Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, 2020, Burke Corporation signed a 4 year noncancelable lease for a machine. The terms of the lease called for Burke to

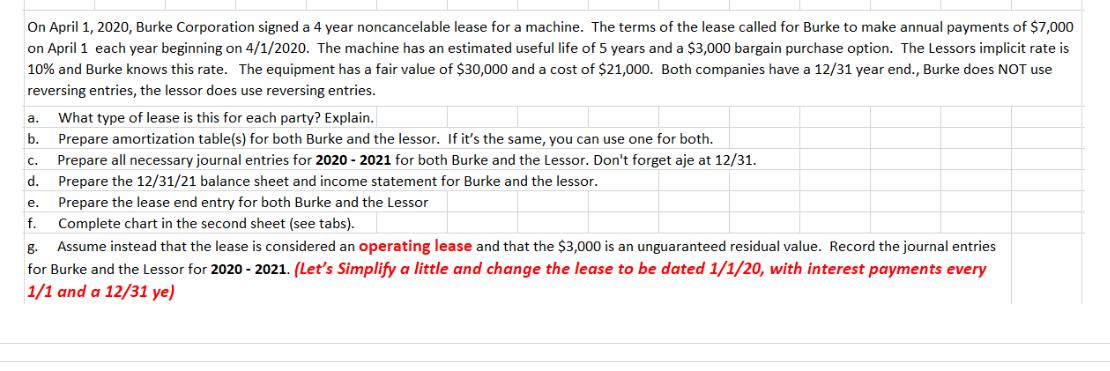

On April 1, 2020, Burke Corporation signed a 4 year noncancelable lease for a machine. The terms of the lease called for Burke to make annual payments of $7,000 on April 1 each year beginning on 4/1/2020. The machine has an estimated useful life of 5 years and a $3,000 bargain purchase option. The Lessors implicit rate is 10% and Burke knows this rate. The equipment has a fair value of $30,000 and a cost of $21,000. Both companies have a 12/31 year end., Burke does NOT use reversing entries, the lessor does use reversing entries. a. What type of lease is this for each party? Explain. b. Prepare amortization table(s) for both Burke and the lessor. If it's the same, you can use one for both. C. Prepare all necessary journal entries for 2020-2021 for both Burke and the Lessor. Don't forget aje at 12/31. d. Prepare the 12/31/21 balance sheet and income statement for Burke and the lessor. e. Prepare the lease end entry for both Burke and the Lessor f. Complete chart in the second sheet (see tabs). g. Assume instead that the lease is considered an operating lease and that the $3,000 is an unguaranteed residual value. Record the journal entries for Burke and the Lessor for 2020-2021. (Let's Simplify a little and change the lease to be dated 1/1/20, with interest payments every 1/1 and a 12/31 ye)

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a This is a capital lease for the lessor and an operating lease for Burke Corporation b Burke Corporation Year Payment Interest Principal Balance 1 70...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started