Answered step by step

Verified Expert Solution

Question

1 Approved Answer

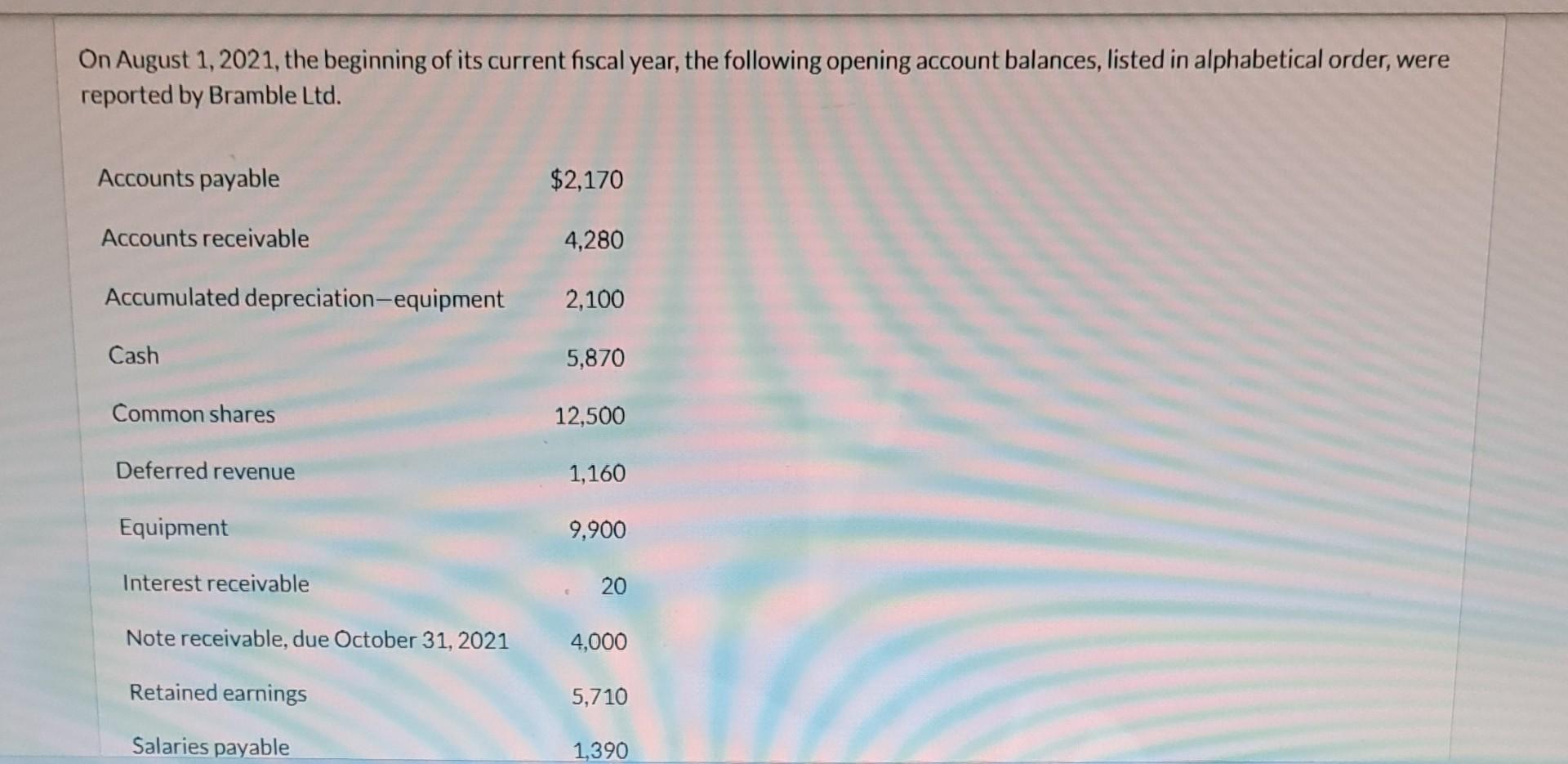

On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Bramble Ltd.

