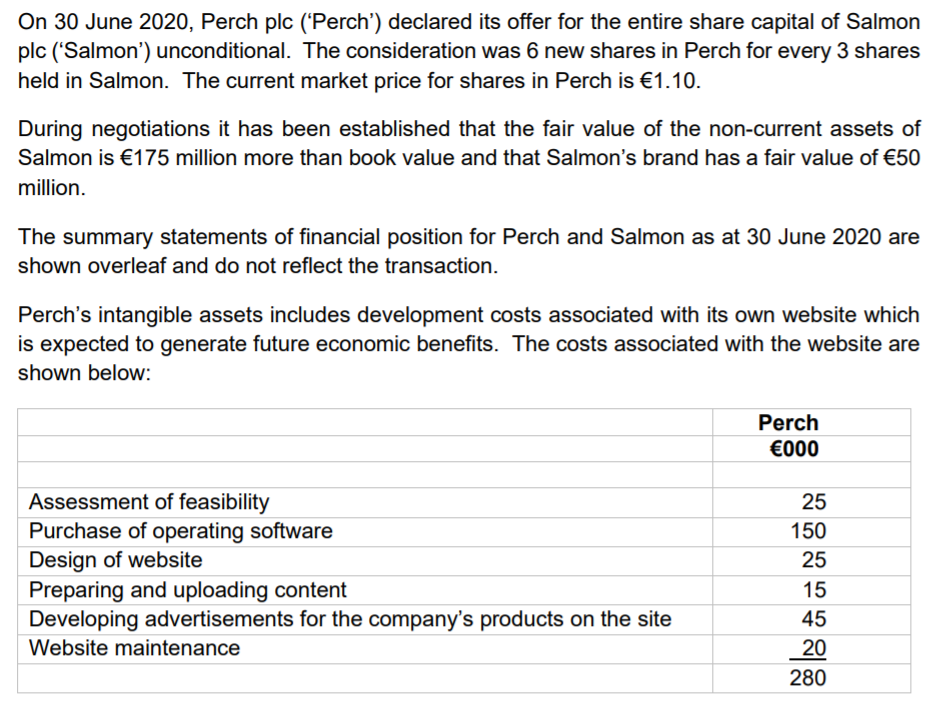

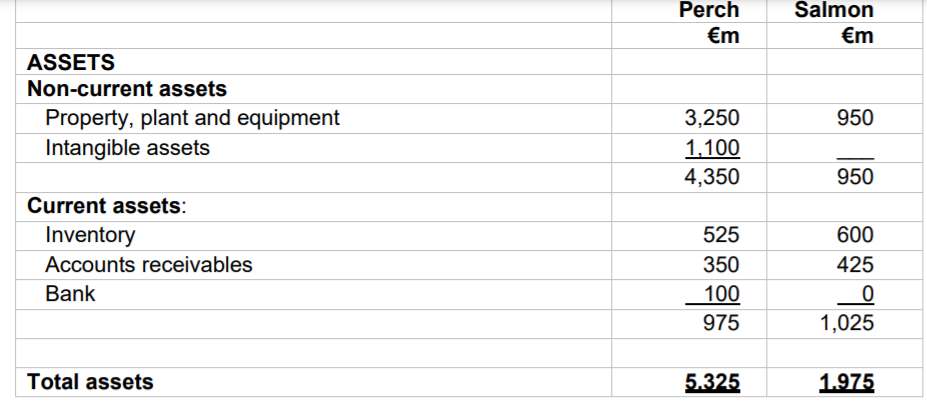

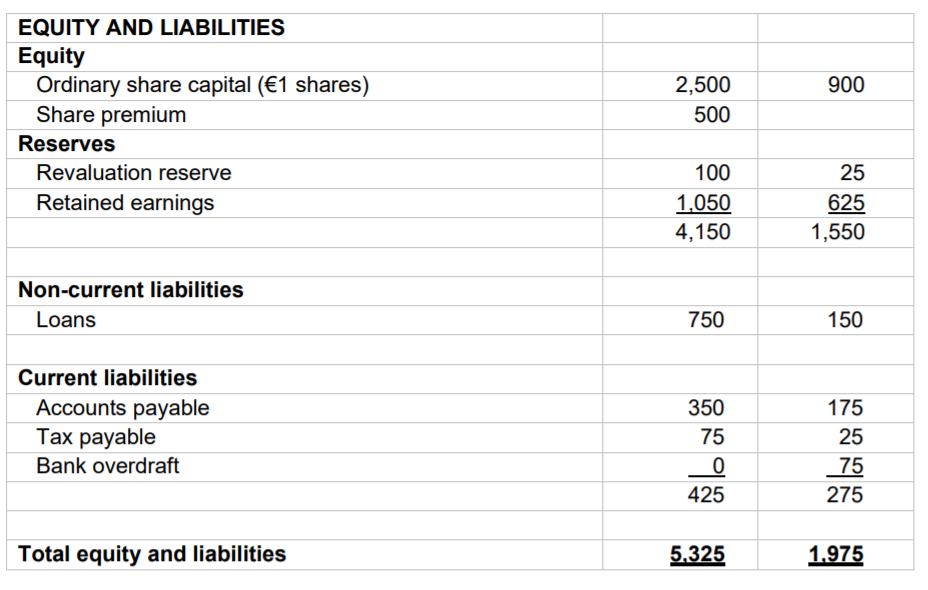

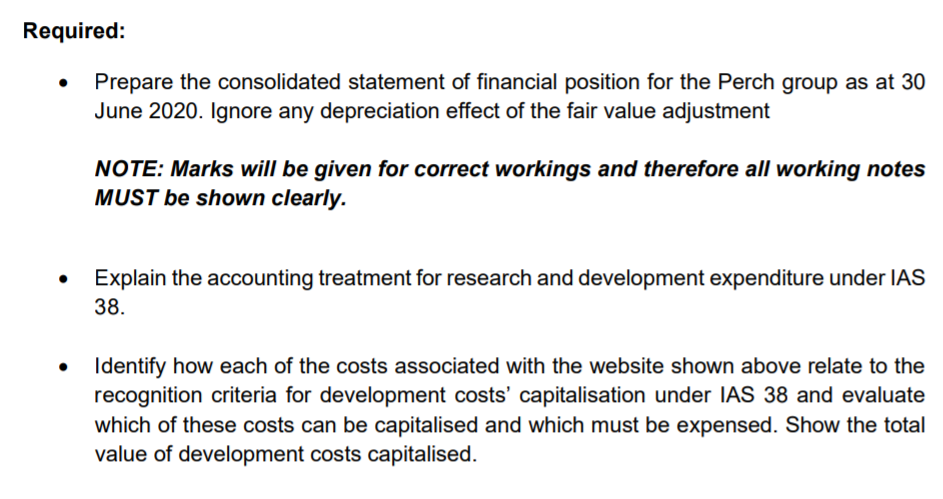

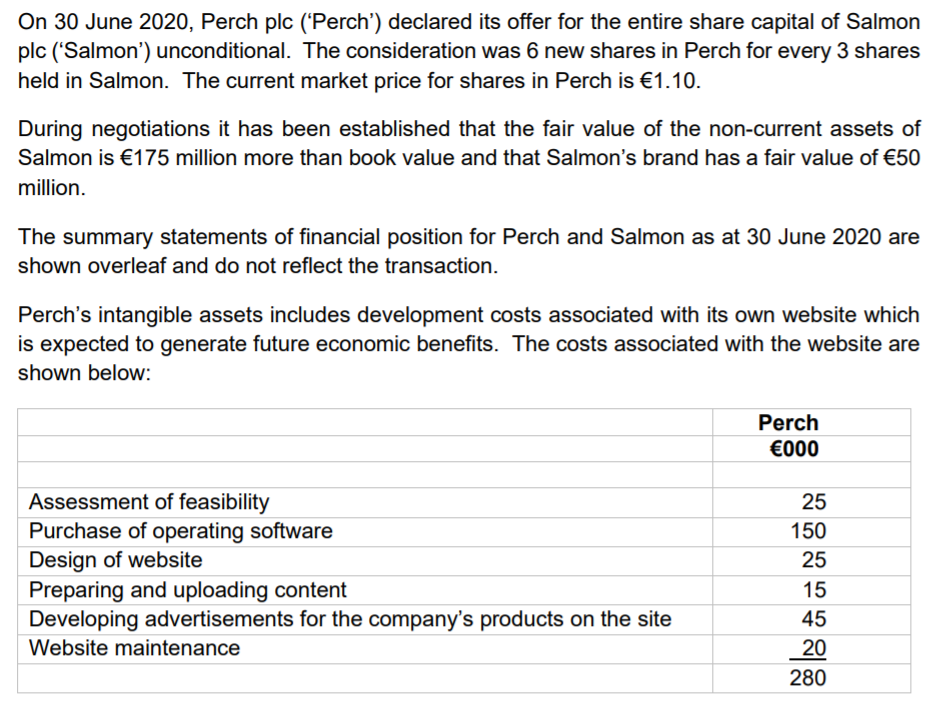

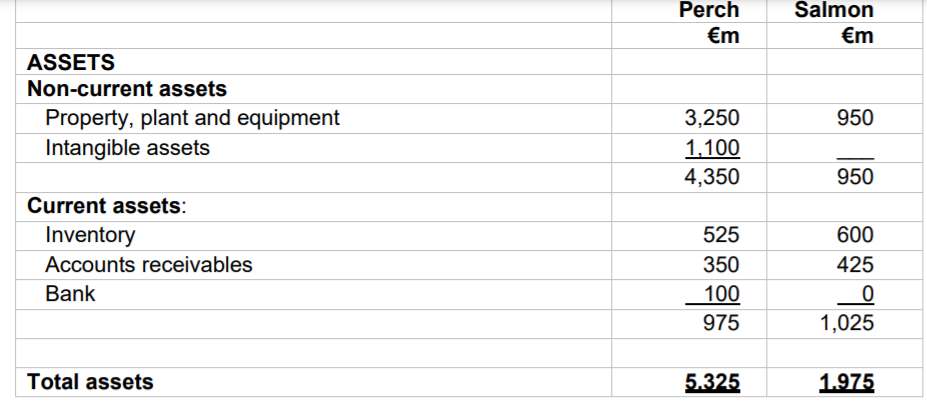

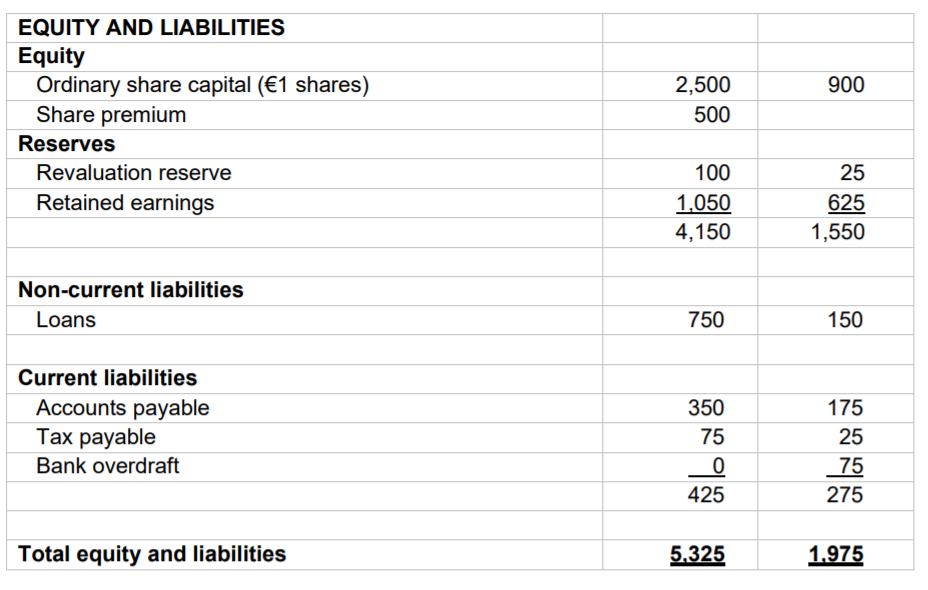

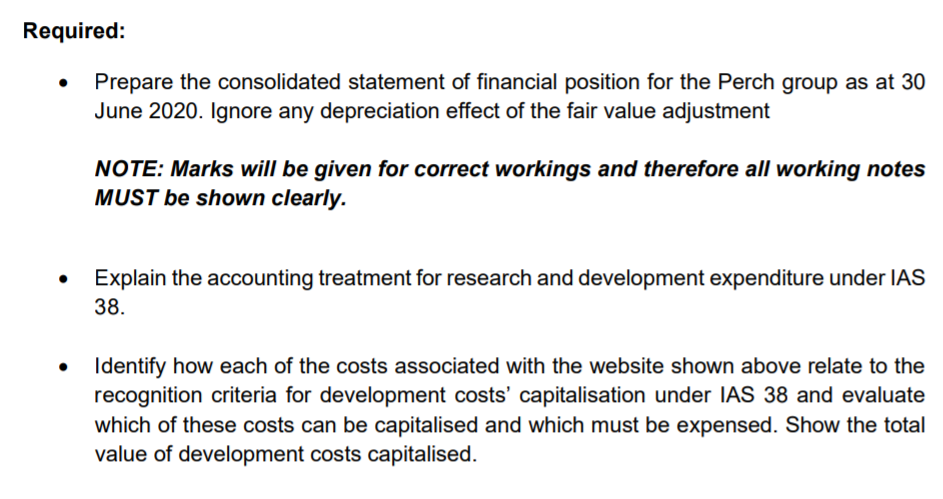

On 30 June 2020, Perch plc ('Perch') declared its offer for the entire share capital of Salmon plc ('Salmon') unconditional. The consideration was 6 new shares in Perch for every 3 shares held in Salmon. The current market price for shares in Perch is 1.10. During negotiations it has been established that the fair value of the non-current assets of Salmon is 175 million more than book value and that Salmon's brand has a fair value of 50 million. The summary statements of financial position for Perch and Salmon as at 30 June 2020 are shown overleaf and do not reflect the transaction. Perch's intangible assets includes development costs associated with its own website which is expected to generate future economic benefits. The costs associated with the website are shown below: Perch 000 Assessment of feasibility Purchase of operating software Design