Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 1, 2020, your company issued $500,000 of 12 year, 7% bonds when the market interest rate was 8%. The bonds pay interest

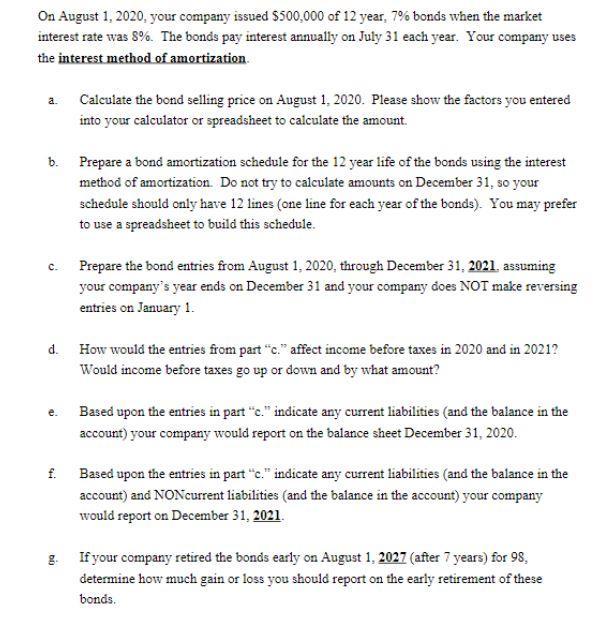

On August 1, 2020, your company issued $500,000 of 12 year, 7% bonds when the market interest rate was 8%. The bonds pay interest annually on July 31 each year. Your company uses the interest method of amortization. a. Calculate the bond selling price on August 1, 2020. Please show the factors you entered into your calculator or spreadsheet to calculate the amount. b. Prepare a bond amortization schedule for the 12 year life of the bonds using the interest method of amortization. Do not try to calculate amounts on December 31, so your schedule should only have 12 lines (one line for each year of the bonds). You may prefer to use a spreadsheet to build this schedule. c. Prepare the bond entries from August 1, 2020, through December 31, 2021. assuming your company's year ends on December 31 and your company does NOT make reversing entries on January 1. d. How would the entries from part "c." affect income before taxes in 2020 and in 2021? Would income before taxes go up or down and by what amount? e. Based upon the entries in part "c." indicate any current liabilities (and the balance in the account) your company would report on the balance sheet December 31, 2020. Based upon the entries in part "c." indicate any current liabilities (and the balance in the account) and NONcurrent liabilities (and the balance in the account) your company would report on December 31, 2021. g. If your company retired the bonds early on August 1, 2027 (after 7 years) for 98, determine how much gain or loss you should report on the early retirement of these bonds. 4-i

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of selling price of the bond as on 01082020 Amount In DATE CASH INFLOW PVIF 8 AMOUNT 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started