Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 1, Cyclone Company purchases a trencher for $286,000. The machine is expected to last five years and have a salvage value of $43,000.

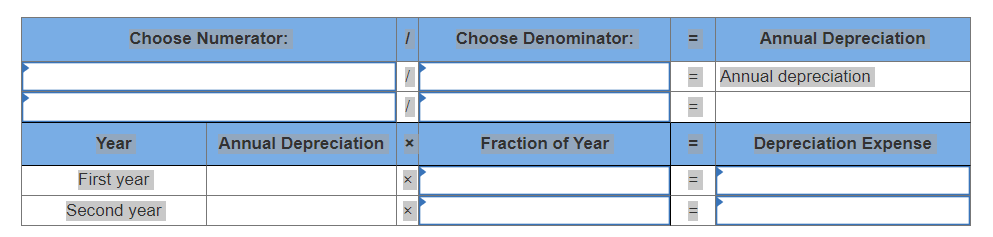

On April 1, Cyclone Company purchases a trencher for $286,000. The machine is expected to last five years and have a salvage value of $43,000. Exercise 8-11 (Algo) Straight-line, partial-year depreciation LO C2 Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the straight-line method.

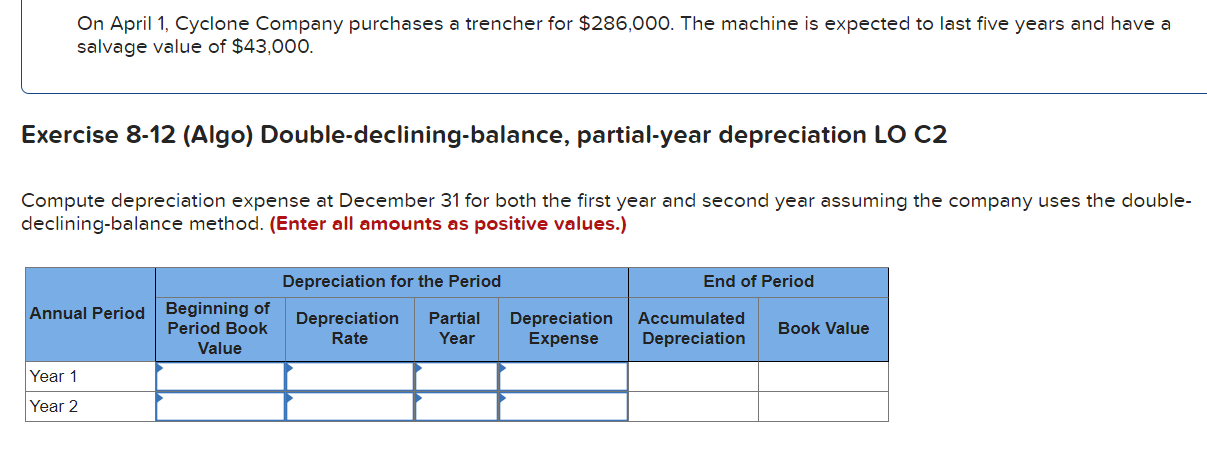

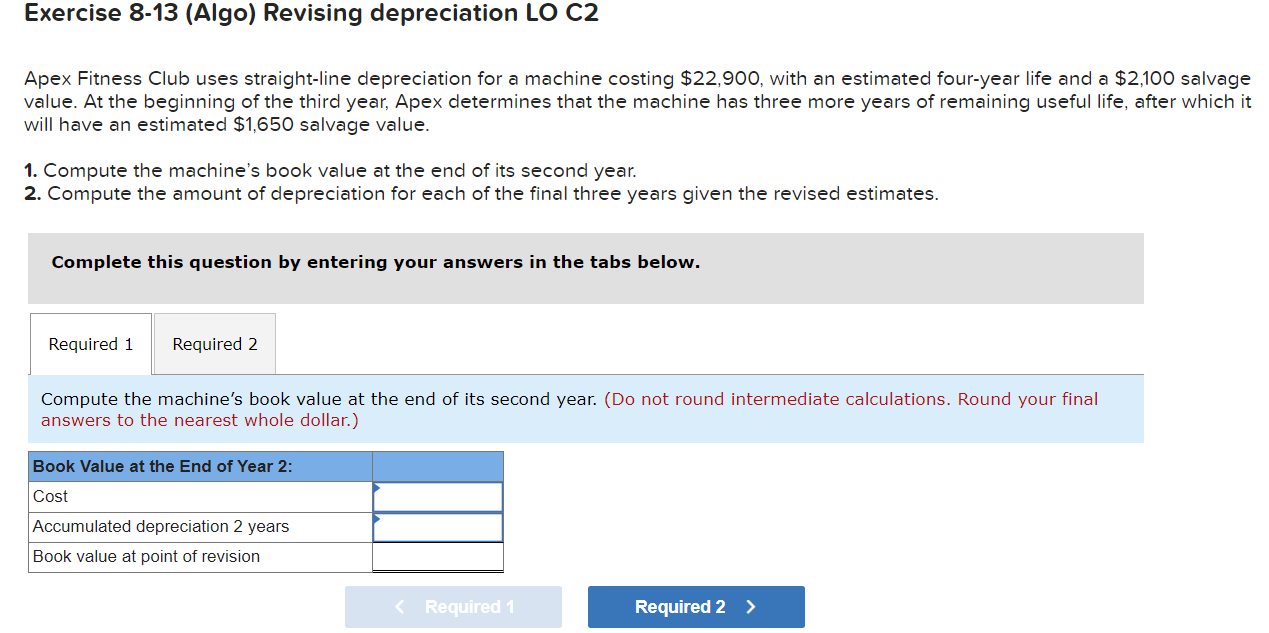

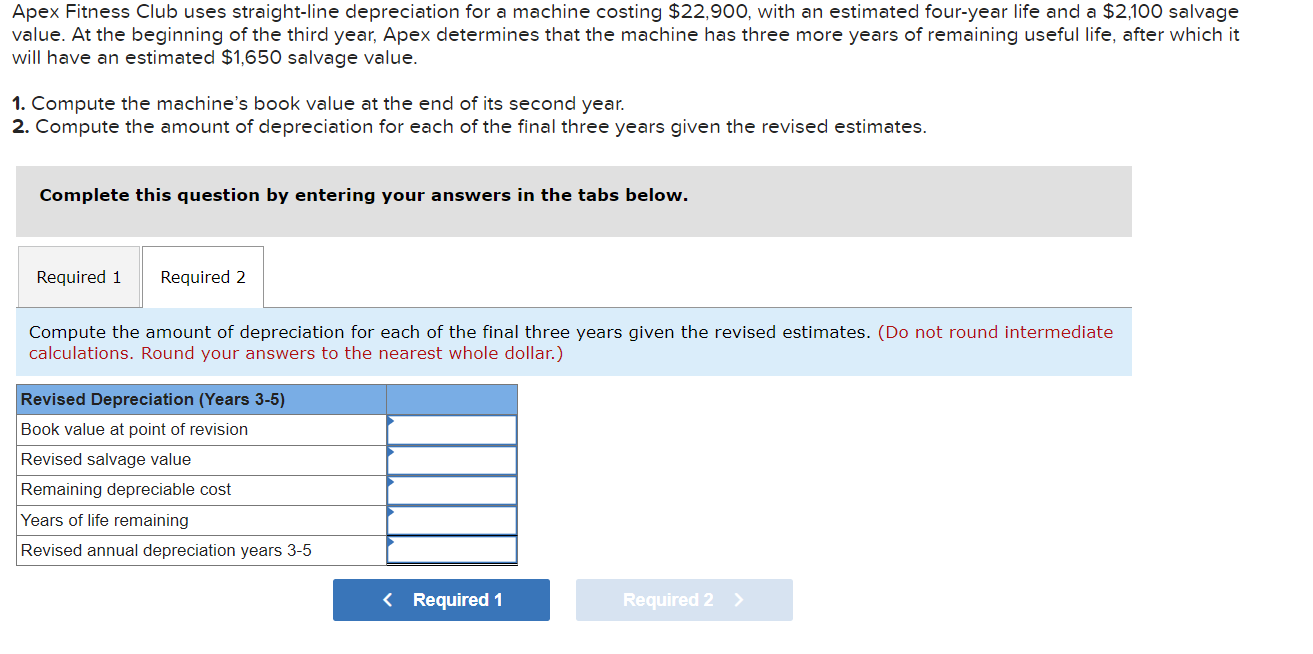

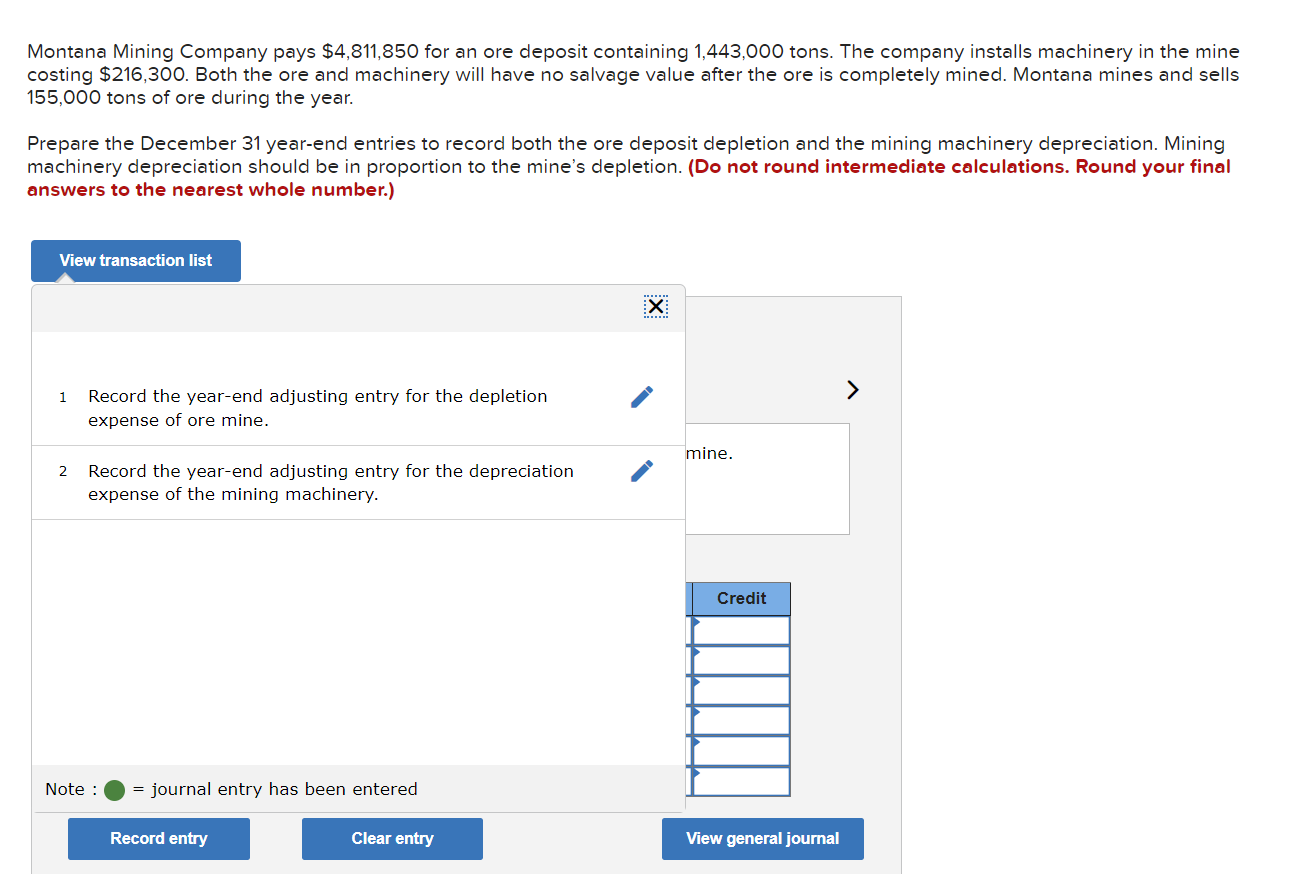

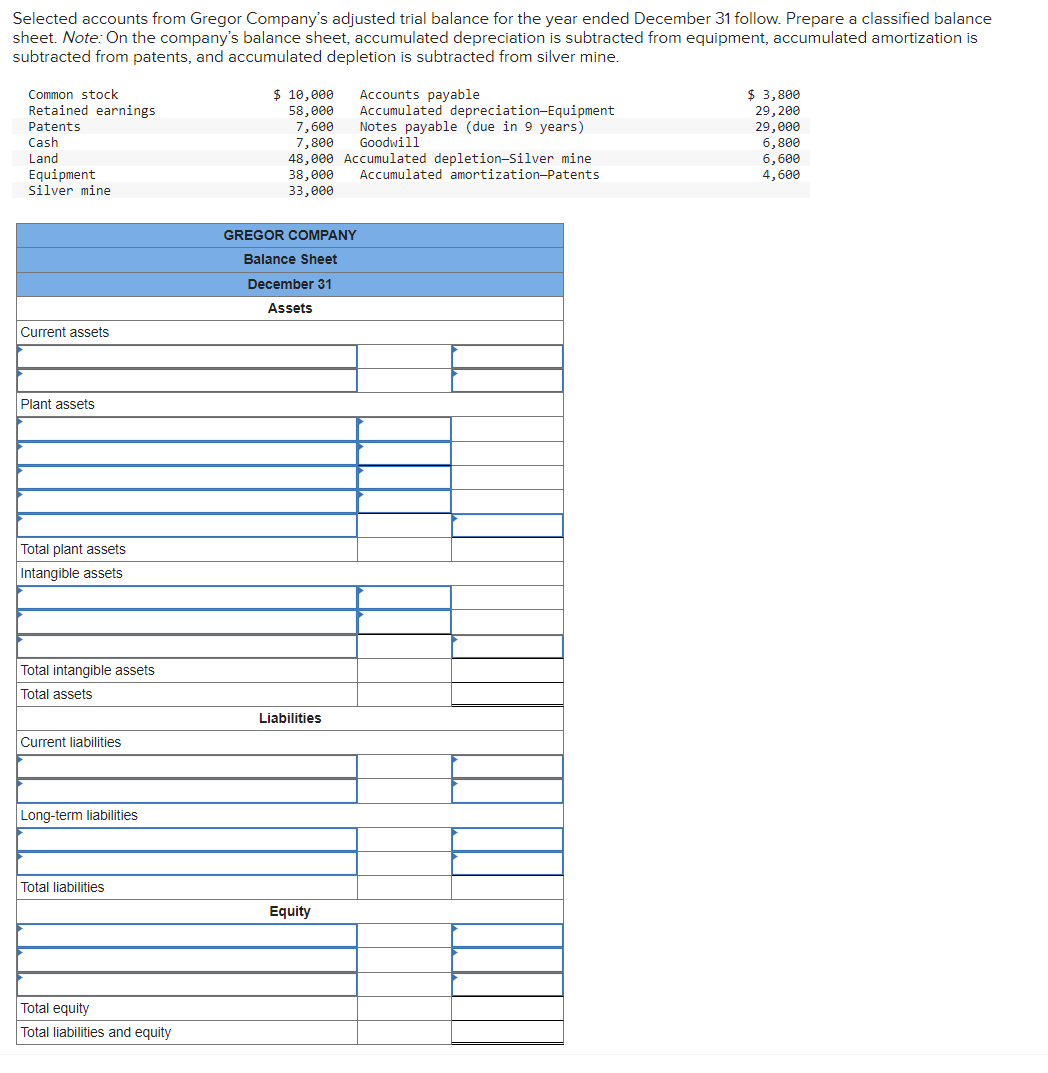

On April 1, Cyclone Company purchases a trencher for $286,000. The machine is expected to last five years and have a salvage value of $43,000. Exercise 8-12 (Algo) Double-declining-balance, partial-year depreciation LO C2 Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the doubledeclining-balance method. (Enter all amounts as positive values.) Exercise 8-13 (Algo) Revising depreciation LO C2 Apex Fitness Club uses