Question

On April 1 of this year, Mr. X sold a parcel of land, a capital property with an adjusted cost base of $100,000, for

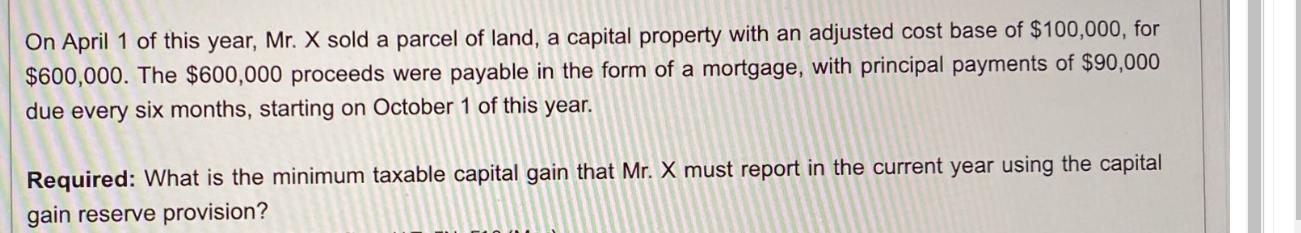

On April 1 of this year, Mr. X sold a parcel of land, a capital property with an adjusted cost base of $100,000, for $600,000. The $600,000 proceeds were payable in the form of a mortgage, with principal payments of $90,000 due every six months, starting on October 1 of this year. Required: What is the minimum taxable capital gain that Mr. X must report in the current year using the capital gain reserve provision?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the minimum taxable capital gain that Mr X must report in the current year using the ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Canadian Income Taxation Planning And Decision Making

Authors: Joan Kitunen, William Buckwold

17th Edition 2014-2015 Version

1259094332, 978-1259094330

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App