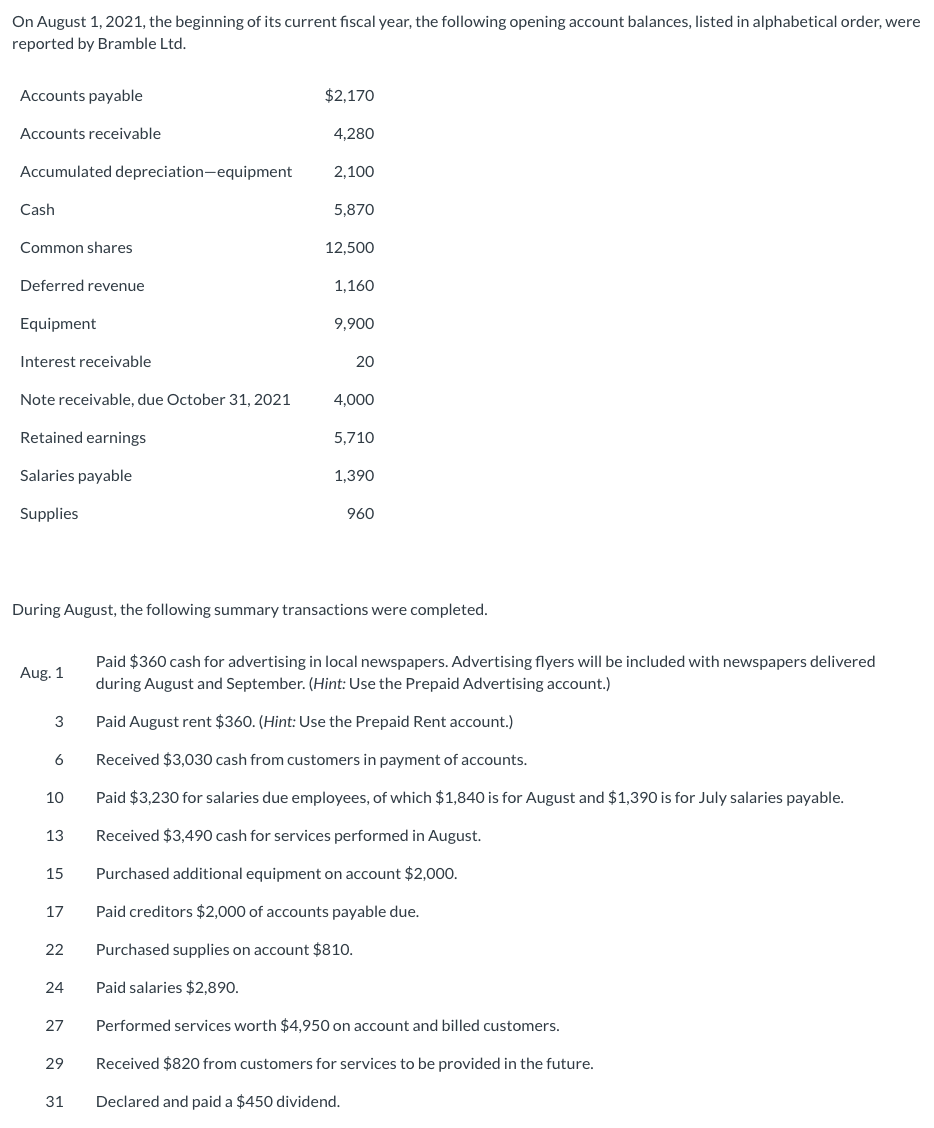

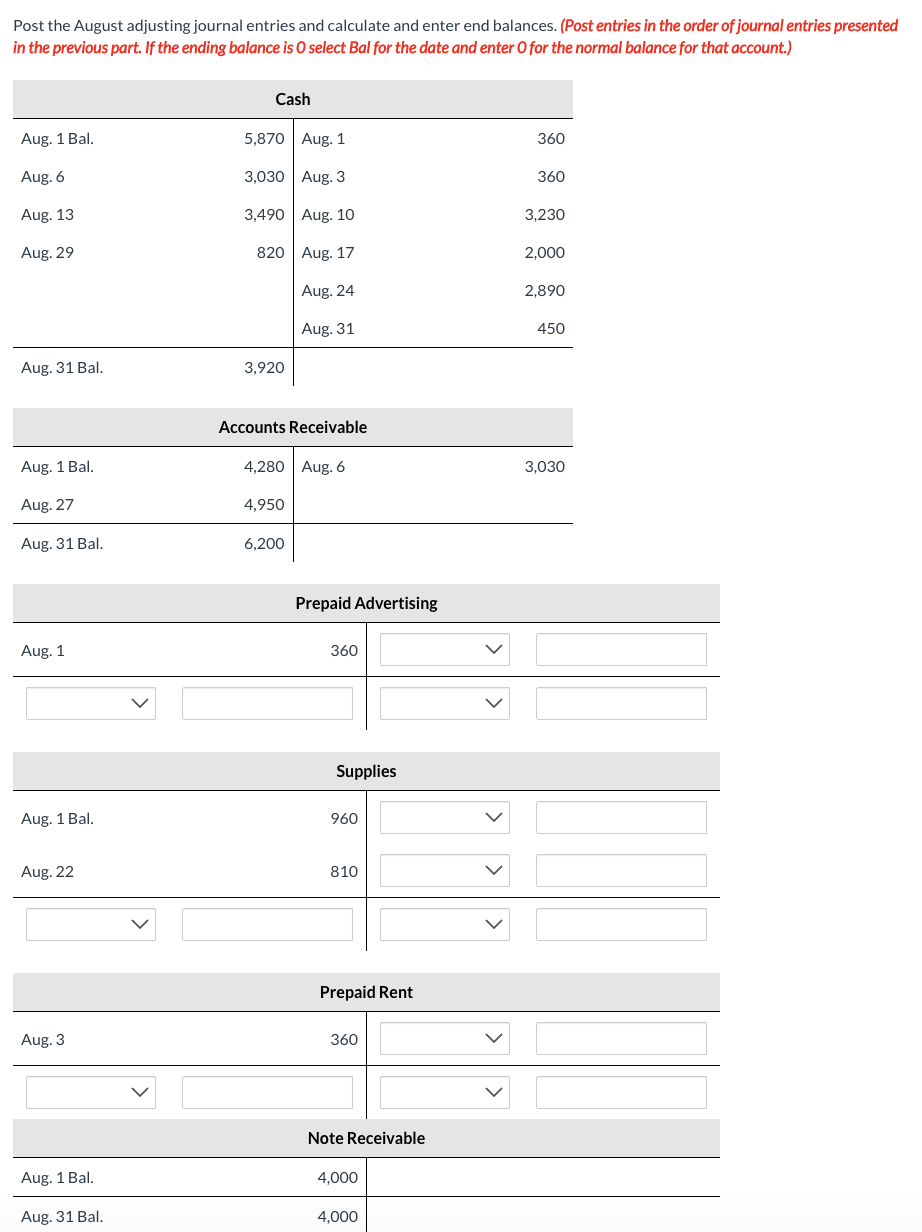

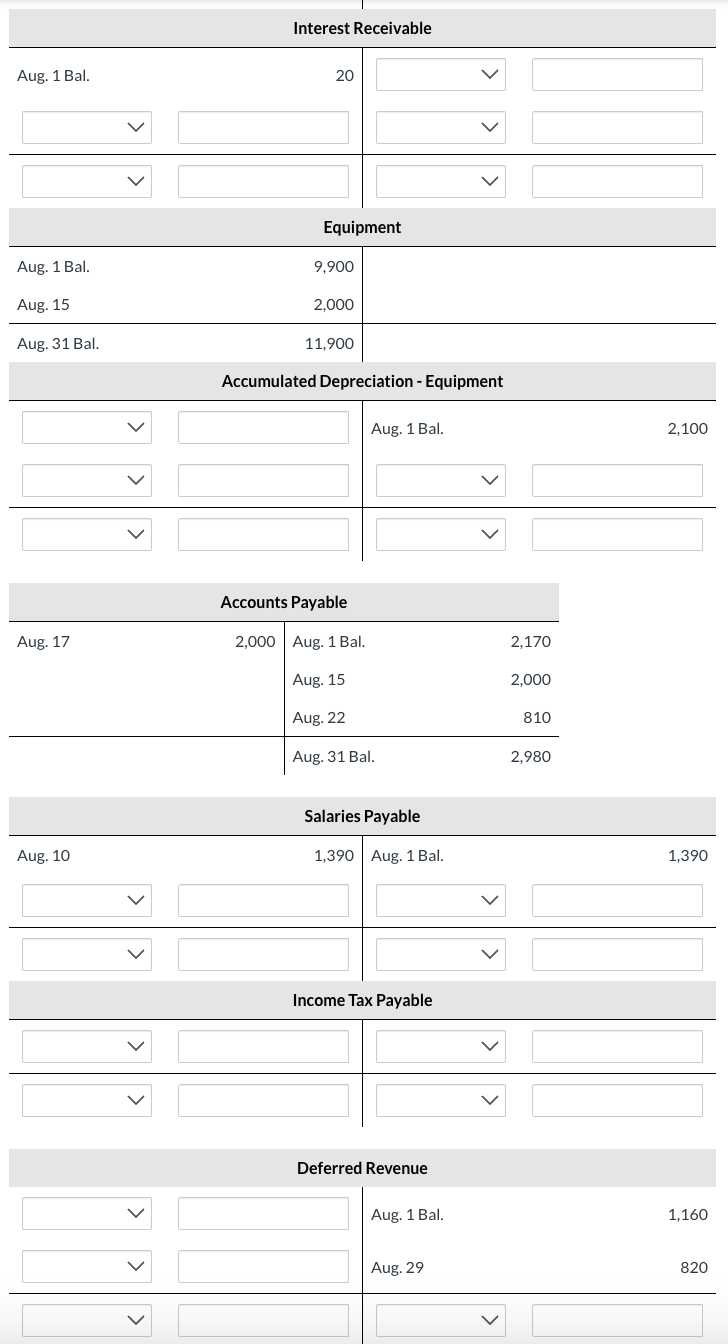

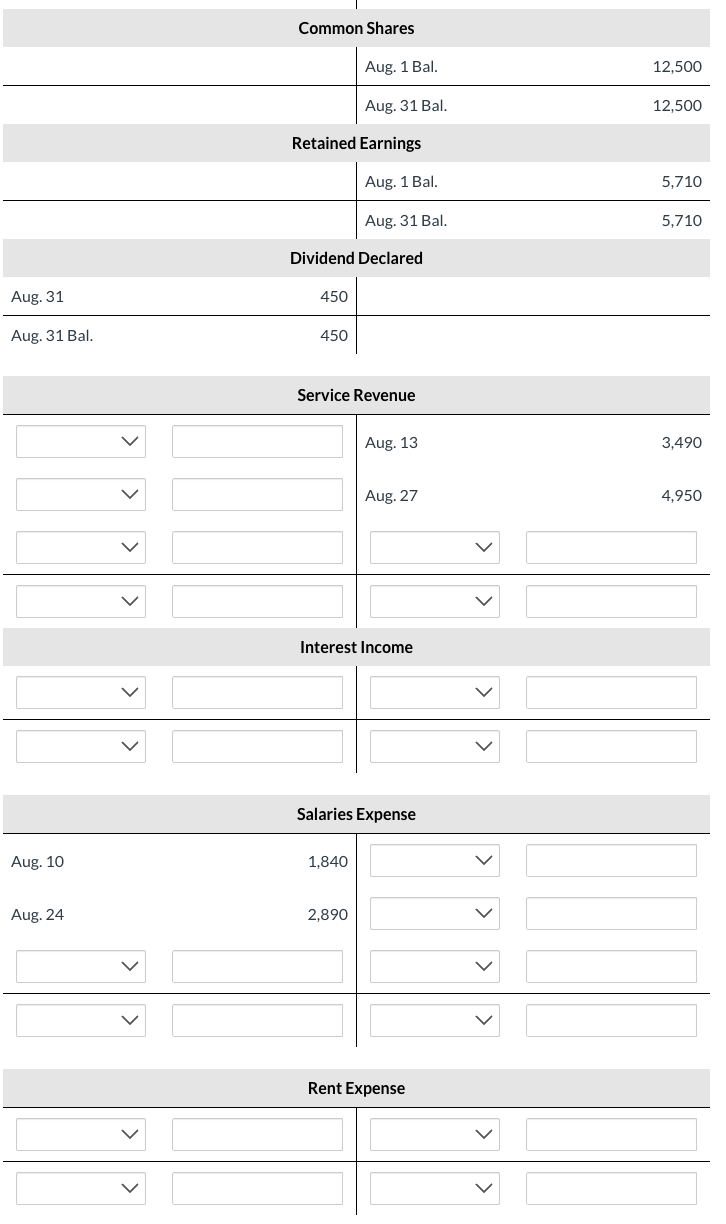

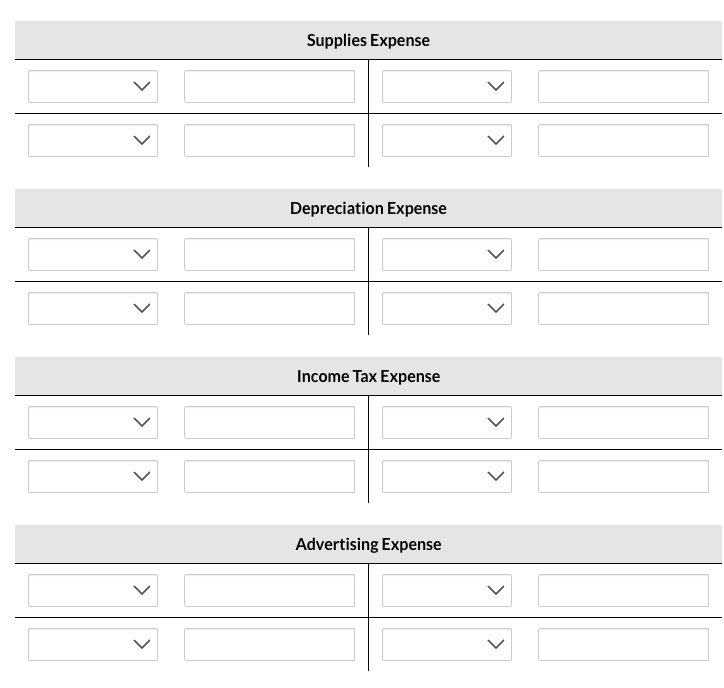

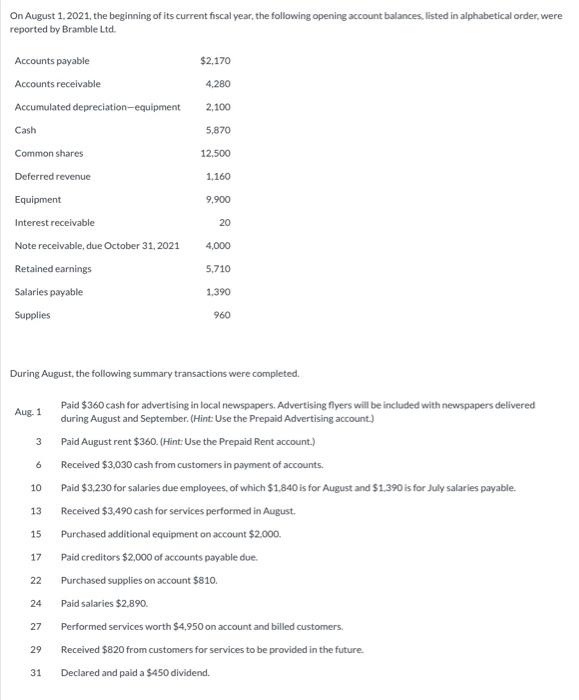

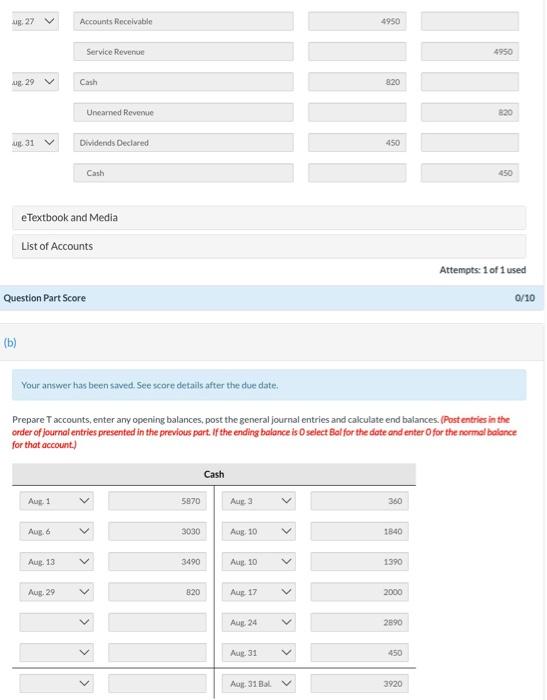

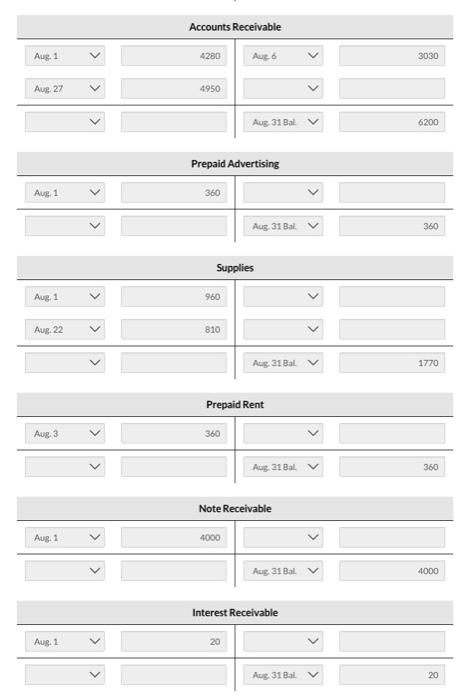

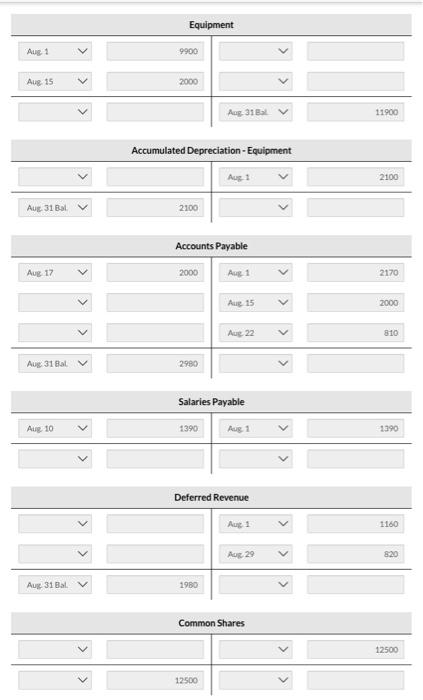

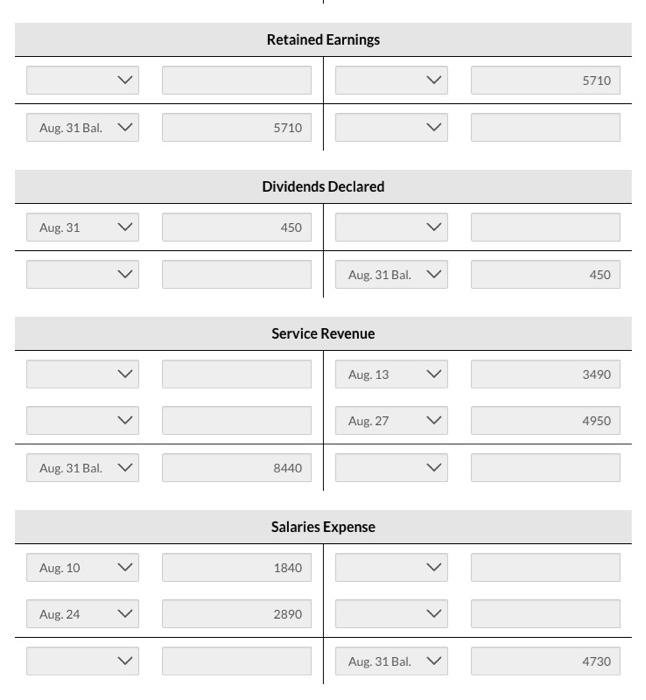

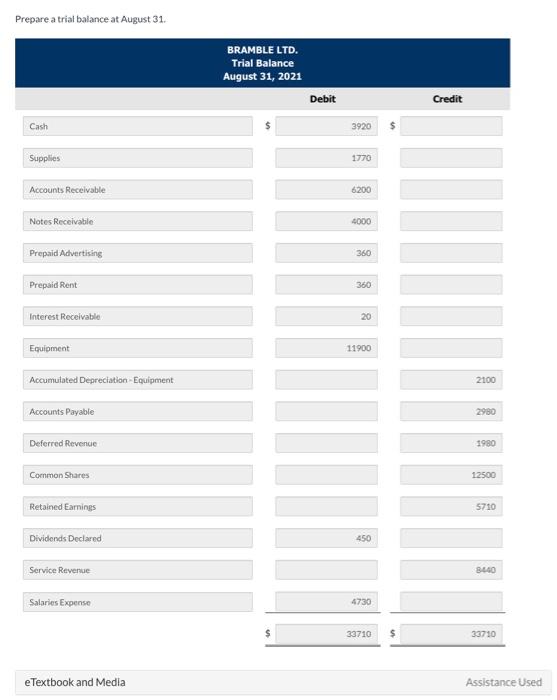

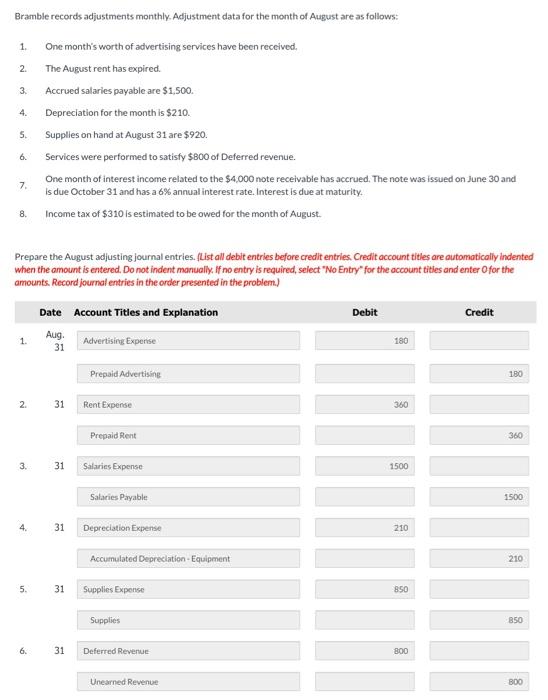

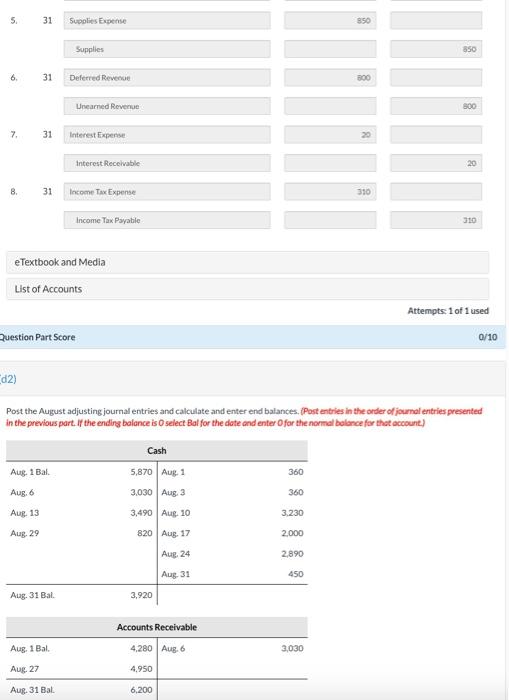

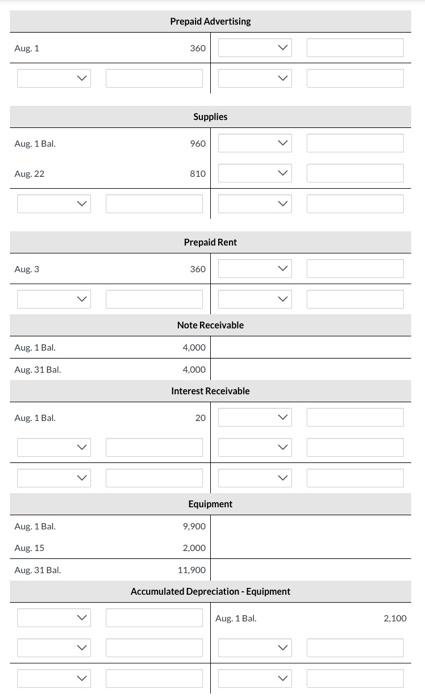

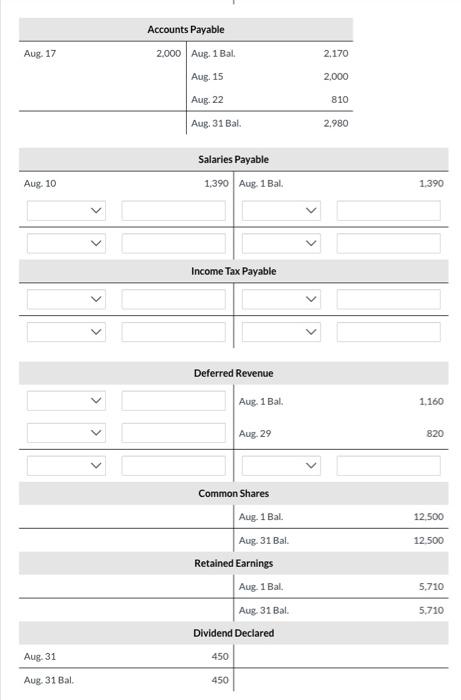

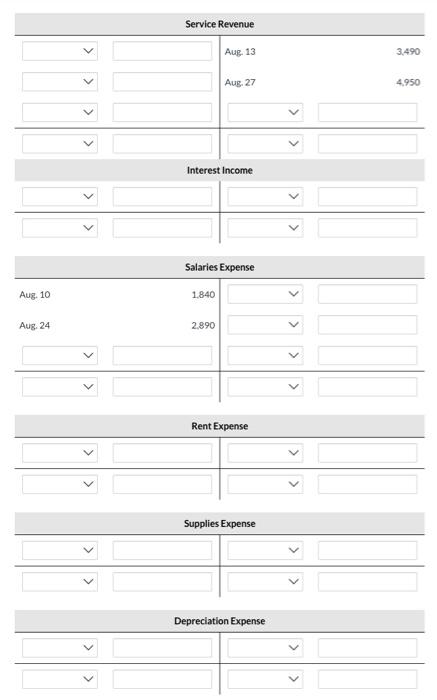

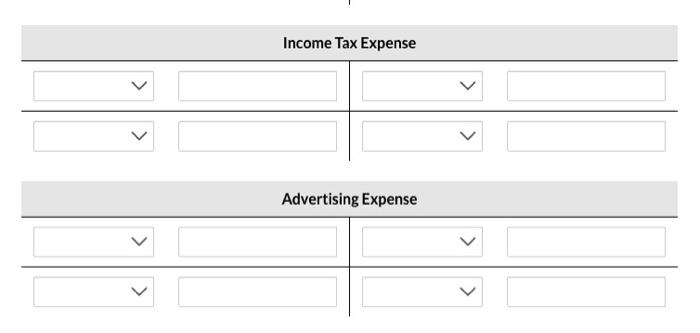

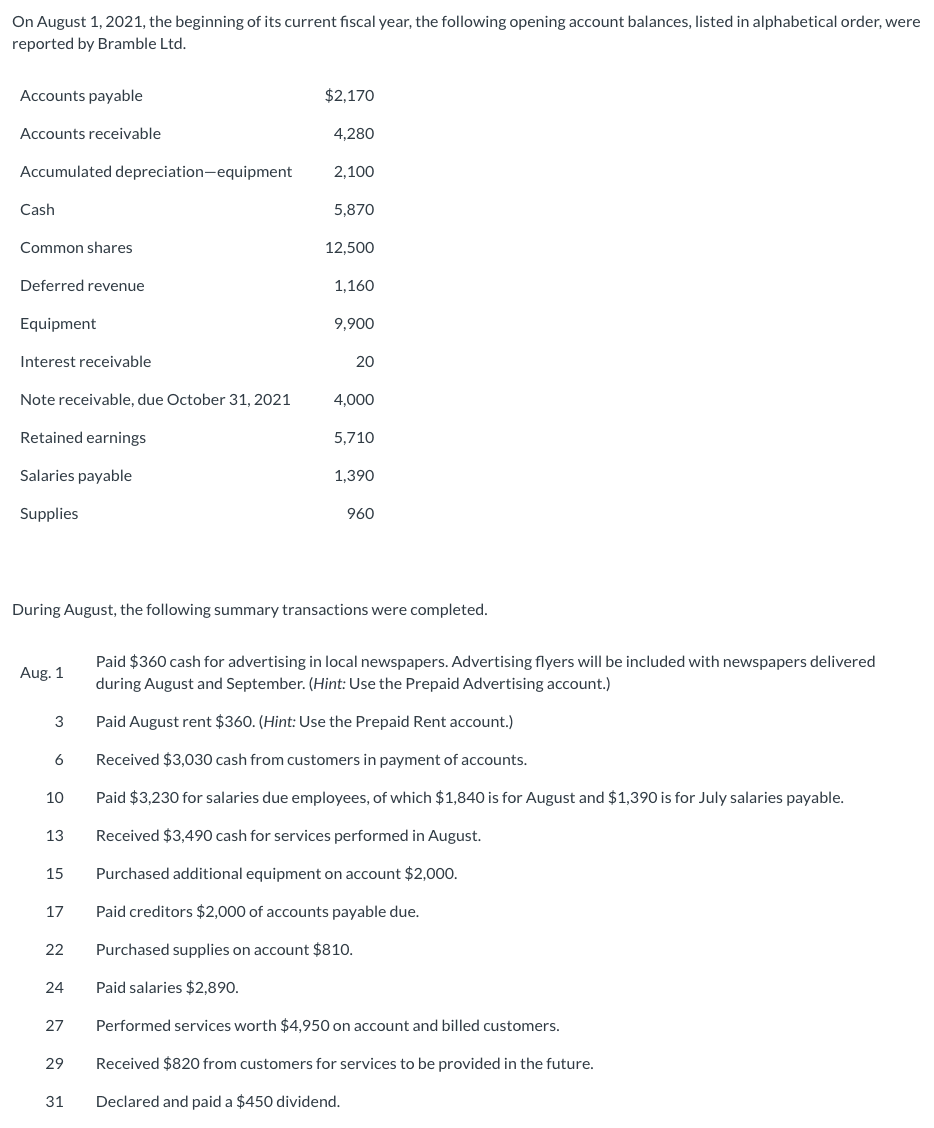

