On April 1st 2014, AqcuirerCo acquired TargetCo's 100% shares. The M&A deal that took place between TargetCo and AcquirerCo with a Fixed Exchange Ratio

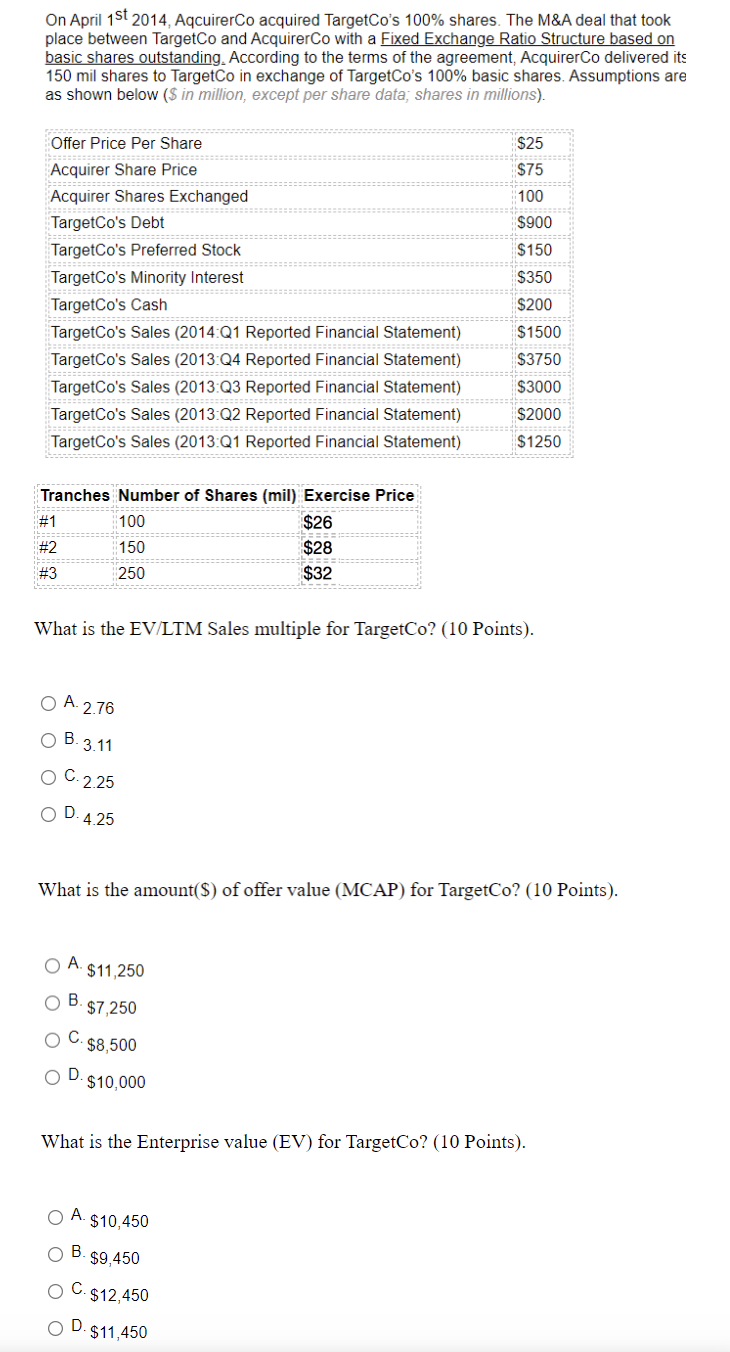

On April 1st 2014, AqcuirerCo acquired TargetCo's 100% shares. The M&A deal that took place between TargetCo and AcquirerCo with a Fixed Exchange Ratio Structure based on basic shares outstanding. According to the terms of the agreement, AcquirerCo delivered its 150 mil shares to TargetCo in exchange of TargetCo's 100% basic shares. Assumptions are as shown below ($ in million, except per share data; shares in millions). Offer Price Per Share Acquirer Share Price Acquirer Shares Exchanged TargetCo's Debt TargetCo's Preferred Stock TargetCo's Minority Interest TargetCo's Cash TargetCo's Sales (2014:Q1 Reported Financial Statement) TargetCo's Sales (2013:Q4 Reported Financial Statement) TargetCo's Sales (2013:Q3 Reported Financial Statement) TargetCo's Sales (2013:Q2 Reported Financial Statement) TargetCo's Sales (2013:Q1 Reported Financial Statement) Tranches Number of Shares (mil) Exercise Price 100 $26 150 $28 ======= 250 $32 #1 #2 ========= #3 What is the EV/LTM Sales multiple for TargetCo? (10 Points). O A. 2.76 O B. 3 O C. 2.25 D.4.25 -3.11 What is the amount($) of offer value (MCAP) for TargetCo? (10 Points). O A. $11,250 O B. $7,250 O C. C. $8,500 O D. $10,000 $25 $75 100 $900 $150 $350 $200 $1500 $3750 $3000 $2000 $1250 What is the Enterprise value (EV) for TargetCo? (10 Points). O A. $10,450 O B. $9,450 C. $12,450 O D. $11,450 O C.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep TargetCos LTM Last 12 months Sales 1500 2014Q1 3750 2013...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started