Question

On April 1, 2019, Sigma Corporation purchased 5-year P10,000,000 10% bonds dated January 1, 2019. The bonds were purchased to yield 12%. Interest is payable

On April 1, 2019, Sigma Corporation purchased 5-year P10,000,000 10% bonds dated January 1, 2019. The bonds were purchased to yield 12%. Interest is payable annually every December 31. The entity holds investment in bonds in order to collect contractual cash flows.

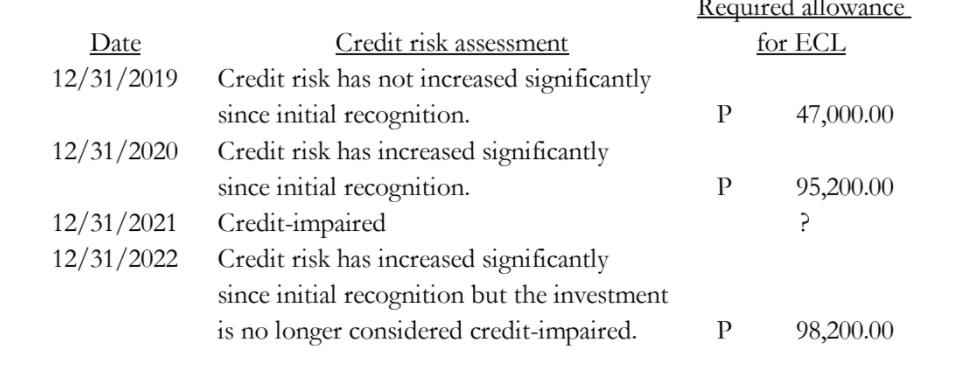

The entity monitors the change in credit quality of the investment since initial recognition and taking into account historical information, current conditions and forward- looking information, the entity computes the required expected credit losses (ECL) as follows:

On December 31, 2021, the issuer of the bonds is in financial difficulties and Sigma estimated that the issuer will not be able to pay interest for 2021 and 2022 and will be able to collect only P10,000,000 on December 31, 2023.

Answer the following: (Round off present value factors to four decimal places and final answers to nearest whole number)

1. How much was the total amount paid to acquire the investment in bonds on April 1, 2019?

2. How much is the amortized cost of the investment in bonds on December 31, 2019?

3. How much should be recognized as impairment loss in 2021?

4. How much should be recognized as interest income in 2022?

5. How much should be recognized as reversal on impairment loss in 2022?

Date 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Credit risk assessment Credit risk has not increased significantly since initial recognition. Credit risk has increased significantly since initial recognition. Credit-impaired Credit risk has increased significantly since initial recognition but the investment is no longer considered credit-impaired. Required allowance for ECL P 47,000.00 P 95,200.00 ? P 98,200.00

Step by Step Solution

3.57 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

1 The total amount paid to acquire the investment in bonds on April 1 2019 was P10000000 This is bec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started