Question

On April 1, 2017, the income tax threshold for Jamaican workers was increased to $1,500,096 per annum. Karen James is employed as an assistant

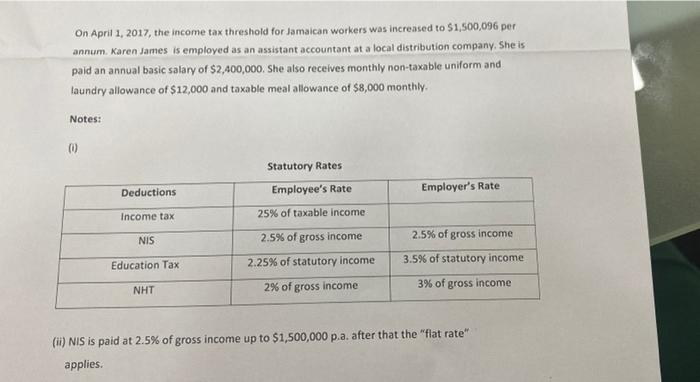

On April 1, 2017, the income tax threshold for Jamaican workers was increased to $1,500,096 per annum. Karen James is employed as an assistant accountant at a local distribution company. She is paid an annual basic salary of $2,400,000. She also receives monthly non-taxable uniform and laundry allowance of $12,000 and taxable meal allowance of $8,000 monthly. Notes: (0) Statutory Rates Employee's Rate Employer's Rate Deductions Income tax 25% of taxable income NIS 2.5% of gross income 2.5% of gross income 2.25% of statutory income 3.5% of statutory income Education Tax 2% of gross income 3% of gross income NHT (ii) NIS is paid at 2.5% of gross income up to $1,500,000 p.a. after that the "flat rate" applies.

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Total deductions from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

7th Canadian Edition Volume 2

1119048478, 978-1119048473

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App