Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On a certain market the market portfolio rate of return is 25%, the market portfolio risk is 30%. We also know that on this market

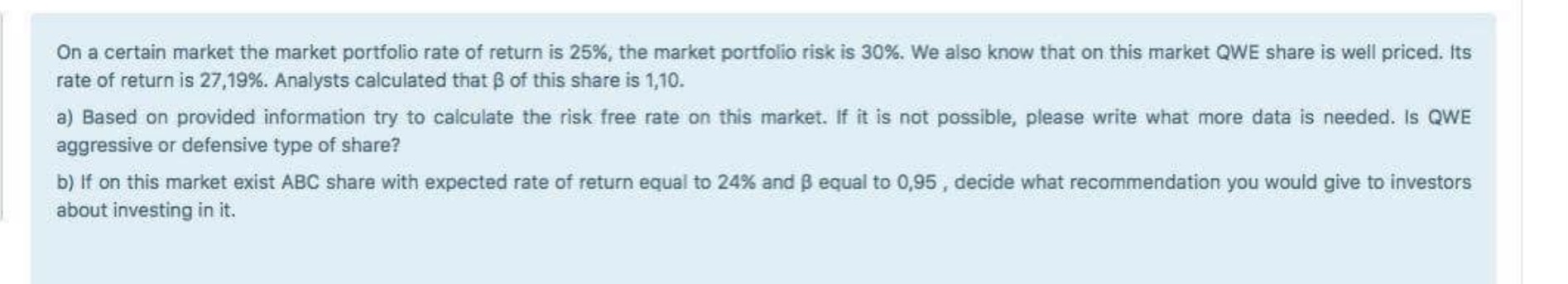

On a certain market the market portfolio rate of return is 25%, the market portfolio risk is 30%. We also know that on this market QWE share is well priced. Its rate of return is 27,19%. Analysts calculated that of this share is 1,10. a) Based on provided information try to calculate the risk free rate on this market. If it is not possible, please write what more data is needed. Is QWE aggressive or defensive type of share? b) If on this market exist ABC share with expected rate of return equal to 24% and equal to 0,95 , decide what recommendation you would give to investors about investing in it

On a certain market the market portfolio rate of return is 25%, the market portfolio risk is 30%. We also know that on this market QWE share is well priced. Its rate of return is 27,19%. Analysts calculated that of this share is 1,10. a) Based on provided information try to calculate the risk free rate on this market. If it is not possible, please write what more data is needed. Is QWE aggressive or defensive type of share? b) If on this market exist ABC share with expected rate of return equal to 24% and equal to 0,95 , decide what recommendation you would give to investors about investing in it Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started