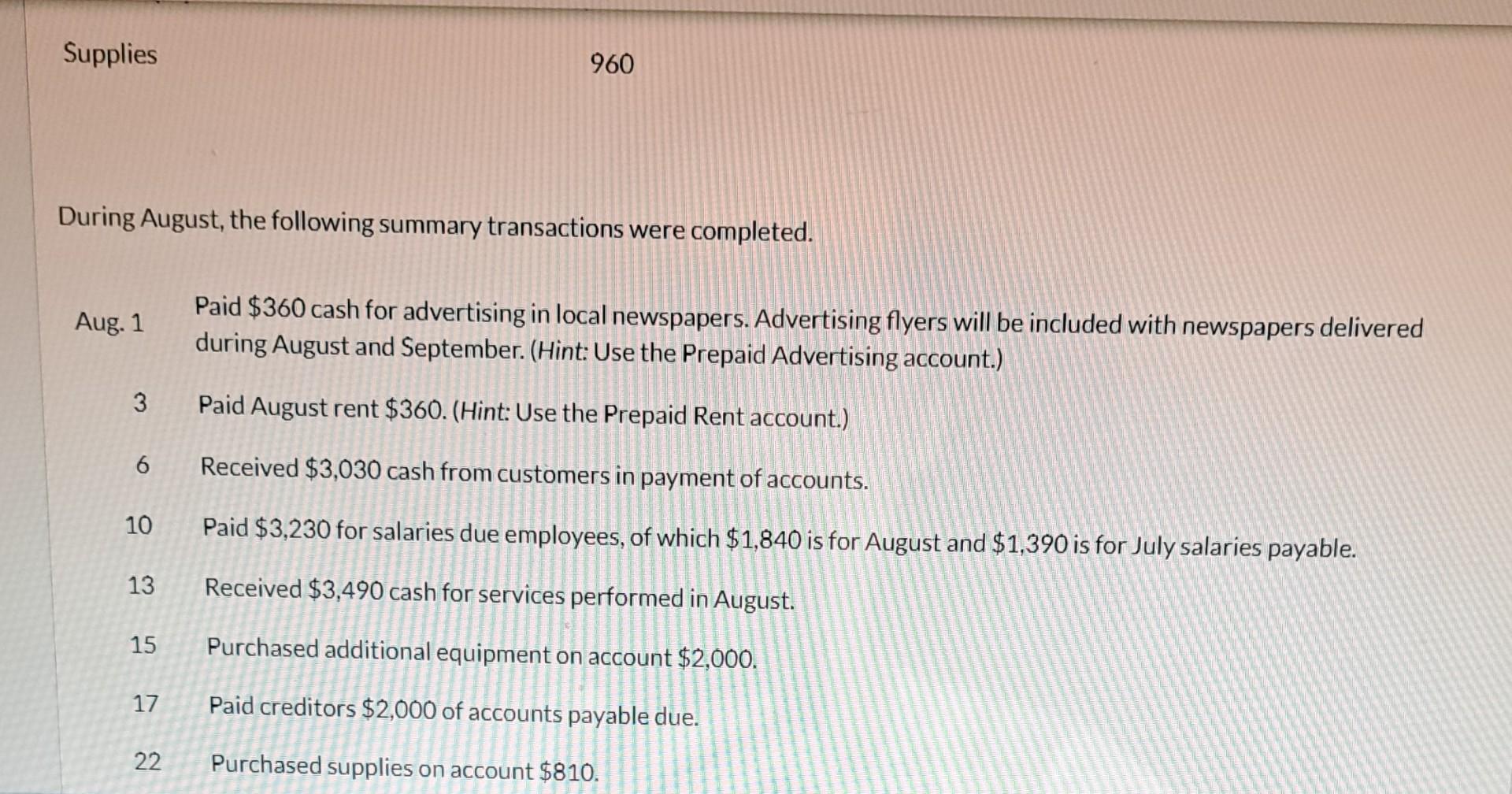

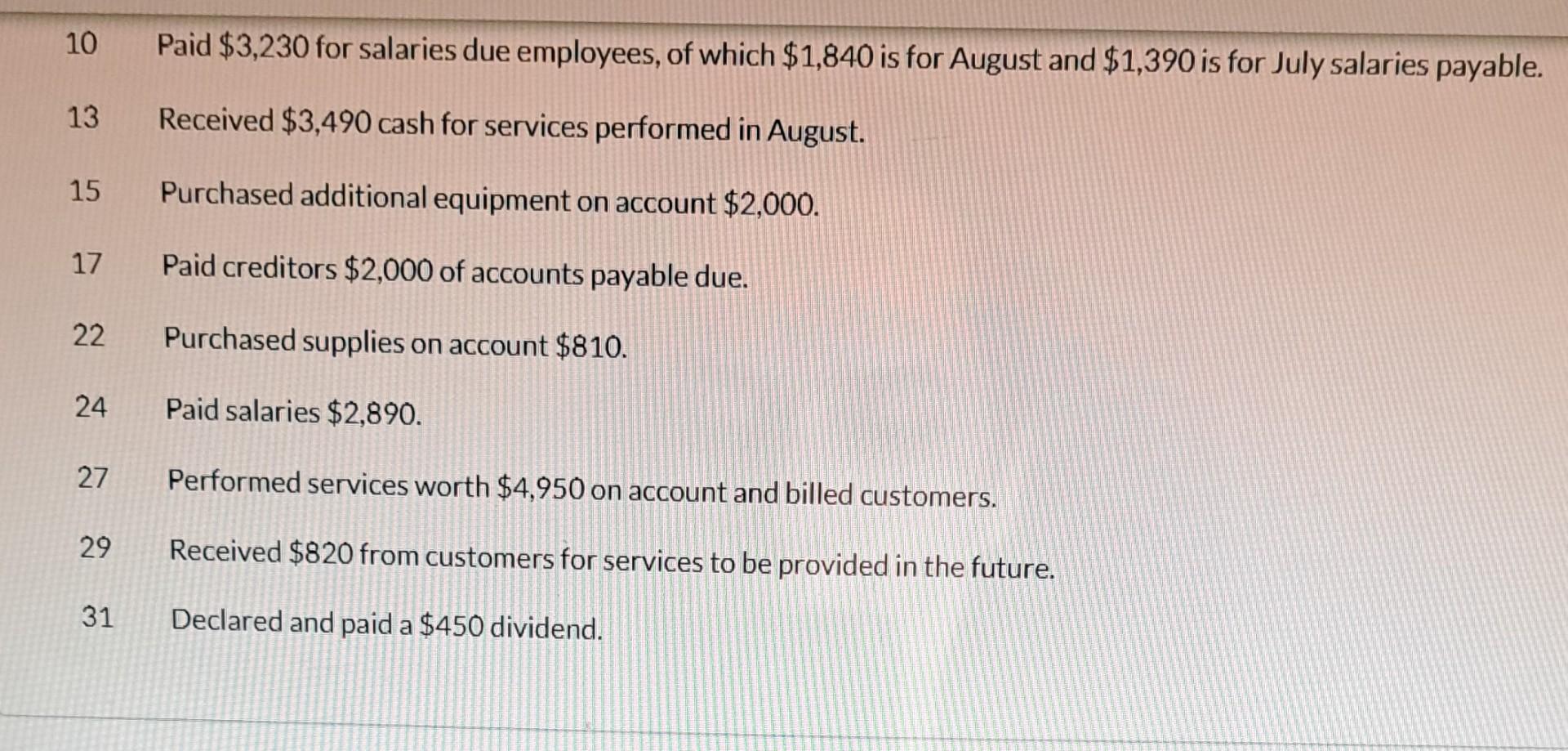

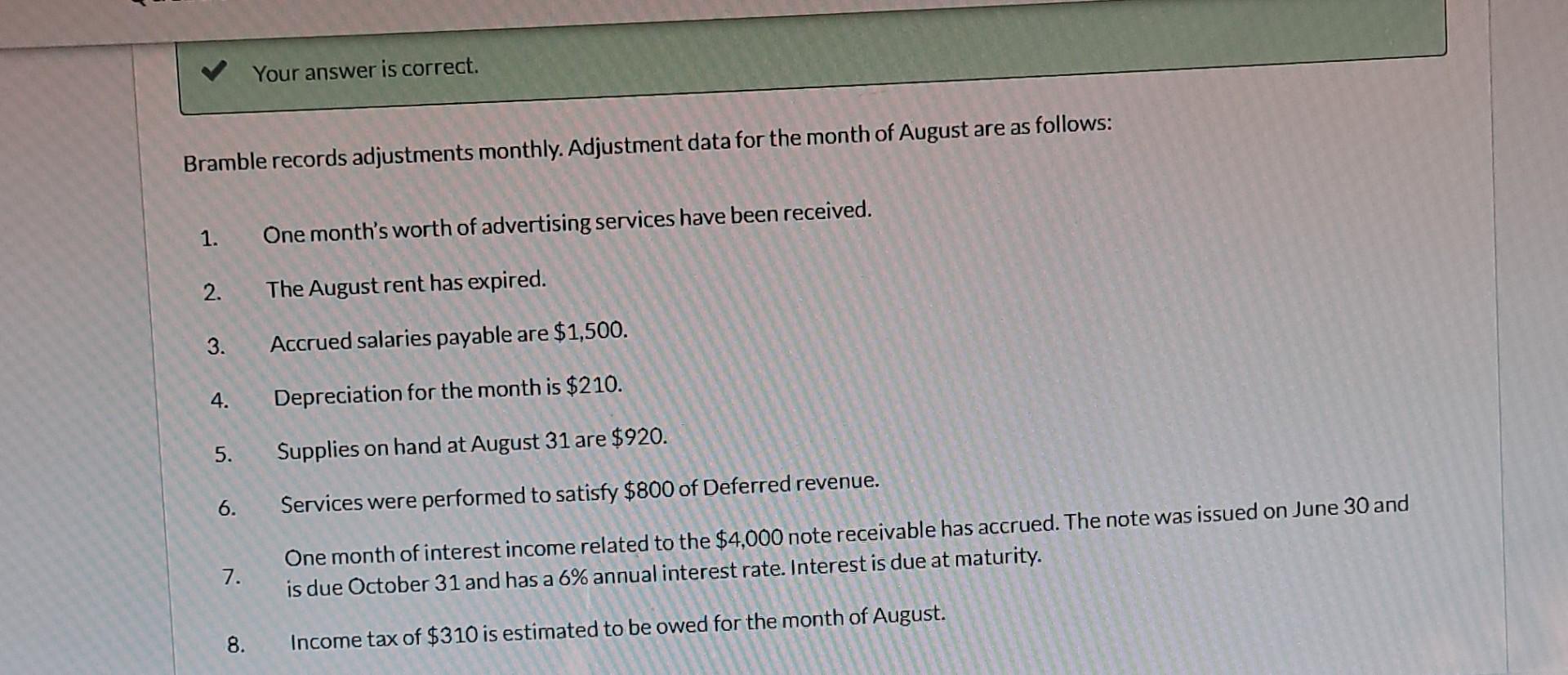

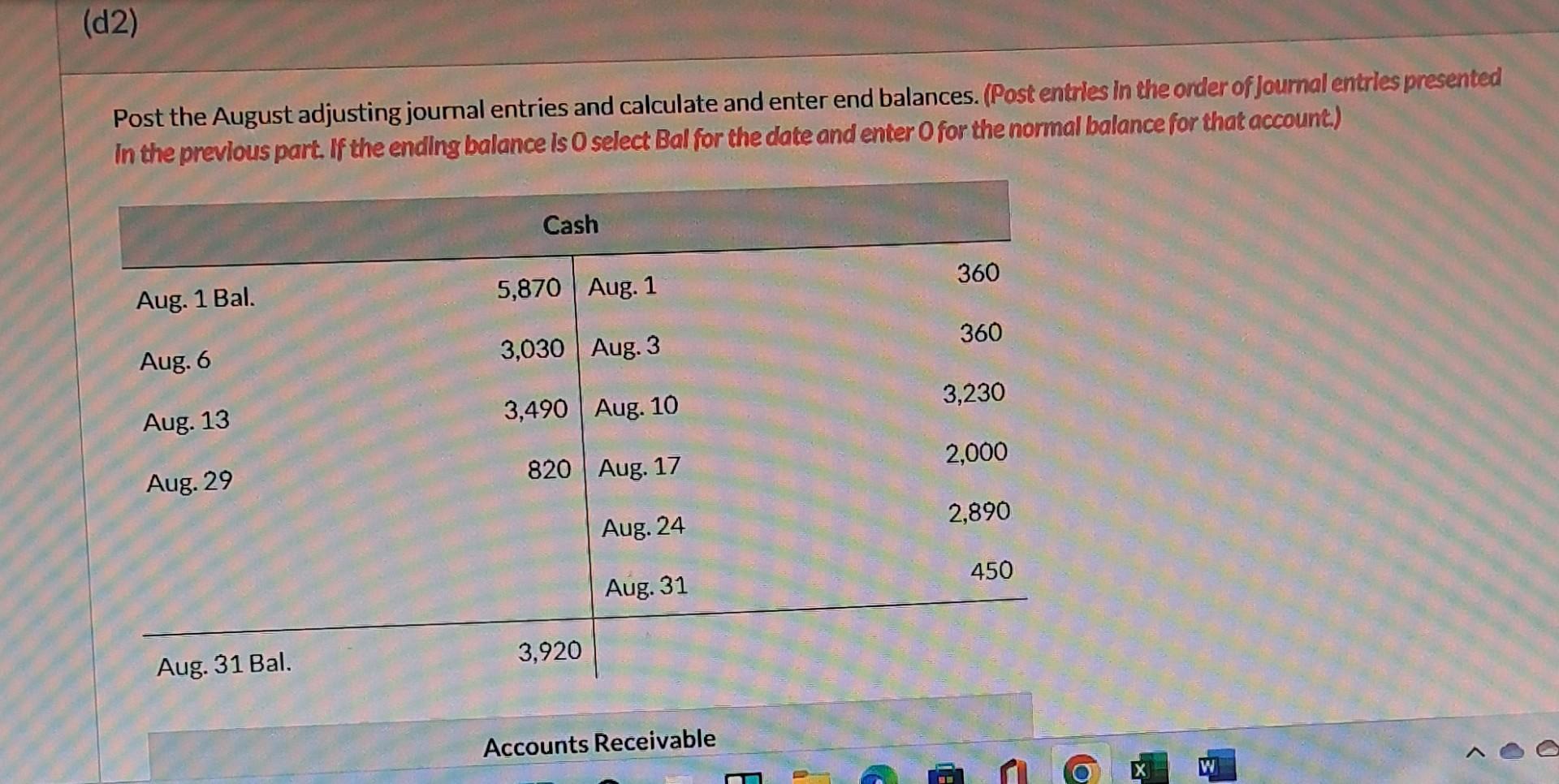

On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Bramble Ltd. During August, the following summary transactions were completed. Aug. 1 Paid $360 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent \$360. (Hint: Use the Prepaid Rent account.) 6 Received $3,030 cash from customers in payment of accounts. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Received $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Received $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 24 Paid salaries $2,890. 27 Performed services worth $4,950 on account and billed customers. 29 Received $820 from customers for services to be provided in the future. 