Answered step by step

Verified Expert Solution

Question

1 Approved Answer

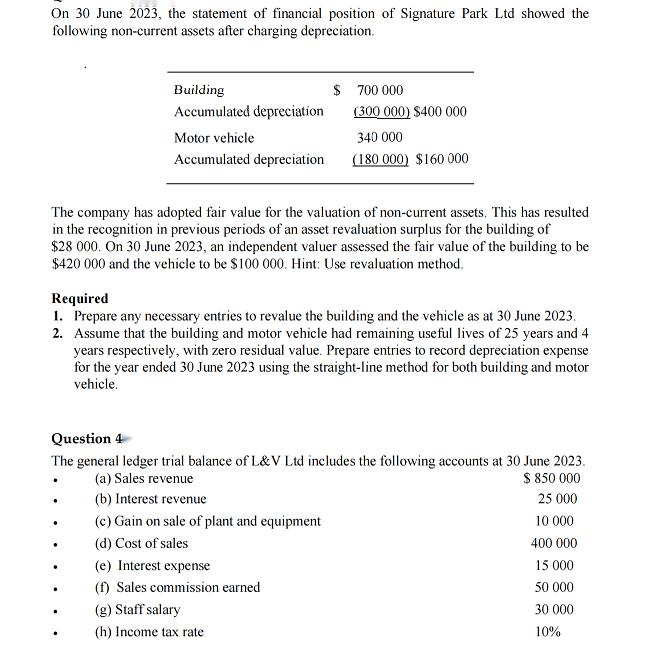

On 30 June 2023, the statement of financial position of Signature Park Ltd showed the following non-current assets after charging depreciation. Building $ 700

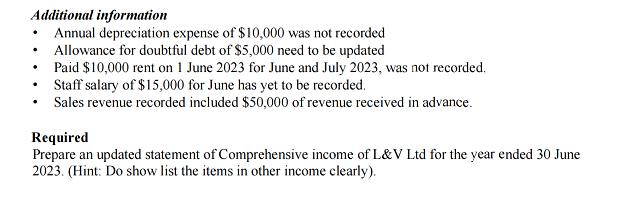

On 30 June 2023, the statement of financial position of Signature Park Ltd showed the following non-current assets after charging depreciation. Building $ 700 000 Accumulated depreciation Motor vehicle Accumulated depreciation (300 000) $400 000 340 000 (180 000) $160 000 The company has adopted fair value for the valuation of non-current assets. This has resulted in the recognition in previous periods of an asset revaluation surplus for the building of $28 000. On 30 June 2023, an independent valuer assessed the fair value of the building to be $420 000 and the vehicle to be $100 000. Hint: Use revaluation method. Required 1. Prepare any necessary entries to revalue the building and the vehicle as at 30 June 2023. 2. Assume that the building and motor vehicle had remaining useful lives of 25 years and 4 years respectively, with zero residual value. Prepare entries to record depreciation expense for the year ended 30 June 2023 using the straight-line method for both building and motor vehicle. Question 4 The general ledger trial balance of L&V Ltd includes the following accounts at 30 June 2023. (a) Sales revenue (b) Interest revenue (c) Gain on sale of plant and equipment (d) Cost of sales (e) Interest expense $ 850 000 25 000 10 000 400 000 . (f) Sales commission earned (g) Staff salary (h) Income tax rate 15 000 50 000 30.000 10% Additional information . Annual depreciation expense of $10,000 was not recorded Allowance for doubtful debt of $5,000 need to be updated Paid $10,000 rent on 1 June 2023 for June and July 2023, was not recorded. Staff salary of $15,000 for June has yet to be recorded. Sales revenue recorded included $50,000 of revenue received in advance. Required Prepare an updated statement of Comprehensive income of L&V Ltd for the year ended 30 June 2023. (Hint: Do show list the items in other income clearly).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started