Answered step by step

Verified Expert Solution

Question

1 Approved Answer

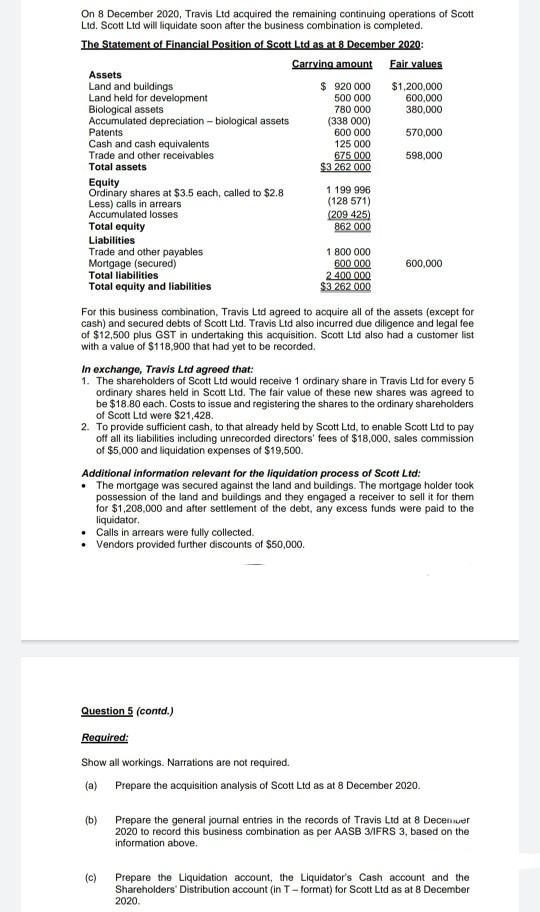

On 8 December 2020, Travis Ltd acquired the remaining continuing operations of Scott Ltd. Scott Ltd will liquidate soon after the business combination is

On 8 December 2020, Travis Ltd acquired the remaining continuing operations of Scott Ltd. Scott Ltd will liquidate soon after the business combination is completed. The Statement of Financial Position of Scott Ltd as at 8 December 2020: Carrying amount Fair values Assets Land and buildings Land held for development Biological assets Accumulated depreciation - biological assets Patents Cash and cash equivalents Trade and other receivables Total assets Equity Ordinary shares at $3.5 each, called to $2.8 Less) calls in arrears Accumulated losses Total equity Liabilities Trade and other payables Mortgage (secured) Total liabilities Total equity and liabilities $ 920 000 500 000 780 000 (338 000) 600 000 125 000 Calls in arrears were fully collected. Vendors provided further discounts of $50,000. 675 000 $3 262 000 1 199 996 (128 571) (209 425) 862 000 (b) 1 800 000 600 000 2.400 000 $3 262 000 For this business combination, Travis Ltd agreed to acquire all of the assets (except for cash) and secured debts of Scott Ltd. Travis Ltd also incurred due diligence and legal fee of $12,500 plus GST in undertaking this acquisition. Scott Ltd also had a customer list with a value of $118,900 that had yet to be recorded. (c) $1,200,000 600,000 380,000 570,000 598,000 In exchange, Travis Ltd agreed that: 1. The shareholders of Scott Ltd would receive 1 ordinary share in Travis Ltd for every 5 ordinary shares held in Scott Ltd. The fair value of these new shares was agreed to be $18.80 each. Costs to issue and registering the shares to the ordinary shareholders of Scott Ltd were $21,428. 600,000 2. To provide sufficient cash, to that already held by Scott Ltd, to enable Scott Ltd to pay off all its liabilities including unrecorded directors' fees of $18,000, sales commission of $5,000 and liquidation expenses of $19,500. Additional information relevant for the liquidation process of Scott Ltd: The mortgage was secured against the land and buildings. The mortgage holder took possession of the land and buildings and they engaged a receiver to sell it for them for $1,208,000 and after settlement of the debt, any excess funds were paid to the liquidator. Question 5 (contd.) Required: Show all workings. Narrations are not required. (a) Prepare the acquisition analysis of Scott Ltd as at 8 December 2020. Prepare the general journal entries in the records of Travis Ltd at 8 December 2020 to record this business combination as per AASB 3/IFRS 3, based on the information above. Prepare the Liquidation account, the Liquidator's Cash account and the Shareholders' Distribution account (in T-format) for Scott Ltd as at 8 December 2020.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Sales revenue A Costs Direct materials Particulars Less Selling and administrative NOL 2 400800 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started