31 Declared and paid a $450 dividend. Bramble records adjustments monthly. Adjustment data for the month of August are as follows: 1. One month's worth of advertising services have been received. 2. The August rent has expired. 3. Accrued salaries payable are $1,500. 4. Depreciation for the month is $210. 5. Supplies on hand at August 31 are $920. 6. Services were performed to satisfy $800 of Deferred revenue. 7. One month of interest income related to the $4,000 note receivable has accrued. The note was issued on June 30 and is due October 31 and has a 6% annual interest rate. Interest is due at maturity. 8. Income tax of $310 is estimated to be owed for the month of August. Post the August adjusting journal entries and calculate and enter end balances. (Post enterles in the order of journal entrles presented In the prevlous part. If the ending balance Is 0 select Bal for the date and enter O for the normal balance for that account.) On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Bramble Ltd. During August, the following summary transactions were completed. Aug. 1 Paid $360 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent \$360. (Hint: Use the Prepaid Rent account.) 6 Received $3,030 cash from customers in payment of accounts. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Received $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Received $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 24 Paid salaries $2,890. 27 Performed services worth $4,950 on account and billed customers. 29 Received $820 from customers for services to be provided in the future. 31 Declared and paid a $450 dividend. Bramble records adjustments monthly. Adjustment data for the month of August are as follows: 1. One month's worth of advertising services have been received. 2. The August rent has expired. 3. Accrued salaries payable are $1,500. 4. Depreciation for the month is $210. 5. Supplies on hand at August 31 are $920. 6. Services were performed to satisfy $800 of Deferred revenue. 7. One month of interest income related to the $4,000 note receivable has accrued. The note was issued on June 30 and is due October 31 and has a 6% annual interest rate. Interest is due at maturity. 8. Income tax of $310 is estimated to be owed for the month of August. Post the August adjusting journal entries and calculate and enter end balances. (Post enterles in the order of journal entrles presented In the prevlous part. If the ending balance Is 0 select Bal for the date and enter O for the normal balance for that account.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started