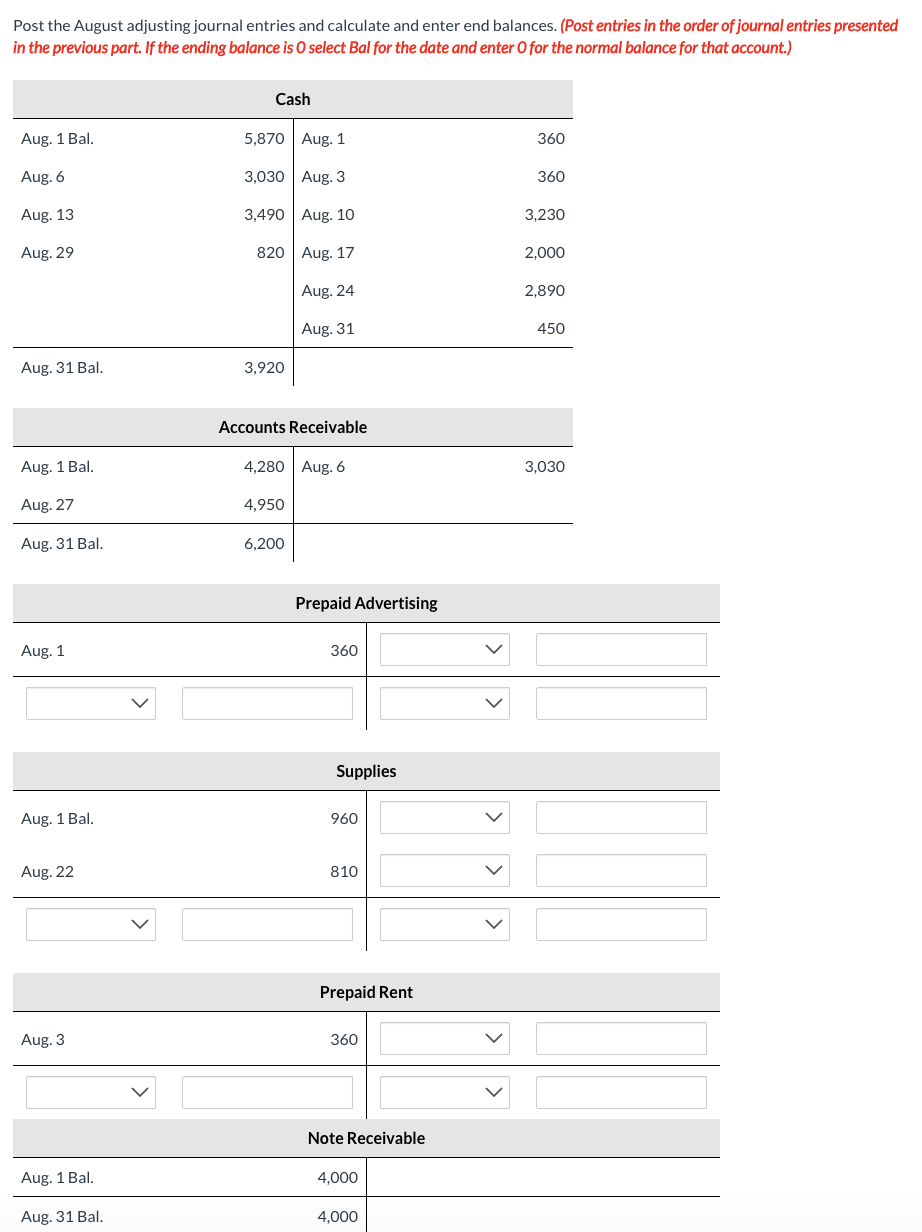

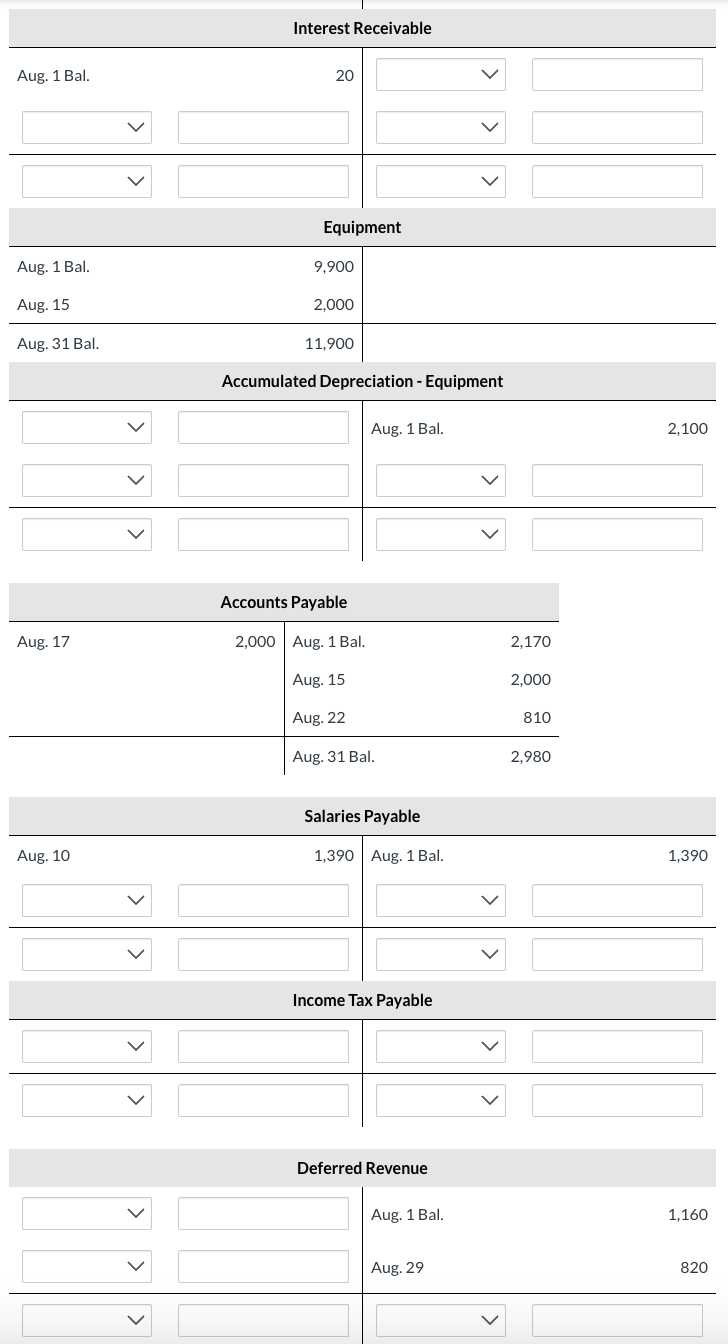

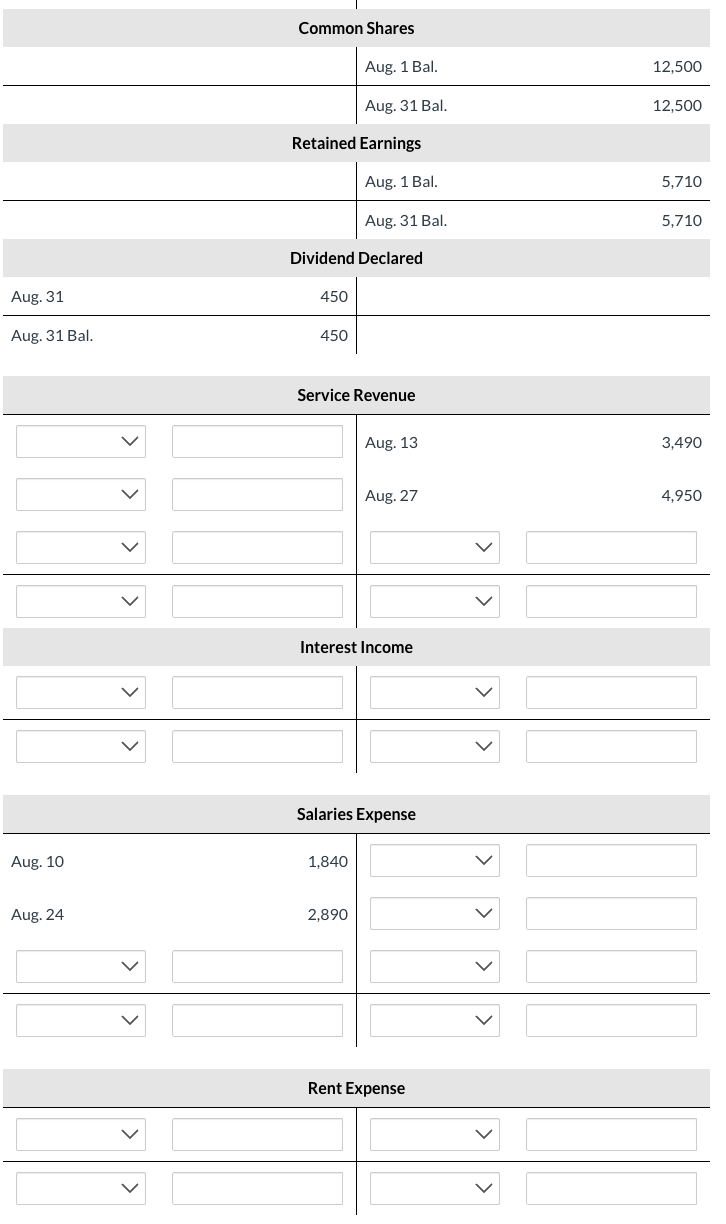

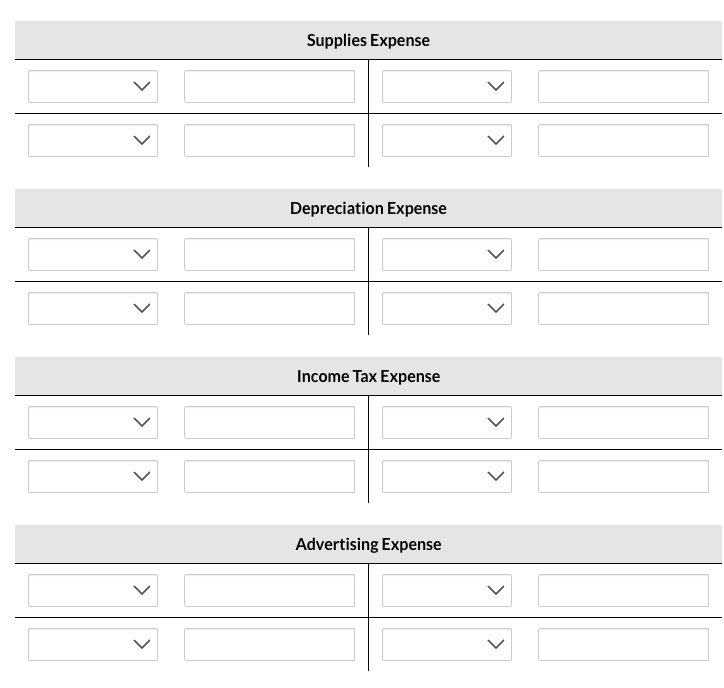

On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Bramble Ltd. During August, the following summary transactions were completed. Aug. 1 Paid $360 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent $360. (Hint: Use the Prepaid Rent account.) 6 Received $3,030 cash from customers in payment of accounts. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Received $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 24 Paid salaries $2,890. 27 Performed services worth $4,950 on account and billed customers. 29 Received $820 from customers for services to be provided in the future. 