Question

On April 3, 2020, David's Chocolates purchased a machine for $87,200. It was assumed that the machine would have a five-year life and a

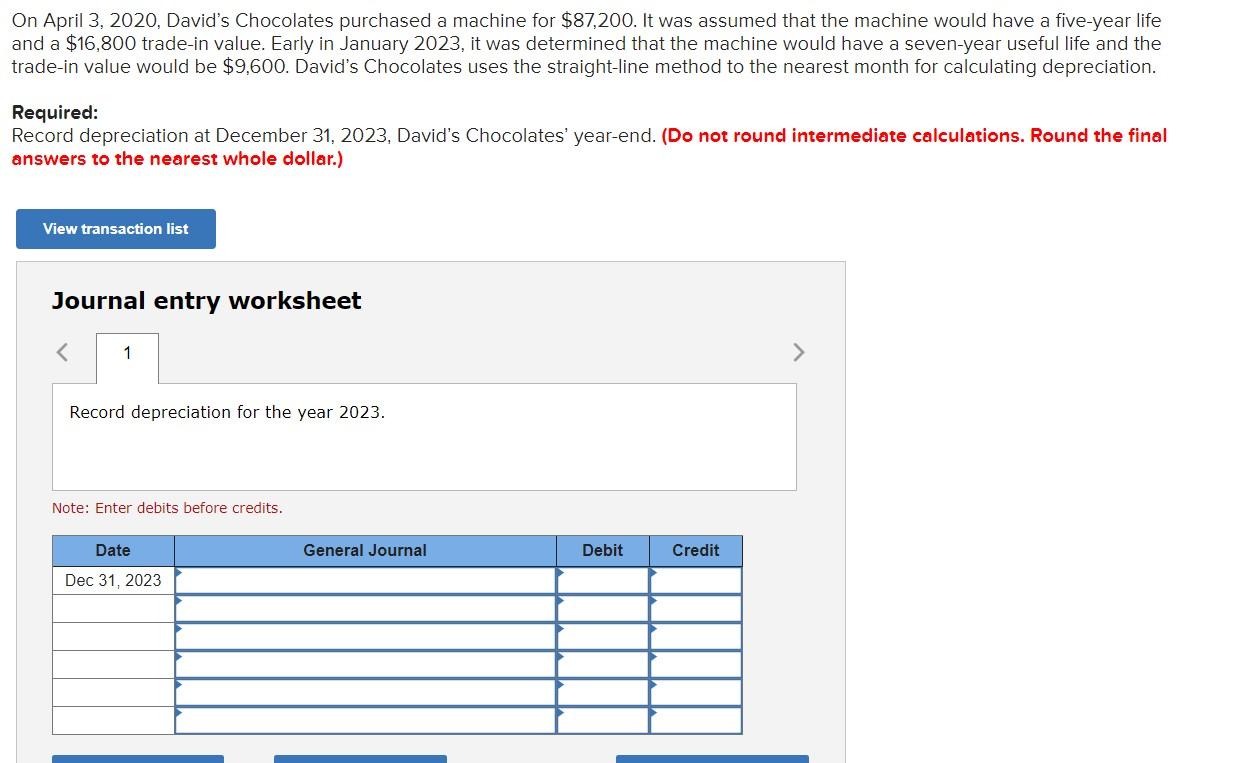

On April 3, 2020, David's Chocolates purchased a machine for $87,200. It was assumed that the machine would have a five-year life and a $16,800 trade-in value. Early in January 2023, it was determined that the machine would have a seven-year useful life and the trade-in value would be $9,600. David's Chocolates uses the straight-line method to the nearest month for calculating depreciation. Required: Record depreciation at December 31, 2023, David's Chocolates' year-end. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) View transaction list Journal entry worksheet < 1 Record depreciation for the year 2023. Note: Enter debits before credits. Date Debit Credit Dec 31, 2023 General Journal

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Annual depreciation 87200168005 14080 Net bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Larson Kermit, Jensen Tilly

14th Canadian Edition

71051570, 0-07-105150-3, 978-0071051576, 978-0-07-10515, 978-1259066511

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App