Answered step by step

Verified Expert Solution

Question

1 Approved Answer

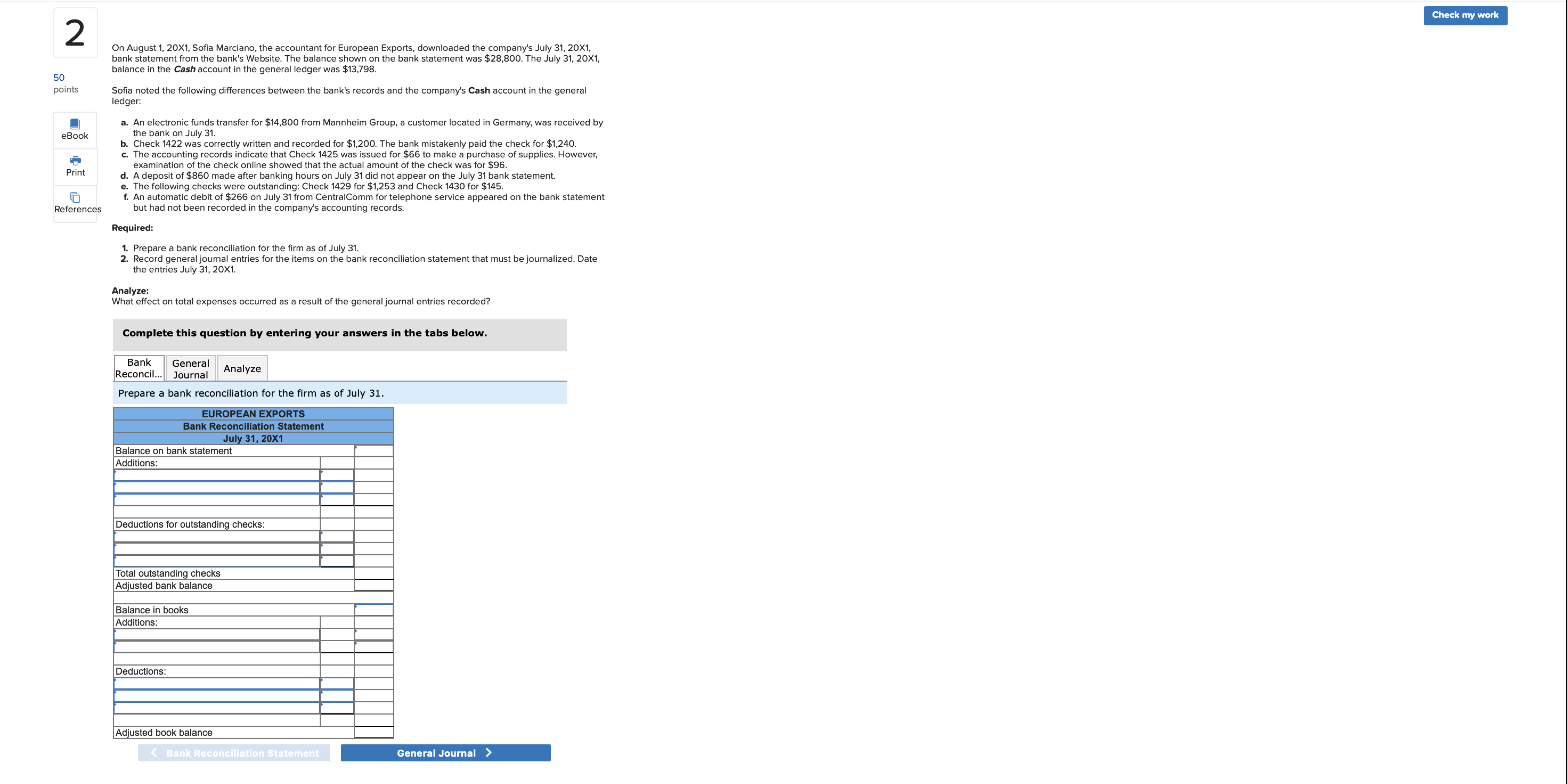

On August 1 , 2 0 X 1 , Sofia Marciano, the accountant for European Exports, downloaded the company's July 3 1 , 2 0

On August X Sofia Marciano, the accountant for European Exports, downloaded the company's July X

bank statement from the bank's Website. The balance shown on the bank statement was $ The July X

balance in the Cash account in the general ledger was $

points

References

Sofia noted the following differences between the bank's records and the company's Cash account in the general

ledger:

a An electronic funds transfer for $ from Mannheim Group, a customer located in Germany, was received by

the bank on July

c Theck was correctly written and recorded for $ The bank mistakenly paid the check for $

The accounting records indicate that Check was issued for $ to make a purchase of supplies. However

A deposit of $ made online showed that the actual amount of the check was for $

f An automatic debit of $ outstanding: Check for $ and Check for $

but had not be the bank statement

Required:

Prepare a bank reconciliation for the firm as of July

Record general journal entries for the items on the bank reconciliation statement that must be journalized. Date

the entries July X

Analyze:

What effect on total expenses occurred as a result of the general journal entries recorded?

Complete this question by entering your answers in the tabs below.

tableBank General

Reconcil... Journal Analyze

Prepare a bank reconciliation for the firm as of July On August X Sofia Marciano, the accountant for European Exports, downloaded the company's July X

bank statement from the bank's Website. The balance shown on the bank statement was $ The July X

balance in the Cash account in the general ledger was $

Sofia n :

ledger:

a An electronic funds transfer for $ from Mannheim Group, a customer located in Germany, was received by

b Check waly

b Check was correctly written and recorded for $ The bank mistakenly paid the check for $

c The accounting records indicate that Check was issued for $ to make a purchase of supplies. However

examination of the check online showed that the actual amount of the check was for $

d A deposit of $ made after banking hours on July did not appear on the July bank statement.

e The following checks were outstanding: Check for $ and Check for $

An automatic debit of $ on July from CentralComm for telephone service appeared on the bank statement

but had not been recorded in the company's accounting records.

Required:

Prepare a bank reconciliation for the firm as of July

Record general journal entries for the items on the bank reconciliation statement that must be journalized. Date

the entries July

Analyze:

What effect on total expenses occurred as a result of the general journal entries rec On August X Sofia Marciano, the accountant for European Exports, downloaded the company's July X bank statement from the bank's Website. The balance shown on the bank statement was $ The July X balance in the Cash account in the general ledger was $

Sofia noted the following differences between the bank's records and the company's Cash account in the general ledger:

An electronic funds transfer for $ from Mannheim Group, a customer located in Germany, was received by the bank on July

Check was correctly written and recorded for $ The bank mistakenly paid the check for $

The accounting records indicate that Check was issued for $ to make a purchase of supplies. However, examination of the check online showed that the actual amount of the check was for $

A deposit of $ made after banking hours on July did not appear on the July bank statement.

The following checks were outstanding: Check for $ and Check for $

An automatic debit of $ on July from CentralComm for telephone service appeared on the bank statement but had not been recorded in the compny's accounting records.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started