31 Declared and paid a $450 dividend. Post the August adjusting journal entries and calculate and enter end balances. (Post entries in the order of journal entries presented in the previous part. If the ending balance is 0 select Bal for the date and enter 0 for the normal balance for that account.) Interest Receivable Aug. 1 Bal. Salaries Payable \begin{tabular}{|r|r|lr|} \hline Aug. 10 & 1,390 & Aug. 1 Bal. \\ \hlineV & 1,390 \\ \hlineV & & \\ \hline \end{tabular} Income Tax Payable Common Shares Service Revenue Aug. 13 3,490 Aug. 27 4,950 Interest Income Salaries Expense Aug. 10 Aug. 24 Rent Expense Supplies Expense Depreciation Expense Income Tax Expense Advertising Expense On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Bramble Ltd. During August, the following summary transactions were completed. Aug. 1 Paid $360 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint Use the Prepaid Advertising account). 3 Paid August rent $360. (Hint: Use the Prepaid Rent account.) 6 Recelved $3,030 cash from customers in payment of accounts. 10 Paid $3,230 for salaries due employees, of which $1,840 is for August and $1,390 is for July salaries payable. 13 Recelved $3,490 cash for services performed in August. 15 Purchased additional equipment on account $2,000. 17 Paid creditors $2,000 of accounts payable due. 22 Purchased supplies on account $810. 24 Paid salaries $2,890. 