Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On April 2, 2006, Trans-Atlantic rivals Alcatel and Lucent announced that they had agreed to merge. This deal would create a global telecom equipment

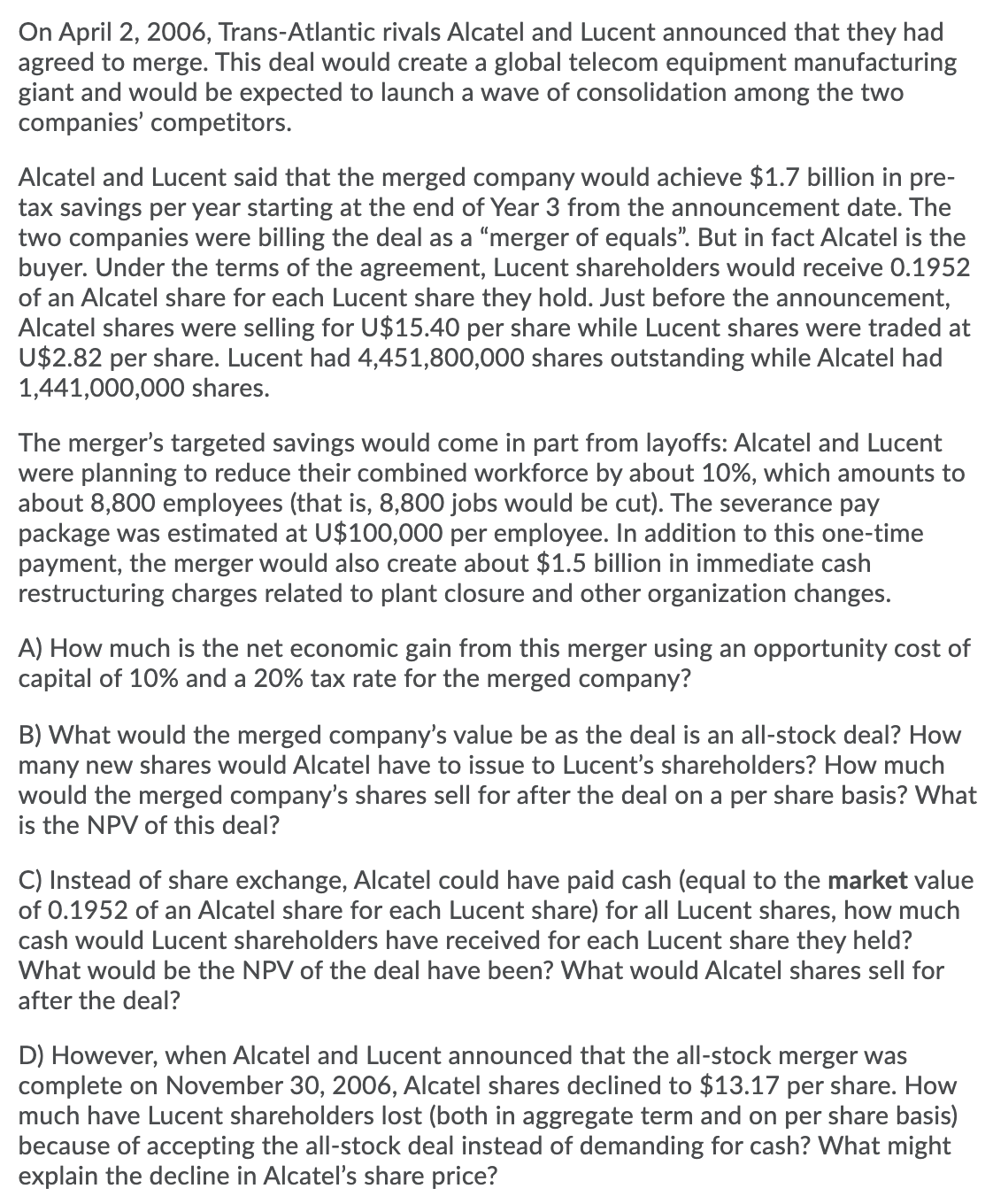

On April 2, 2006, Trans-Atlantic rivals Alcatel and Lucent announced that they had agreed to merge. This deal would create a global telecom equipment manufacturing giant and would be expected to launch a wave of consolidation among the two companies' competitors. Alcatel and Lucent said that the merged company would achieve $1.7 billion in pre- tax savings per year starting at the end of Year 3 from the announcement date. The two companies were billing the deal as a "merger of equals". But in fact Alcatel is the buyer. Under the terms of the agreement, Lucent shareholders would receive 0.1952 of an Alcatel share for each Lucent share they hold. Just before the announcement, Alcatel shares were selling for U$15.40 per share while Lucent shares were traded at U$2.82 per share. Lucent had 4,451,800,000 shares outstanding while Alcatel had 1,441,000,000 shares. The merger's targeted savings would come in part from layoffs: Alcatel and Lucent were planning to reduce their combined workforce by about 10%, which amounts to about 8,800 employees (that is, 8,800 jobs would be cut). The severance pay package was estimated at U$100,000 per employee. In addition to this one-time payment, the merger would also create about $1.5 billion in immediate cash restructuring charges related to plant closure and other organization changes. A) How much is the net economic gain from this merger using an opportunity cost of capital of 10% and a 20% tax rate for the merged company? B) What would the merged company's value be as the deal is an all-stock deal? How many new shares would Alcatel have to issue to Lucent's shareholders? How much would the merged company's shares sell for after the deal on a per share basis? What is the NPV of this deal? C) Instead of share exchange, Alcatel could have paid cash (equal to the market value of 0.1952 of an Alcatel share for each Lucent share) for all Lucent shares, how much cash would Lucent shareholders have received for each Lucent share they held? What would be the NPV of the deal have been? What would Alcatel shares sell for after the deal? D) However, when Alcatel and Lucent announced that the all-stock merger was complete on November 30, 2006, Alcatel shares declined to $13.17 per share. How much have Lucent shareholders lost (both in aggregate term and on per share basis) because of accepting the all-stock deal instead of demanding for cash? What might explain the decline in Alcatel's share price?

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the net economic gain from the merger we need to consider the pretax savings severance pay cash restructuring charges and the opportunity cost of capital The pretax savings per year sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started