On April 30, 2016, Witt Corp. had outstanding 8%, $1,000,000 face amount, convertible bonds maturing on April 30, 2024. Interest Is payable on April

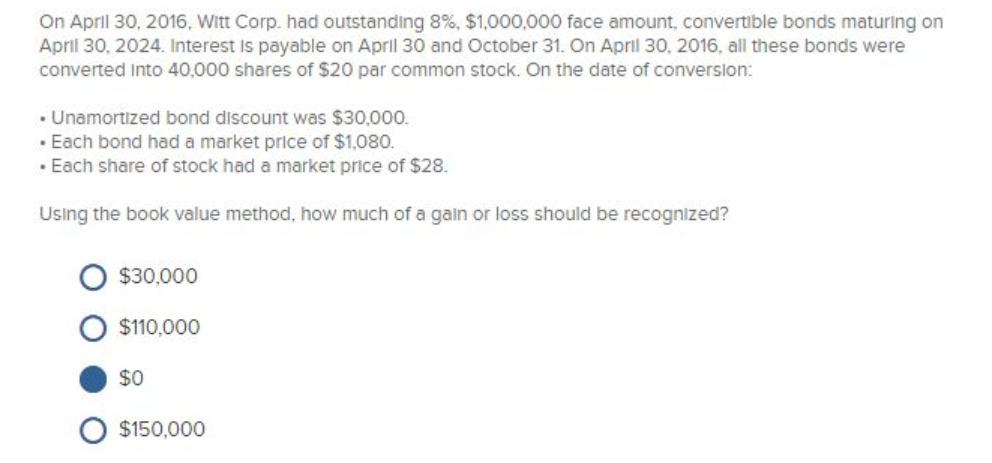

On April 30, 2016, Witt Corp. had outstanding 8%, $1,000,000 face amount, convertible bonds maturing on April 30, 2024. Interest Is payable on April 30 and October 31. On April 30, 2016, all these bonds were converted Into 40,000 shares of $20 par common stock. On the date of conversion: Unamortized bond discount was $30,000. Each bond had a market price of $1,080. Each share of stock had a market price of $28. Using the book value method, how much of a gain or loss should be recognized? $30,000 $110,000 $0 $150,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

First pore pare journal eny for the conuersion of bonds o Frow loss recogmized t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started