Answered step by step

Verified Expert Solution

Question

1 Approved Answer

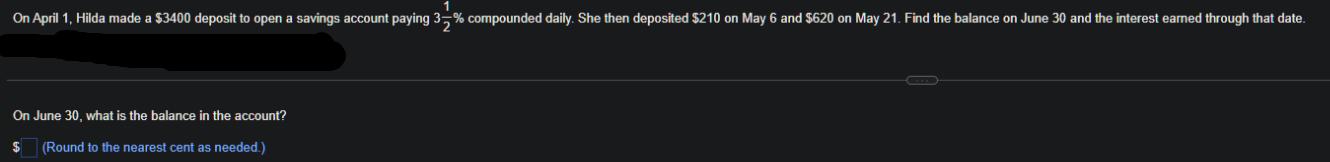

On April 1, Hilda made a $3400 deposit to open a savings account paying 3% compounded daily. She then deposited $210 on May 6

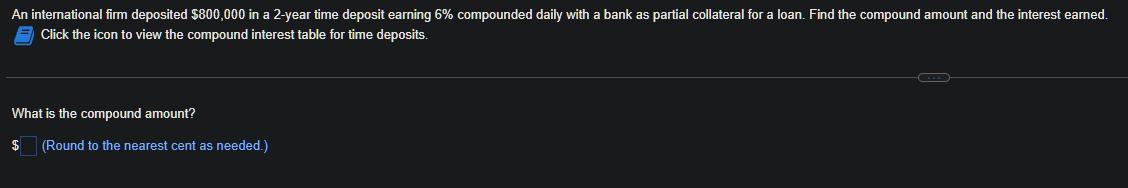

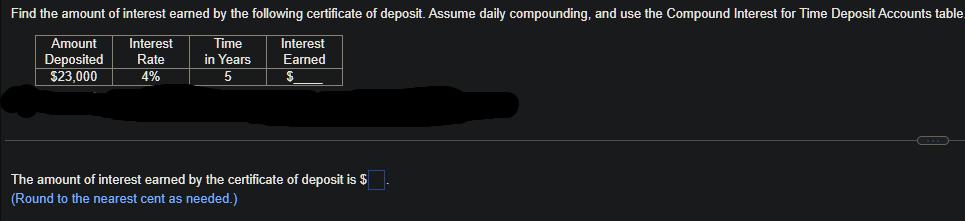

On April 1, Hilda made a $3400 deposit to open a savings account paying 3% compounded daily. She then deposited $210 on May 6 and $620 on May 21. Find the balance on June 30 and the interest earned through that date. On June 30, what is the balance in the account? $ (Round to the nearest cent as needed.) An international firm deposited $800,000 in a 2-year time deposit earning 6% compounded daily with a bank as partial collateral for a loan. Find the compound amount and the interest earned. Click the icon to view the compound interest table for time deposits. What is the compound amount? $ (Round to the nearest cent as needed.) (...) Find the amount of interest earned by the following certificate of deposit. Assume daily compounding, and use the Compound Interest for Time Deposit Accounts table Amount Deposited $23,000 Interest Rate 4% Time in Years 5 Interest Earned The amount of interest earned by the certificate of deposit is $ (Round to the nearest cent as needed.) C

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Interest earned is that the quantity of interest attained from investments that pay the hol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started