Question

On 31 December 2021, PT Pagi leased a tractor from PT Sore. The carrying amount and fair value of the asset are Rp80.000.000 with a

On 31 December 2021, PT Pagi leased a tractor from PT Sore. The carrying amount and fair value of the asset are Rp80.000.000 with a useful life of 5 years. For assetsof similar nature, both PT Pagi and PT Sore depreciate such an asset in straight-line. PT Sore aims to earn 8% return from this lease contract. Within the contract, it is agreed that:

● lease payments are payable every 31 December, starting 2021, amounted Rp20.309.681,77;

● the lease duration is 4 years and the contract can neither be extended nor cancelled;

● PT Pagi is required to guarantee the asset’s residual value of Rp10.000.000;

● at the end of the lease term, the asset will be returned to PT Sore (bargain purchase option is not provided).

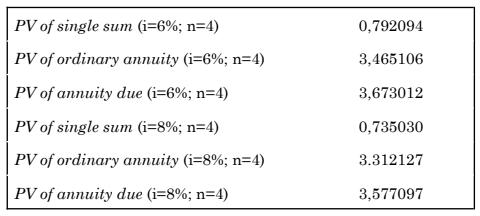

Furthermore, the following information are also given:

The lessor’s implicit rate is not known to PT Pagi. The company’s incremental borrowing rate is 6%. PT Pagi has determined that the residual value of the asset at the end of the lease term will be Rp8.000.000.

Instructions:

1. Calculate the lease receivable that should be recorded by PT Sore and the lease liability that should be booked by PT Pagi at the start of the lease term.

2. Make all necessary entries for the years 2021, 2022, and 2025 from the perspectives of:

i. PT Sore as lessor; and

ii. PT Pagi as lessee.

3. Make the required presentation in the 2022 financial statements of both companies!

PV of single sum (i=6%; n=4) 0,792094 PV of ordinary annuity (i=6%; n=4) 3,465106 PV of annuity due (i=6%; n=4) 3,673012 PV of single sum (i=8%; n=4) 0,735030 PV of ordinary annuity (i=8%; n=4) 3.312127 PV of annuity due (i=8%; n=4) 3,577097

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started