Question

On 30 June 2017, Sue sold her holiday house for $550,000. The house had been purchased on 1 March 2006 for $360,000. At the time

On 30 June 2017, Sue sold her holiday house for $550,000. The house had been purchased on 1 March 2006 for $360,000. At the time of acquiring the holiday house Sue incurred $5,000 in stamp duty, $4,000 in valuation costs and $1,000 for a conveyancing kit as she had chosen to do the transfer of the property herself rather than hire a solicitor.

On 1 July 2008 Sue incurred costs of $15,000 in removing an old dilapidated garage from the property. On 1 July 2009 she incurred legal costs of $5,000 in a dispute with her neighbour over the proper location of the boundary separating their respective properties. On 1 February 2010, Sue spent $40,000 adding a second floor to the house. During the period that she owned the house she had paid a total of $60,000 in interest, rates and insurance. She rented the property for six months in the 2008-2009 income year and had claimed $15,000 of the $60,000 in respect of interest, rates and insurance as a tax deduction in her personal tax return. She used the property solely for her personal use at all other times.

Prior to the sale, Sue granted a $10,500 three month option to purchase the property for $480,000 to a local property developer on 1 January 2017. The option lapsed on 31 March 2017. Sue retained the $10,500. Her solicitor charged her $500 legal fees to prepare the option contract. At settlement she incurred legal expenses of $2,000 and real estate agent’s commission of $8,000 in relation to the sale of her holiday house.

On 4 April 2017, Sue also sold her Porsche sports car that she had bought for $165,000 on 2 April 2006 for $110,000. She gave her painting by Monet to her brother on 16 May 2017. The painting cost her $560,000 and was valued at $580,000 on the day she gave it to her brother.

Sue has an unabsorbed capital loss of $120,000 from the sale of shares in the 2007-2008 income year. She also has capital gain of $35,000 from the sale of her father’s World War II bravery medal.

During the 2016-2017 income year, Sue earned $60,000 as a part-time school teacher but she made a loss of $25,000 from her fudge manufacturing business. The fudge business has made a taxable profit in every one of the ten years Sue has owned the fudge making business except the 2016-2017 income year.

****REQUIRED****

Calculate Sue’s tax payable for the income year ending 30 June 2017.

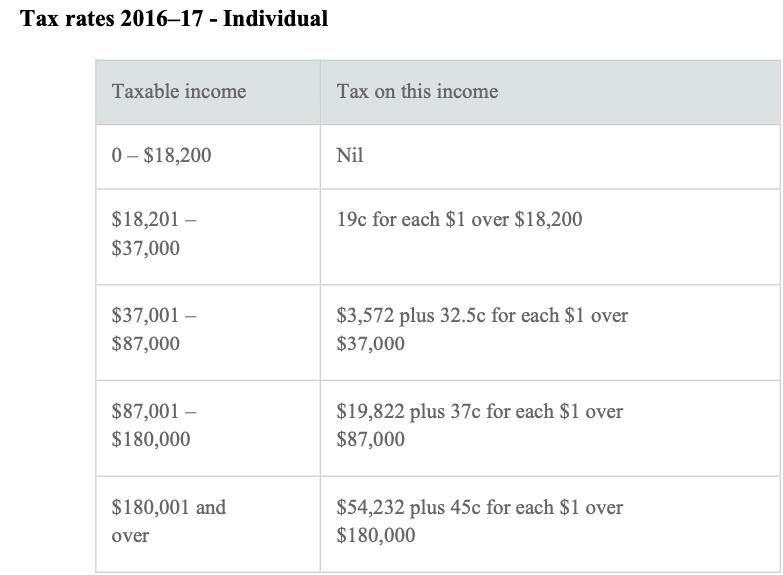

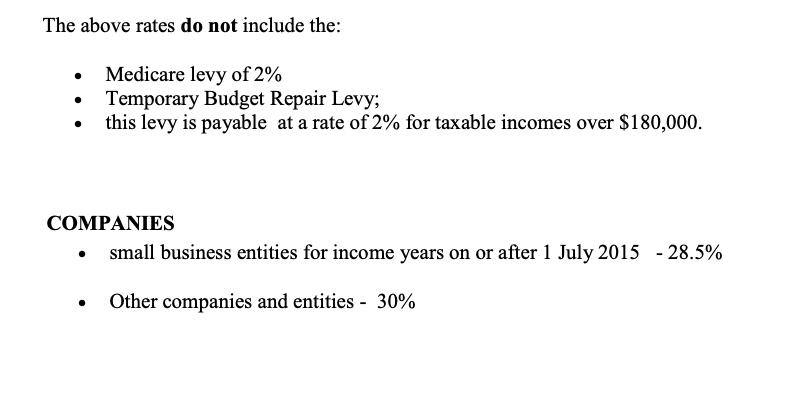

Tax rates 2016-17 - Individual Taxable income 0-$18,200 $18,201 - $37,000 $37,001 - $87,000 $87,001 - $180,000 $180,001 and over Tax on this income Nil 19c for each $1 over $18,200 $3,572 plus 32.5c for each $1 over $37,000 $19,822 plus 37c for each $1 over $87,000 $54,232 plus 45c for each $1 over $180,000

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Gain on sale of Property 1 Gross sale proceeds of the apartment 580000 Less Expenses incidental to s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started