Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On a piece of paper you will photograph and upload to Blackboard upon completion of the exam, show your work for the following calculations for

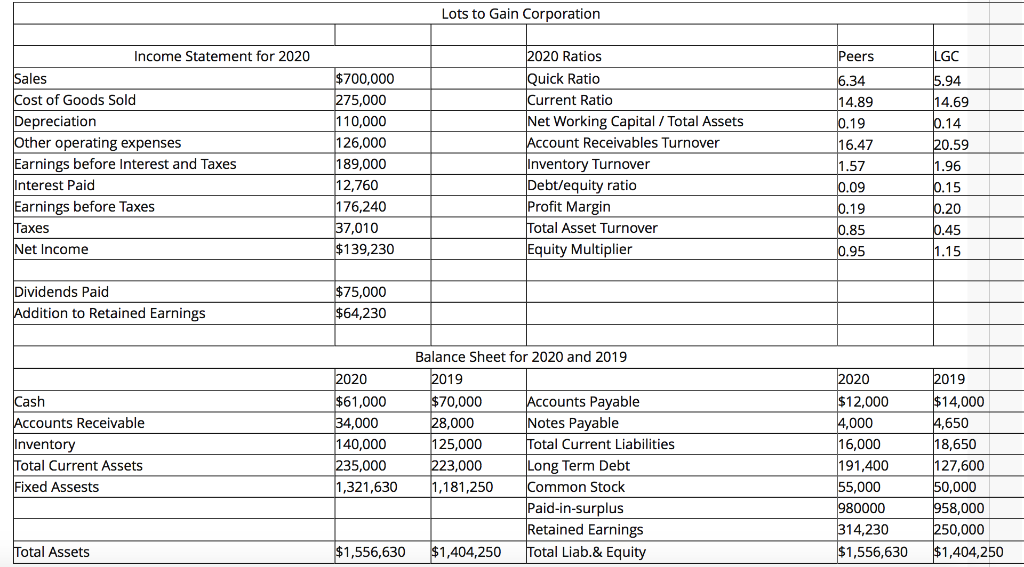

On a piece of paper you will photograph and upload to Blackboard upon completion of the exam, show your work for the following calculations for the balance sheet and income statement shown below:

a. What is the 2020 operating cash flow?

b. What is the 2020 change in net working capital?

c. What is the 2020 net capital spending?

D. What is the 2020 cash flow from assets? [enter this number as your response to this question]

Lots to Gain Corporation Peers LGC Income Statement for 2020 Sales Cost of Goods Sold Depreciation Other operating expenses Earnings before Interest and Taxes Interest Paid Earnings before Taxes Taxes Net Income $700,000 275,000 110,000 126,000 189,000 12,760 176,240 37,010 $139,230 2020 Ratios Quick Ratio Current Ratio Net Working Capital / Total Assets Account Receivables Turnover Inventory Turnover Debt/equity ratio Profit Margin Total Asset Turnover Equity Multiplier 6.34 14.89 0.19 16.47 1.57 0.09 0.19 0.85 0.95 5.94 14.69 0.14 20.59 11.96 0.15 0.20 10.45 11.15 Dividends Paid Addition to retained Earnings $75,000 $64,230 Balance Sheet for 2020 and 2019 2019 2020 2020 Cash Accounts Receivable Inventory Total Current Assets Fixed Assests $61,000 34,000 140,000 235,000 1,321,630 $70,000 28,000 125,000 223,000 1,181,250 Accounts Payable Notes Payable Total Current Liabilities Long Term Debt Common Stock Paid-in-surplus Retained Earnings Total Liab.& Equity $12,000 4,000 16,000 191,400 55,000 980000 314,230 $1,556,630 2019 $14,000 4,650 18,650 127,600 50,000 958,000 250,000 $1,404,250 Total Assets $1,556,630 $1,404,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started