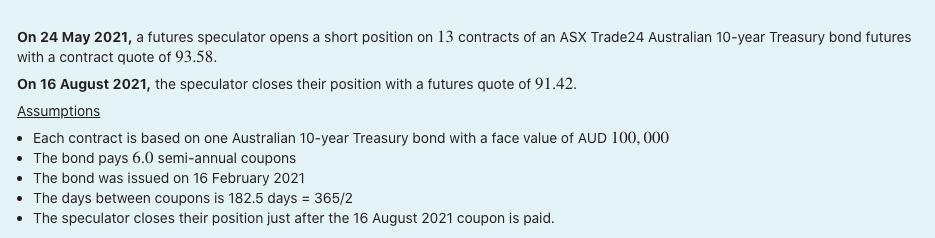

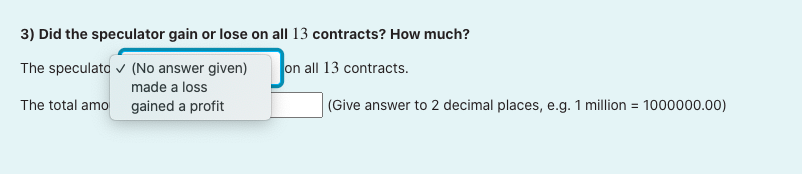

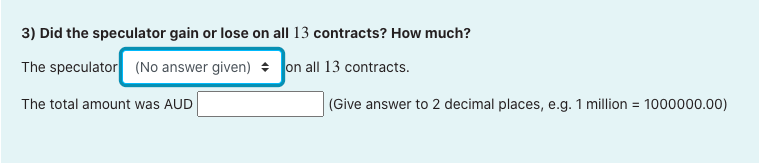

On 24 May 2021, a futures speculator opens a short position on 13 contracts of an ASX Trade24 Australian 10-year Treasury bond futures with a contract quote of 93.58. On 16 August 2021, the speculator closes their position with a futures quote of 91.42. Assumptions Each contract is based on one Australian 10-year Treasury bond with a face value of AUD 100,000 The bond pays 6.0 semi-annual coupons The bond was issued on 16 February 2021 The days between coupons is 182.5 days = 365/2 The speculator closes their position just after the 16 August 2021 coupon is paid. 3) Did the speculator gain or lose on all 13 contracts? How much? The speculato (No answer given) made a loss The total amo gained a profit on all 13 contracts. (Give answer to 2 decimal places, e.g. 1 million = 1000000.00) 3) Did the speculator gain or lose on all 13 contracts? How much? The speculator (No answer given) on all 13 contracts. The total amount was AUD (Give answer to 2 decimal places, e.g. 1 million = 1000000.00)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started