Question

On 30th September 2018, the financial position of OGS Ltd. and Manu Ltd. were as follows: OGS Ltd. Manu Ltd. Assets Non-current assets PPE 1,054,000

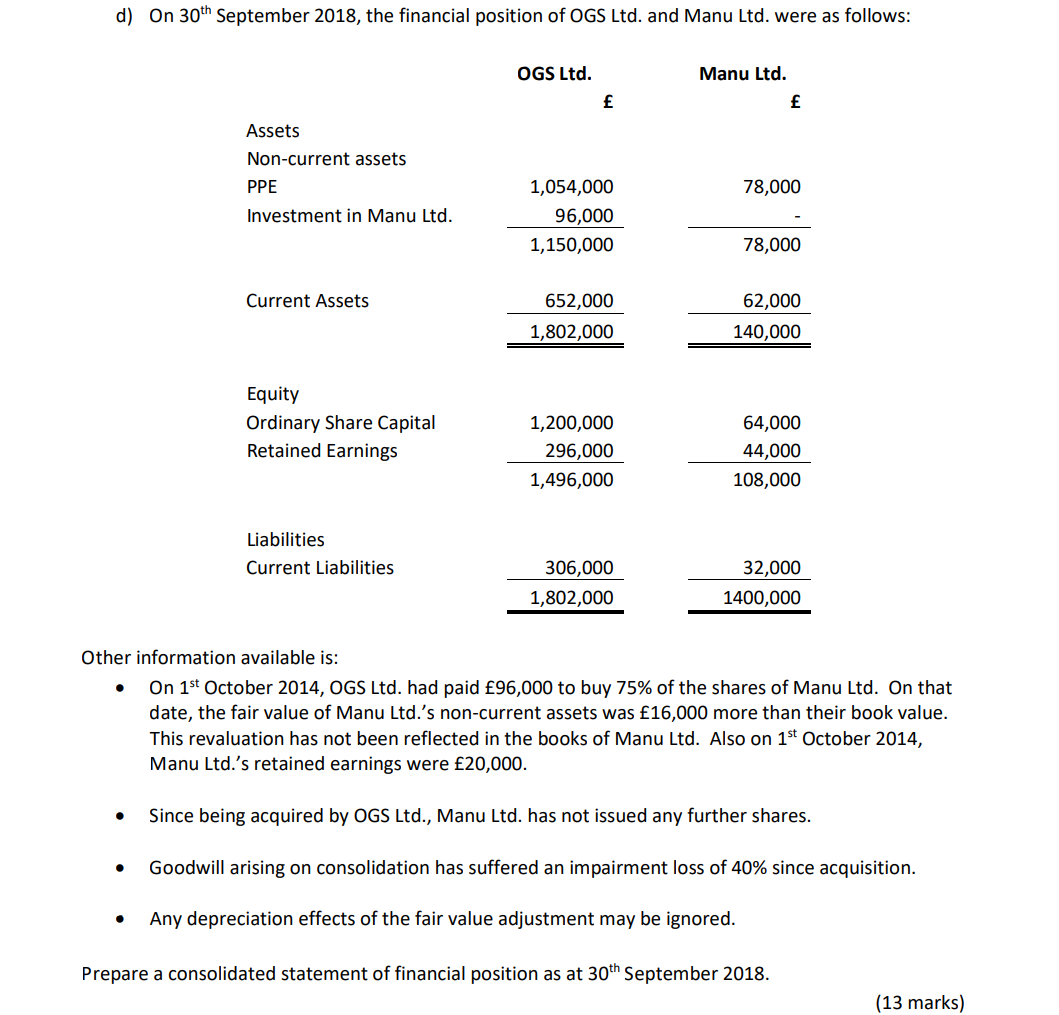

On 30th September 2018, the financial position of OGS Ltd. and Manu Ltd. were as follows: OGS Ltd. Manu Ltd. Assets Non-current assets PPE 1,054,000 78,000 Investment in Manu Ltd. 96,000 - 1,150,000 78,000 Current Assets 652,000 62,000 1,802,000 140,000 Equity Ordinary Share Capital 1,200,000 64,000 Retained Earnings 296,000 44,000 1,496,000 108,000 Liabilities Current Liabilities 306,000 32,000 1,802,000 1400,000 Other information available is: On 1st October 2014, OGS Ltd. had paid 96,000 to buy 75% of the shares of Manu Ltd. On that date, the fair value of Manu Ltd.s non-current assets was 16,000 more than their book value. This revaluation has not been reflected in the books of Manu Ltd. Also on 1st October 2014, Manu

d) On \\( 30^{\\text {th }} \\) September 2018, the financial position of OGS Ltd. and Manu Ltd. were as follows: Other information available is: - \\( \\quad \\) On \\( 1^{\\text {st }} \\) October 2014, OGS Ltd. had paid \\( 96,000 \\) to buy \75 of the shares of Manu Ltd. On that date, the fair value of Manu Ltd.'s non-current assets was \\( 16,000 \\) more than their book value. This revaluation has not been reflected in the books of Manu Ltd. Also on \\( 1^{\\text {st }} \\) October 2014, Manu Ltd.'s retained earnings were \\( 20,000 \\). - \\( \\quad \\) Since being acquired by OGS Ltd., Manu Ltd. has not issued any further shares. - Goodwill arising on consolidation has suffered an impairment loss of \40 since acquisition. - Any depreciation effects of the fair value adjustment may be ignored. Prepare a consolidated statement of financial position as at \\( 30^{\\text {th }} \\) September 2018

d) On \\( 30^{\\text {th }} \\) September 2018, the financial position of OGS Ltd. and Manu Ltd. were as follows: Other information available is: - \\( \\quad \\) On \\( 1^{\\text {st }} \\) October 2014, OGS Ltd. had paid \\( 96,000 \\) to buy \75 of the shares of Manu Ltd. On that date, the fair value of Manu Ltd.'s non-current assets was \\( 16,000 \\) more than their book value. This revaluation has not been reflected in the books of Manu Ltd. Also on \\( 1^{\\text {st }} \\) October 2014, Manu Ltd.'s retained earnings were \\( 20,000 \\). - \\( \\quad \\) Since being acquired by OGS Ltd., Manu Ltd. has not issued any further shares. - Goodwill arising on consolidation has suffered an impairment loss of \40 since acquisition. - Any depreciation effects of the fair value adjustment may be ignored. Prepare a consolidated statement of financial position as at \\( 30^{\\text {th }} \\) September 2018 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started