27 Performed services worth $4,950 on account and billed customers: 29 Received $820 from customers for services to be provided in the future 31 Declared and paid a $450 dividend. Record the above summary transactions. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is enteref. Do not indent manually, If no entry is required, select "Nh Fntru" for the arrount fitlec and enter 0 for the amsunte] Your answer has been saved. See score details after the due date. Prepare T accounts, enter any opening balances, post the general journal entries and calculate end balances. (Post entries in the order of journal entries presented in the previous part. If the ending balance is 0 select Bal for the date and enter O for the normal balance for that account.) Accounts Receivable Prepaid Advertising \begin{tabular}{l|l|l|l|} \hline Aug. 1 & 360 & & \\ \hlineV & Aug 31 Bal. & & 360 \\ \hline \end{tabular} Supplies Prepaid Rent \begin{tabular}{|r|r|r|r|} \hline Aug.3 & & & \\ \hlineV & 360 & & \\ \hline \end{tabular} Note Receivable Retained Earnings Dividends Declared \begin{tabular}{r|r|r|r|} \hline Aug. 31 & & & \\ \hlineV & 450 & Aug. 31 Bal. V & 450 \\ \hline \end{tabular} Service Revenue Salaries Expense Drawara s brist halarara sb Aumbet 71 Bramble records adjustments monthly. Adjustment data for the month of August are as follows: 1. One month's worth of advertising services have been received. 2. The August rent has expired. 3. Accrued salaries payable are $1,500. 4. Depreciation for the month is $210. 5. Supplies on hand at August 31 are $920. 