of website Preparing and uploading content Developing advertisements for the company's products on the site Website maintenance 25 150 25 15 45 20 280 Perch m Salmon m ASSETS Non-current assets Property, plant and equipment Intangible assets 950 3,250 1,100 4,350 950 Current assets: Inventory Accounts receivables Bank 525 350 100 975 600 425 0 1,025 Total assets 5.325 1.975 900 EQUITY AND LIABILITIES Equity Ordinary share capital (1 shares) Share premium Reserves Revaluation reserve Retained earnings 2,500 500 100 1,050 4,150 25 625 1,550 Non-current liabilities Loans 750 150 Current liabilities Accounts payable Tax payable Bank overdraft 350 75 0 425 175 25 75 275 Total equity and liabilities 5.325 1.975 Required: Prepare the consolidated statement of financial position for the Perch group as at 30 June 2020. Ignore any depreciation effect of the fair value adjustment NOTE: Marks will be given for correct workings and therefore all working notes MUST be shown clearly. Explain the accounting treatment for research and development expenditure under IAS 38. Identify how each of the costs associated with the website shown above relate to the recognition criteria for development costs' capitalisation under IAS 38 and evaluate which of these costs can be capitalised and which must be expensed. Show the total value of development costs capitalised. On 30 June 2020, Perch plc ('Perch') declared its offer for the entire share capital of Salmon plc ('Salmon') unconditional. The consideration was 6 new shares in Perch for every 3 shares held in Salmon. The current market price for shares in Perch is 1.10. During negotiations it has been established that the fair value of the non-current assets of Salmon is 175 million more than book value and that Salmon's brand has a fair value of 50 million. The summary statements of financial position for Perch and Salmon as at 30 June 2020 are shown overleaf and do not reflect the transaction. Perch's intangible assets includes development costs associated with its own website which is expected to generate future economic benefits. The costs associated with the website are shown below: Perch 000 Assessment of feasibility Purchase of operating software Design of website Preparing and uploading content Developing advertisements for the company's products on the site Website maintenance 25 150 25 15 45 20 280 Perch m Salmon m ASSETS Non-current assets Property, plant and equipment Intangible assets 950 3,250 1,100 4,350 950 Current assets: Inventory Accounts receivables Bank 525 350 100 975 600 425 0 1,025 Total assets 5.325 1.975 900 EQUITY AND LIABILITIES Equity Ordinary share capital (1 shares) Share premium Reserves Revaluation reserve Retained earnings 2,500 500 100 1,050 4,150 25 625 1,550 Non-current liabilities Loans 750 150 Current liabilities Accounts payable Tax payable Bank overdraft 350 75 0 425 175 25 75 275 Total equity and liabilities 5.325 1.975 Required: Prepare the consolidated statement of financial position for the Perch group as at 30 June 2020. Ignore any depreciation effect of the fair value adjustment NOTE: Marks will be given for correct workings and therefore all working notes MUST be shown clearly. Explain the accounting treatment for research and development expenditure under IAS 38. Identify how each of the costs associated with the website shown above relate to the recognition criteria for development costs' capitalisation under IAS 38 and evaluate which of these costs can be capitalised and which must be expensed. Show the total value of development costs capitalised