Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On an established natural gas plant, an expansion project has been approved, in principle, to process significantly more gas from a nearby newly discovered

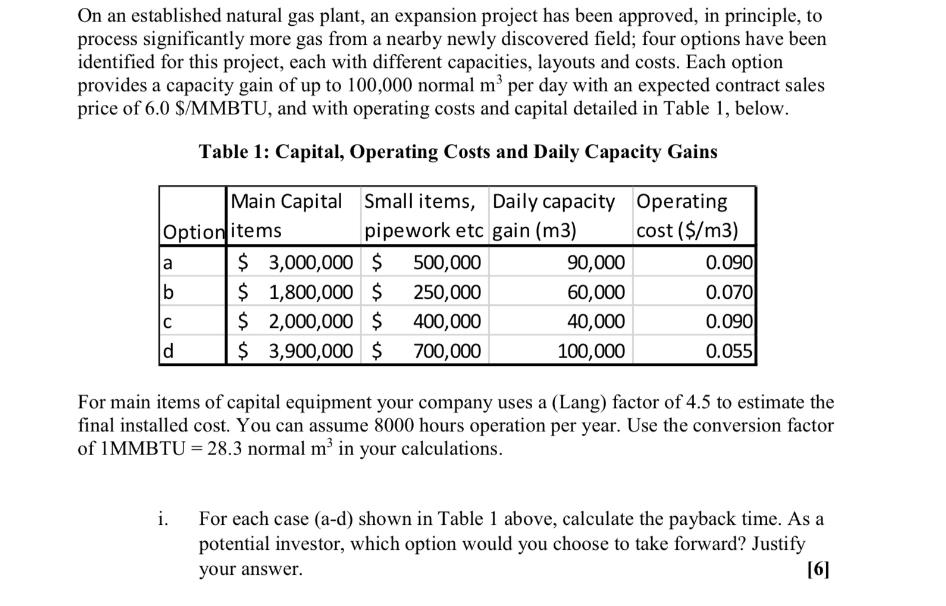

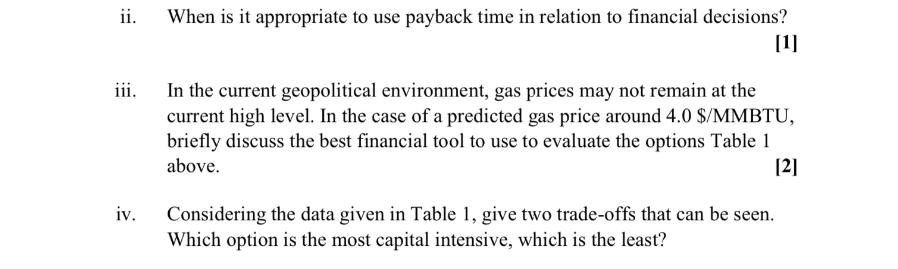

On an established natural gas plant, an expansion project has been approved, in principle, to process significantly more gas from a nearby newly discovered field; four options have been identified for this project, each with different capacities, layouts and costs. Each option provides a capacity gain of up to 100,000 normal m per day with an expected contract sales price of 6.0 $/MMBTU, and with operating costs and capital detailed in Table 1, below. Table 1: Capital, Operating Costs and Daily Capacity Gains Main Capital Small items, Daily capacity Operating Option items pipework etc gain (m3) cost ($/m3) a $ 3,000,000 $ 500,000 90,000 0.090 b $ 1,800,000 $ 250,000 60,000 0.070 C $ 2,000,000 $ 400,000 40,000 0.090 d $ 3,900,000 $ 700,000 100,000 0.055 For main items of capital equipment your company uses a (Lang) factor of 4.5 to estimate the final installed cost. You can assume 8000 hours operation per year. Use the conversion factor of 1MMBTU = 28.3 normal m in your calculations. i. For each case (a-d) shown in Table 1 above, calculate the payback time. As a potential investor, which option would you choose to take forward? Justify your answer. [6] ii. When is it appropriate to use payback time in relation to financial decisions? [1] iii. iv. In the current geopolitical environment, gas prices may not remain at the current high level. In the case of a predicted gas price around 4.0 $/MMBTU, briefly discuss the best financial tool to use to evaluate the options Table 1 above. Considering the data given in Table 1, give two trade-offs that can be seen. Which option is the most capital intensive, which is the least? [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started