6. Services were performed to satisfy $800 of Deferred revenue. 7. One month of interest income related to the $4,000 note receivable has accrued. The note was issued on June 30 and is due October 31 and has a 6% annual interest rate. Interest is due at maturity. 8. Income tax of $310 is estimated to be owed for the month of August. Prepare the August adjusting journal entries. fList all debit entries before credit entries. Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter 0 for the amounts. Record journal entries in the order presented in the problent.) Post the August adjusting journal entries and calculate and enter end balances, (Post entries in the order of journol tntries presented in the previous part. If the ending balence is O select Bal for the date and enter Ofor the normal balance for that account.) Prepaid Advertising \begin{tabular}{lr|l} \hline Aug. 1 & 360 & \\ \hline & V & \\ \hline \end{tabular} Supplies Aug. 1Bal. Aug. 22 810 Prepaid Rent Aug. 3 Note Receivable \begin{tabular}{lr|r} \hline Aug. 1 Bal. & 4,000 & \\ \hline Aug. 31 Bal. & 4,000 & \\ \hline Interest Recelvable \\ \hline Aug. 1 Bal. & 20 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{lr|r|} \hline \multicolumn{2}{c}{ Equipment } \\ \hline Aug. 1 Bal. & 9,900 & \\ \hline Aug. 15 & 2,000 & \\ \hline Aug. 31 Bal. & 11,900 & \\ \hline & Accumulated Depreciation - Equipment \\ \hline & & Aug. 1 Bal. \\ \hline \end{tabular} Deferred Revenue Aug. 1Bal. 1,160 Common Shares Income Tax Expense Advertising Expense