Answered step by step

Verified Expert Solution

Question

1 Approved Answer

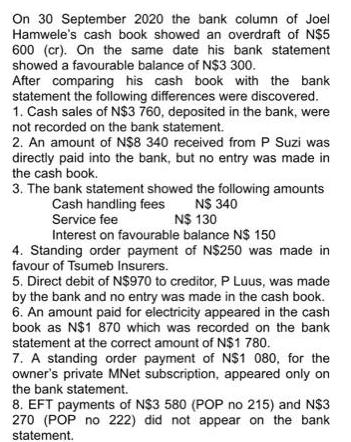

On 30 September 2020 the bank column of Joel Hamwele's cash book showed an overdraft of N$5 600 (cr). On the same date his

On 30 September 2020 the bank column of Joel Hamwele's cash book showed an overdraft of N$5 600 (cr). On the same date his bank statement showed a favourable balance of N$3 300. After comparing his cash book with the bank statement the following differences were discovered. 1. Cash sales of N$3 760, deposited in the bank, were not recorded on the bank statement. 2. An amount of N$8 340 received from P Suzi was directly paid into the bank, but no entry was made in the cash book. 3. The bank statement showed the following amounts Cash handling fees N$ 340 Service fee N$ 130 Interest on favourable balance N$ 150 4. Standing order payment of N$250 was made in favour of Tsumeb Insurers. 5. Direct debit of N$970 to creditor, P Luus, was made by the bank and no entry was made in the cash book. 6. An amount paid for electricity appeared in the cash book as N$1 870 which was recorded on the bank statement at the correct amount of N$1 780. 7. A standing order payment of NS1 080, for the owner's private MNet subscription, appeared only on the bank statement. 8. EFT payments of N$3 580 (POP no 215) and N$3 270 (POP no 222) did not appear on the bank statement. REQUIRED (a) Make the necessary entries to update the bank columns of the cash book. Bring down the balance on 1 October 2020. (b) Prepare a bank reconciliation statement on 30 September 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To update the bank columns of Joel Hamweles cash book and prepare a bank reconciliation statement on September 30 2020 we will go through each of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started