Question

On April 1, 2021, BlueRock Capital Corporation issued $1,000,000 of 6.0% coupon 5-year bonds. Interest is payable on April 1 and October 1. The market

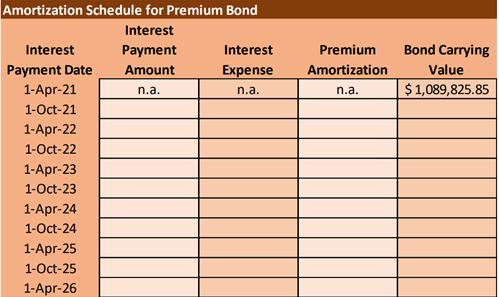

On April 1, 2021, BlueRock Capital Corporation issued $1,000,000 of 6.0% coupon 5-year bonds. Interest is payable on April 1 and October 1. The market rate of interest at the time was 4.0%. Thus, the bonds sold at a premium price of $41,089,825.85. BlueRock uses the effective interest rate method to accrete the bond discount.

A. Complete the following accretion schedule for the bond discount.

B. What amount of interest expense will be recognized during 2021?

C. What will be the carrying value of the bond at December 31, 2025?

D. What entry will Cobblestone make to record the payment of interest and principal upon the bond’s maturity on April 1, 2026? In which section of the Statement of Cash Flows will each of these payment amounts appear?

Amortization Schedule for Premium Bond Interest Interest Payment Interest Premium Bond Carrying Payment Date 1-Apr-21 Amount Expense Amortization Value $1,089,825.85 n.a. n.a. n.a. 1-Oct-21 1-Apr-22 1-Oct-22 1-Apr-23 1-Oct-23 1-Apr-24 1-Oct-24 1-Apr-25 1-Oct-25 1-Apr-26

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A Part b Interest Expense during 2021 2179652 2163...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started