Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 15, 2016, the taxpayer filed his 2015 income tax return. BIR gave all the required notices, including the final assessment notice which

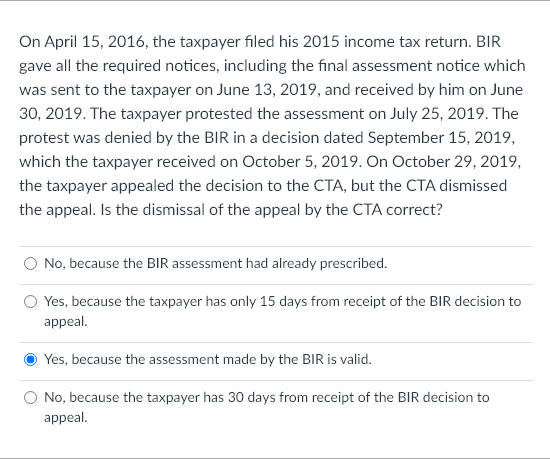

On April 15, 2016, the taxpayer filed his 2015 income tax return. BIR gave all the required notices, including the final assessment notice which was sent to the taxpayer on June 13, 2019, and received by him on June 30, 2019. The taxpayer protested the assessment on July 25, 2019. The protest was denied by the BIR in a decision dated September 15, 2019, which the taxpayer received on October 5, 2019. On October 29, 2019, the taxpayer appealed the decision to the CTA, but the CTA dismissed the appeal. Is the dismissal of the appeal by the CTA correct? No, because the BIR assessment had already prescribed. Yes, because the taxpayer has only 15 days from receipt of the BIR decision to appeal. Yes, because the assessment made by the BIR is valid. No, because the taxpayer has 30 days from receipt of the BIR decision to appeal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is No because the di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started