Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On a late Friday afternoon in 2013, Jim Norris stared at his computer screen, his tired mind racing. Norris had been having the time

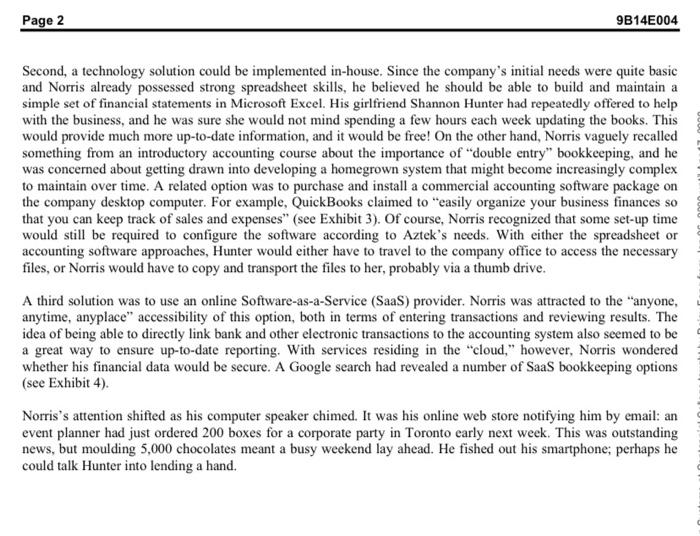

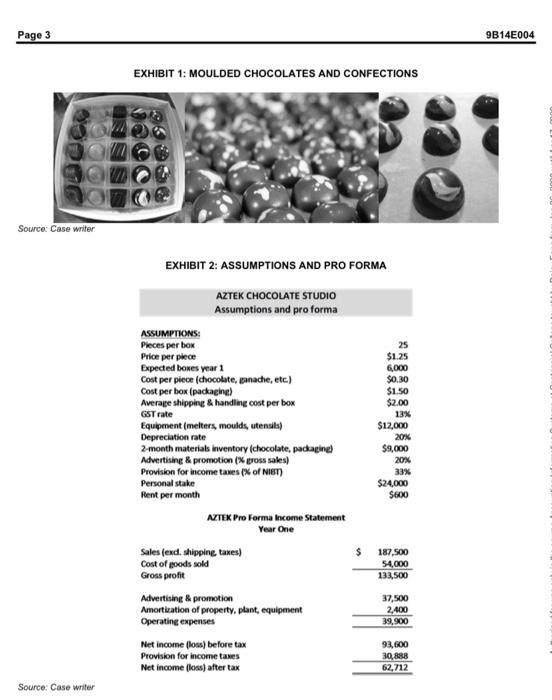

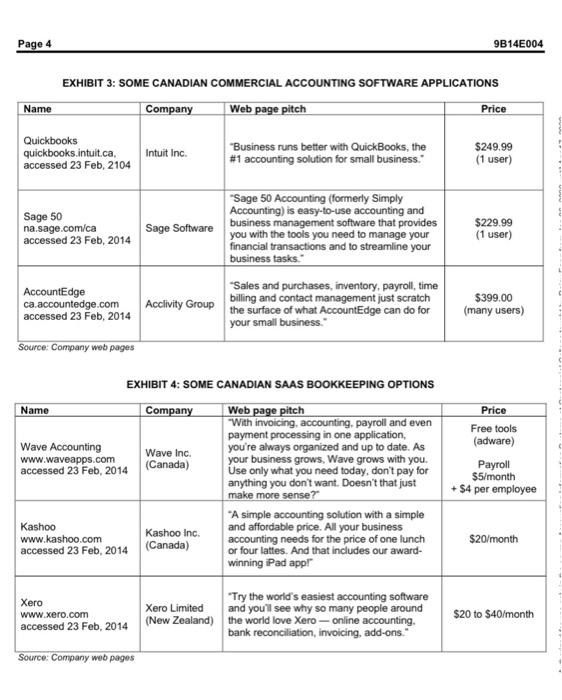

On a late Friday afternoon in 2013, Jim Norris stared at his computer screen, his tired mind racing. Norris had been having the time of his life converting his chocolate making passion into a business venture, Aztek Chocolate (Aztek), but he was exhausted. Over the past 30 days, he had managed to set up a functional commercial kitchen in Winnipeg, Manitoba, while successfully navigating the required inspections. Sales were starting to flow in, and chocolates were starting to ship out (see Exhibit 1). He was on the way to realizing his dream! Attending to the financial details of the new operation had been troubling. It was not as though record keeping was an afterthought. As a business school graduate, Norris understood how important it was to stay in tune with his firm's financial performance, and so he'd kept detailed paper records during the first weeks of Aztek's operations. But with customer orders starting to accumulate and financial transactions growing in complexity, he was already starting to feel as though he might be missing things. He glanced furtively at the accordion file folder perched on his desk. All receipts were carefully organized in there sales invoices, equipment purchases, payables, receivables-all nicely separated in different pockets with detailed sticky notes attached. But when exactly should the data from those receipts be entered, and how should he extract and use the resulting financial information? Norris knew the answer to that question: the time was now. THREE ALTERNATIVES As he had repeatedly turned to this question over the past couple of weeks, Norris had arrived at three possible solutions. First, he could hire an accountant to process the receipts and prepare financial statements. Many small businesses took this approach and had their books prepared once per year for tax purposes, at a cost in the neighbourhood of $1,200. This annual approach did not sit well with Norris, however, since it meant having to wait until year-end to properly understand how Aztek was performing. A related option was to hire a bookkeeper to maintain the books on a monthly basis, at a cost of about $200 per month with a 50 per cent reduction in the year- end tax preparation costs. Monthly statements would be preferable, but Norris worried that the information would still not be as timely as necessary, and he questioned whether these precious dollars would not be better spent on advertising to boost top line sales (see assumptions and pro forma projections in Exhibit 2). Page 2 9B14E004 Second, a technology solution could be implemented in-house. Since the company's initial needs were quite basic and Norris already possessed strong spreadsheet skills, he believed he should be able to build and maintain a simple set of financial statements in Microsoft Excel. His girlfriend Shannon Hunter had repeatedly offered to help with the business, and he was sure she would not mind spending a few hours each week updating the books. This would provide much more up-to-date information, and it would be free! On the other hand, Norris vaguely recalled something from an introductory accounting course about the importance of "double entry" bookkeeping, and he was concerned about getting drawn into developing a homegrown system that might become increasingly complex to maintain over time. A related option was to purchase and install a commercial accounting software package on the company desktop computer. For example, QuickBooks claimed to "easily organize your business finances so that you can keep track of sales and expenses" (see Exhibit 3). Of course, Norris recognized that some set-up time would still be required to configure the software according to Aztek's needs. With either the spreadsheet or accounting software approaches, Hunter would either have to travel to the company office to access the necessary files, or Norris would have to copy and transport the files to her, probably via a thumb drive. A third