Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 3/20/2013, DELPHI entered into a definitive merger agreement to merge with SISCO in a friendly stock swap transaction with a collar. The transaction

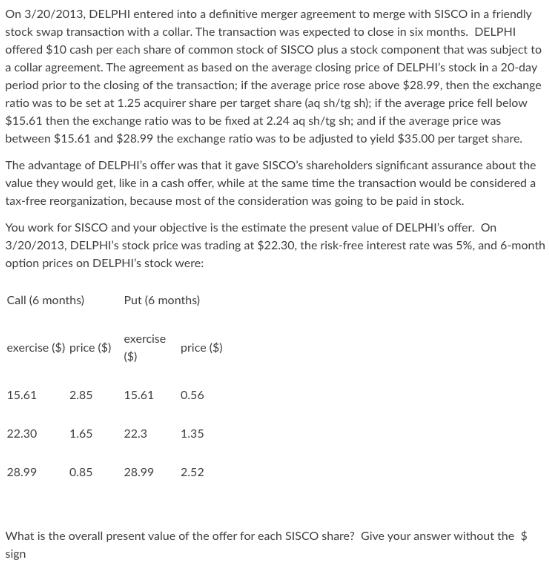

On 3/20/2013, DELPHI entered into a definitive merger agreement to merge with SISCO in a friendly stock swap transaction with a collar. The transaction was expected to close in six months. DELPHI offered $10 cash per each share of common stock of SISCO plus a stock component that was subject to a collar agreement. The agreement as based on the average closing price of DELPHI's stock in a 20-day period prior to the closing of the transaction; if the average price rose above $28.99, then the exchange ratio was to be set at 1.25 acquirer share per target share (aq sh/tg sh); if the average price fell below $15.61 then the exchange ratio was to be fixed at 2.24 aq sh/tg sh; and if the average price was between $15.61 and $28.99 the exchange ratio was to be adjusted to yield $35.00 per target share. The advantage of DELPHI's offer was that it gave SISCO's shareholders significant assurance about the value they would get, like in a cash offer, while at the same time the transaction would be considered a tax-free reorganization, because most of the consideration was going to be paid in stock. You work for SISCO and your objective is the estimate the present value of DELPHI's offer. On 3/20/2013, DELPHI's stock price was trading at $22.30, the risk-free interest rate was 5%, and 6-month option prices on DELPHI's stock were: Call (6 months) exercise ($) price ($) 15.61 22.30 28.99 2.85 1.65 0.85 Put (6 months) exercise ($) 15.61 22.3 28.99 price ($) 0.56 1.35 2.52 What is the overall present value of the offer for each SISCO share? Give your answer without the $ sign

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To estimate the present value of DELPHIs offer we need to consider the different scenarios based on the collar agreement and calculate the expected value of the offer using option pricing the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started