straight-line depreciation for a machine costing $22,900, with an estimated four-year life and a $2,100 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,650 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Apex Fitness Club uses straight-line depreciation for a machine costing $22,900, with an estimated four-year life and a $2,100 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,650 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the amount of depreciation for each of the final three years given the revised estimates. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Montana Mining Company pays $4,811,850 for an ore deposit containing 1,443,000 tons. The company installs machinery in the mine costing $216,300. Both the ore and machinery will have no salvage value after the ore is completely mined. Montana mines and sells 155,000 tons of ore during the year. Prepare the December 31 year-end entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) 1 Record the year-end adjusting entry for the depletion expense of ore mine. 2 Record the year-end adjusting entry for the depreciation mine. expense of the mining machinery. Note: = journal entry has been entered Selected accounts from Gregor Company's adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Note: On the company's balance sheet, accumulated depreciation is subtracted from equipment, accumulated amortization is subtracted from patents, and accumulated depletion is subtracted from silver mine

On April 1, Cyclone Company purchases a trencher for $286,000. The machine is expected to last five years and have a salvage value of $43,000. Exercise 8-12 (Algo) Double-declining-balance, partial-year depreciation LO C2 Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the doubledeclining-balance method. (Enter all amounts as positive values.) Exercise 8-13 (Algo) Revising depreciation LO C2 Apex Fitness Club uses straight-line depreciation for a machine costing $22,900, with an estimated four-year life and a $2,100 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,650 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Apex Fitness Club uses straight-line depreciation for a machine costing $22,900, with an estimated four-year life and a $2,100 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,650 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the amount of depreciation for each of the final three years given the revised estimates. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Montana Mining Company pays $4,811,850 for an ore deposit containing 1,443,000 tons. The company installs machinery in the mine costing $216,300. Both the ore and machinery will have no salvage value after the ore is completely mined. Montana mines and sells 155,000 tons of ore during the year. Prepare the December 31 year-end entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) 1 Record the year-end adjusting entry for the depletion expense of ore mine. 2 Record the year-end adjusting entry for the depreciation mine. expense of the mining machinery. Note: = journal entry has been entered Selected accounts from Gregor Company's adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Note: On the company's balance sheet, accumulated depreciation is subtracted from equipment, accumulated amortization is subtracted from patents, and accumulated depletion is subtracted from silver mine Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started