Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 30 September 2014, Pelangi Berhad, a listed company had 8 million ordinary shares amounted to RM4 million. Two months later, on 1 December

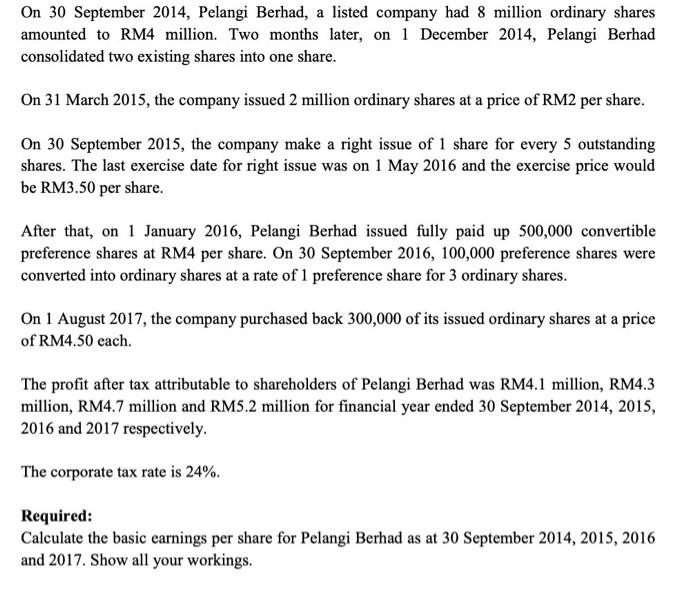

On 30 September 2014, Pelangi Berhad, a listed company had 8 million ordinary shares amounted to RM4 million. Two months later, on 1 December 2014, Pelangi Berhad consolidated two existing shares into one share. On 31 March 2015, the company issued 2 million ordinary shares at a price of RM2 per share. On 30 September 2015, the company make a right issue of 1 share for every 5 outstanding shares. The last exercise date for right issue was on 1 May 2016 and the exercise price would be RM3.50 per share. After that, on 1 January 2016, Pelangi Berhad issued fully paid up 500,000 convertible preference shares at RM4 per share. On 30 September 2016, 100,000 preference shares were converted into ordinary shares at a rate of 1 preference share for 3 ordinary shares. On 1 August 2017, the company purchased back 300,000 of its issued ordinary shares at a price of RM4.50 cach. The profit after tax attributable to shareholders of Pelangi Berhad was RM4.1 million, RM4.3 million, RM4.7 million and RMS.2 million for financial year ended 30 September 2014, 2015, 2016 and 2017 respectively. The corporate tax rate is 24%. Required: Calculate the basic earnings per share for Pelangi Berhad as at 30 September 2014, 2015, 2016 and 2017. Show all your workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started