Question

On an individual basis each participant should study the financial statements of a listed Indian Real Estate Company and report the following: (be sure to

- On an individual basis each participant should study the financial statements of a listed Indian Real Estate Company and report the following: (be sure to send the scanned copy /excel file of the financial statements ALONG WITH YOUR SUBMISSION. You can refer to the company’s website or else databases like money control / Bloomberg etc.

You should select an Indian Real Estate Company For the most recent year’s data available:

- What is the major source of revenue for your company? What is its % of the total income?

- What is the major chunk of expenses? Express it in % terms (% to Total income). Has there been any change over the years? (look at least 3 years to see a trend) How do you think there is scope for your organization to reduce the ‘costs’ vis a vis increase in sales? (Answer this from your understanding of your organization’s financials).

- Comment on the asset mix w.r.t need/importance/typicality of your industry? What are the top three assets by size? Are they the top three in your kind of industry? Why? What percentage is each of them to total assets? (Calculated as asset A/Total assets).

- Has the Balance sheet size increased over the last three years? Can you identify some of the reasons for this?

- Similarly has the PAT amount changed over the last three years? Could you identify the major reasons for this?

(Please use different sheets in excel for pasting/attaching your company’s financial statements/notes to accounting etc. Please DO NOT send separate pdf documents. Do not embed the PDF of the entire Annual Statement. Please only provide relevant sections in the form of images in your excel file. Workings must be derived in MS-excel itself. If you are facing obstacles in obtaining financial statements of your Company incase you work for a Private Ltd Company, you may use the statements of your closest competitors or those of companies in allied industries that are listed. However, in doing so, clearly mention the same in your assignment in the form of a note)

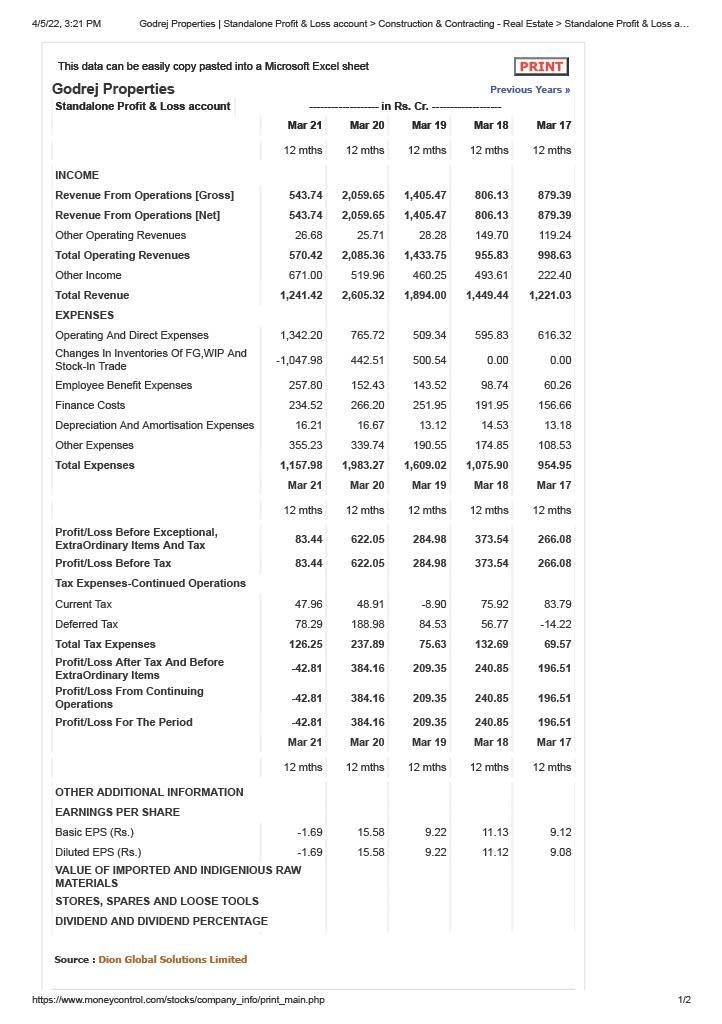

4/5/22, 3:21 PM Godrej Properties | Standalone Profit & Loss account > Construction & Contracting - Real Estate > Standalone Profit & Loss a... This data can be easily copy pasted into a Microsoft Excel sheet Godrej Properties Standalone Profit & Loss account INCOME Revenue From Operations [Gross] Revenue From Operations [Net] Other Operating Revenues Total Operating Revenues Other Income Total Revenue EXPENSES Operating And Direct Expenses Changes In Inventories Of FG, WIP And Stock-In Trade Employee Benefit Expenses Finance Costs Depreciation And Amortisation Expenses Other Expenses Total Expenses Profit/Loss Before Exceptional, Extraordinary Items And Tax Profit/Loss Before Tax Tax Expenses-Continued Operations Current Tax Deferred Tax Total Tax Expenses Profit/Loss After Tax And Before Extraordinary Items Profit/Loss From Continuing Operations Profit/Loss For The Period OTHER ADDITIONAL INFORMATION EARNINGS PER SHARE Basic EPS (Rs.) Mar 21 12 mths Source: Dion Global Solutions Limited 1,342.20 -1,047.98 257.80 234.52 16.21 355.23 1,157.98 Mar 21 12 mths 83.44 83.44 543.74 2,059.65 1,405.47 806.13 879.39 543.74 2,059.65 1,405.47 806.13 879.39 26.68 25.71 28.28 149.70 119.24 570.42 2,085.36 1,433.75 955.83 998.63 519.96 460.25 493.61 222.40 671.00 1,241.42 2,605.32 1,894.00 1,449.44 1,221.03 47.96 78.29 126.25 -42.81 42.81 -42.81 Mar 21 12 mths -1.69 -1.69 Diluted EPS (Rs.) VALUE OF IMPORTED AND INDIGENIOUS RAW MATERIALS STORES, SPARES AND LOOSE TOOLS DIVIDEND AND DIVIDEND PERCENTAGE in Rs. Cr. Mar 19 12 mths https://www.moneycontrol.com/stocks/company_info/print_main.php Mar 20 12 mths 765.72 509.34 442.51 500.54 152.43 266.20 16.67 339.74 1,983.27 Mar 20 12 mths 622.05 622.05 48.91 188.98 237.89 384.16 384.16 384.16 Mar 20 12 mths 15.58 15.58 143.52 251.95 13.12 190.55 1,609.02 Mar 19 12 mths 284.98 284.98 -8.90 84.53 75.63 209.35 209.35 209.35 Mar 19 12 mths PRINT Previous Years >> 9.22 9.22 Mar 18 12 mths 595.83 0.00 98.74 191.95 14.53 174.85 1,075.90 Mar 18 12 mths 373.54 373.54 75.92 56.77 132.69 240.85 240.85 240.85 Mar 18 12 mths Mar 17 12 mths 11.13 11.12 616.32 0.00 60.26 156.66 13.18 108.53 954.95 Mar 17 12 mths 266.08 266.08 83.79 -14.22 69.57 196.51 196.51 196.51 Mar 17 12 mths 9.12 9.08 1/2

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Major source of revenue for the Company The major source of revenue for the company I have selected is rental income Rental income is the largest sour...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started