solution was to use an online Software-as-a-Service (SaaS) provider. Norris was attracted to the "anyone, anytime, anyplace" accessibility of this option, both in terms of entering transactions and reviewing results. The idea of being able to directly link bank and other electronic transactions to the accounting system also seemed to be a great way to ensure up-to-date reporting. With services residing in the "cloud," however, Norris wondered whether his financial data would be secure. A Google search had revealed a number of SaaS bookkeeping options (see Exhibit 4). Norris's attention shifted as his computer speaker chimed. It was his online web store notifying him by email: an event planner had just ordered 200 boxes for a corporate party in Toronto early next week. This was outstanding news, but moulding 5,000 chocolates meant a busy weekend lay ahead. He fished out his smartphone; perhaps he could talk Hunter into lending a hand. Page 3 Source: Case writer Source: Case writer EXHIBIT 1: MOULDED CHOCOLATES AND CONFECTIONS EXHIBIT 2: ASSUMPTIONS AND PRO FORMA AZTEK CHOCOLATE STUDIO Assumptions and pro forma ASSUMPTIONS: Pieces per box Price per piece Expected boxes year 1 Cost per piece (chocolate, ganache, etc.) Cost per box (packaging) Average shipping & handling cost per box GST rate Equipment (melters, moulds, utensils) Depreciation rate 2-month materials inventory (chocolate, packaging) Advertising & promotion (% gross sales) Provision for income taxes (% of NIBT) Personal stake Rent per month AZTEK Pro Forma Income Statement Year One Sales (excl. shipping, taxes) Cost of goods sold Gross profit Advertising & promotion Amortization of property, plant, equipment Operating expenses Net income (loss) before tax Provision for income taxes Net income (loss) after tax 25 $1.25 6,000 $0.30 $1.50 $2.00 13% $12,000 20% $9,000 20% 33% $24,000 $600 187,500 54,000 133,500 37,500 2,400 39,900 93,600 30,888 62,712 9B14E004 0000 0000 Page 4 Name Quickbooks quickbooks.intuit.ca. accessed 23 Feb, 2104 Sage 50 na.sage.com/ca accessed 23 Feb, 2014 EXHIBIT 3: SOME CANADIAN COMMERCIAL ACCOUNTING SOFTWARE APPLICATIONS Web page pitch AccountEdge ca.accountedge.com accessed 23 Feb, 2014 Source: Company web pages Name Wave Accounting www.waveapps.com accessed 23 Feb, 2014 Xero Kashoo www.kashoo.com accessed 23 Feb, 2014 Company Intuit Inc. Source: Company web pages Sage Software EXHIBIT 4: SOME CANADIAN SAAS BOOKKEEPING OPTIONS Company Web page pitch "With invoicing, accounting, payroll and even payment processing in one application, you're always organized and up to date. As your business grows, Wave grows with you. Use only what you need today, don't pay for anything you don't want. Doesn't that just make more sense?" "Sales and purchases, inventory, payroll, time billing and contact management just scratch Acclivity Group the surface of what AccountEdge can do for your small business." Wave Inc. (Canada) "Business runs better with QuickBooks, the #1 accounting solution for small business." Kashoo Inc. (Canada) Xero Limited www.xero.com accessed 23 Feb, 2014 (New Zealand) "Sage 50 Accounting (formerly Simply Accounting) is easy-to-use accounting and business management software that provides you with the tools you need to manage your financial transactions and to streamline your business tasks. "A simple accounting solution with a simple and affordable price. All your business accounting needs for the price of one lunch or four lattes. And that includes our award- winning iPad app! 9B14E004 "Try the world's easiest accounting software and you'll see why so many people around the world love Xero-online accounting. bank reconciliation, invoicing, add-ons. Price $249.99 (1 user) $229.99 (1 user) $399.00 (many users) Price Free tools (adware) Payroll $5/month + $4 per employee $20/month $20 to $40/month L For the Ivey case on Aztex chocolate studio-Accounting software system. Kindly answer the following questions: 1. Summary of the case 2. What challenge is Jim Norris facing? 3. What options does he have? what are the trade-offs? 4. which option do you recommend and justify? 5. submit a reports of accounting transactions based on those transactions given in the case study.

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started