Answered step by step

Verified Expert Solution

Question

1 Approved Answer

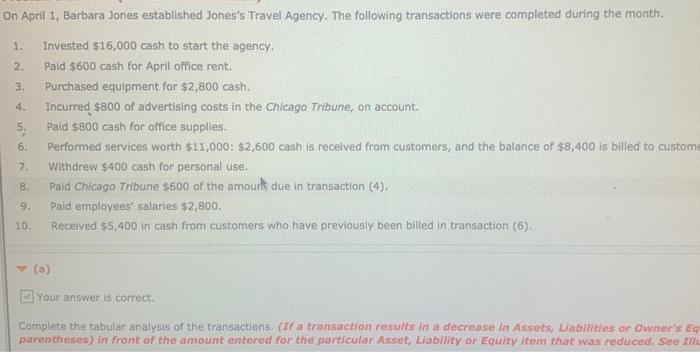

On April 1, Barbara Jones established Jones's Travel Agency. The following transactions were completed during the month. 1. Invested $16,000 cash to start the

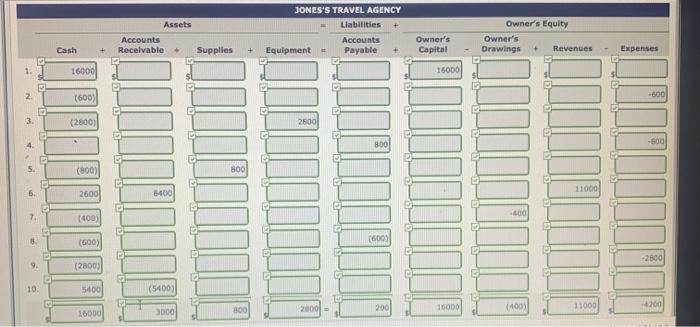

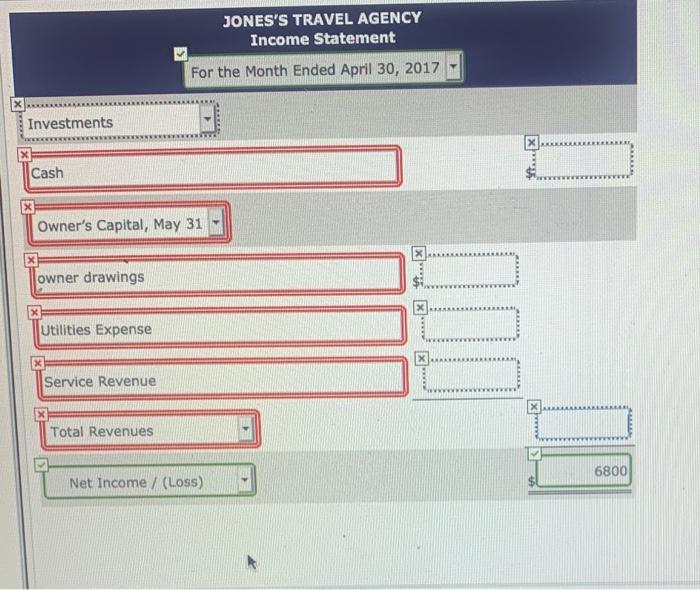

On April 1, Barbara Jones established Jones's Travel Agency. The following transactions were completed during the month. 1. Invested $16,000 cash to start the agency. 2. Paid $600 cash for April office rent. 3. Purchased equipment for $2,800 cash. Incurred $800 of advertising costs in the Chicago Tribune, on account. Paid $800 cash for office supplies. Performed services worth $11,000: $2,600 cash is received from customers, and the balance of $8,400 is billed to custome Withdrew $400 cash for personal use. 8. Paid Chicago Tribune $600 of the amour due in transaction (4). 5. 6. 739 9. Paid employees' salaries $2,800. 10. Received $5,400 in cash from customers who have previously been billed in transaction (6). (a) Your answer is correct. Complete the tabular analysis of the transactions. (If a transaction results in a decrease in Assets, Liabilities or Owner's Eq parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Ill Mi 2. 3. 4. 5. 6. 7. 8. E E 9. 10. Cash 16000 (600) (2800) (800) 2600 (400) (600) Accounts + Receivable + Supplies (2800) 5400 16000 E Assets D 6400 (5400) 3000 800 800 JONES'S TRAVEL AGENCY Liabilities Accounts Payable Equipment - 2600 M 2000 800 (600) 200 + Owner's Capital 16000 16000 Owner's Equity Owner's Drawings -400 (400) Revenues 11000 11000 Expenses -600 -800 -2800 -4200 Investments x Cash X x Owner's Capital, May 31 owner drawings x Utilities Expense x Service Revenue JONES'S TRAVEL AGENCY Income Statement For the Month Ended April 30, 2017 Total Revenues Net Income / (Loss) ********** 000 6800

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

workings The tabular analysis of the transaction can be co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started