Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 7-1-21 , The Foster Company bought a new piece of equipment. The Unit itself cost $100,000. The Sales Tax was $2,000, Freight has $1,500

- On 7-1-21, The Foster Company bought a new piece of equipment. The Unit itself cost $100,000. The Sales Tax was $2,000, Freight has $1,500 and Platform and Installation cost are 6,500. The Machine was setup and placed into service on the day it was purchased. The Company also purchased spare parts for routine maintenance for $5,000 on the date of purchase. The equipment is expected to have an estimated useful life of 5 Years and a Salvage value of $10,000. Please compete the following:

- Calculate the amount that should be capitalized as an Asset for the Equipment Purchase

- Calculate the Depreciation schedule based on the Straight-line Method

- Assuming the Company decides to use the Straight-line Method, please book the depreciation adjusting entry as of 12-31-21

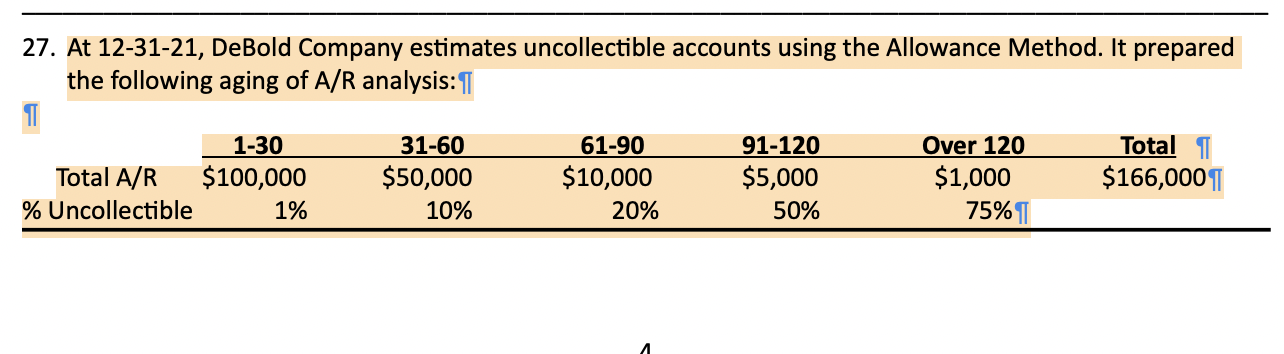

27. At 12-31-21, DeBold Company estimates uncollectible accounts using the Allowance Method. It prepared the following aging of A/R analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started