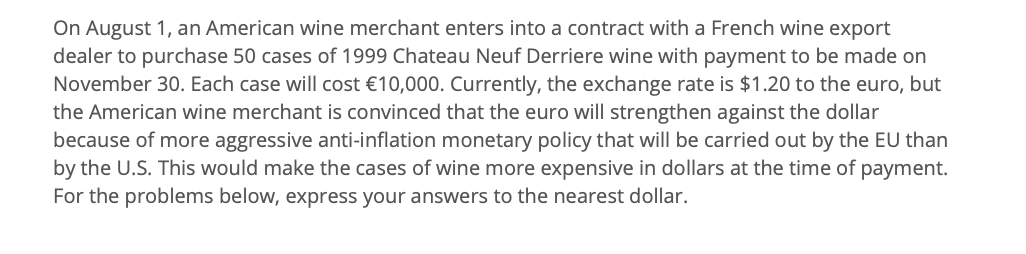

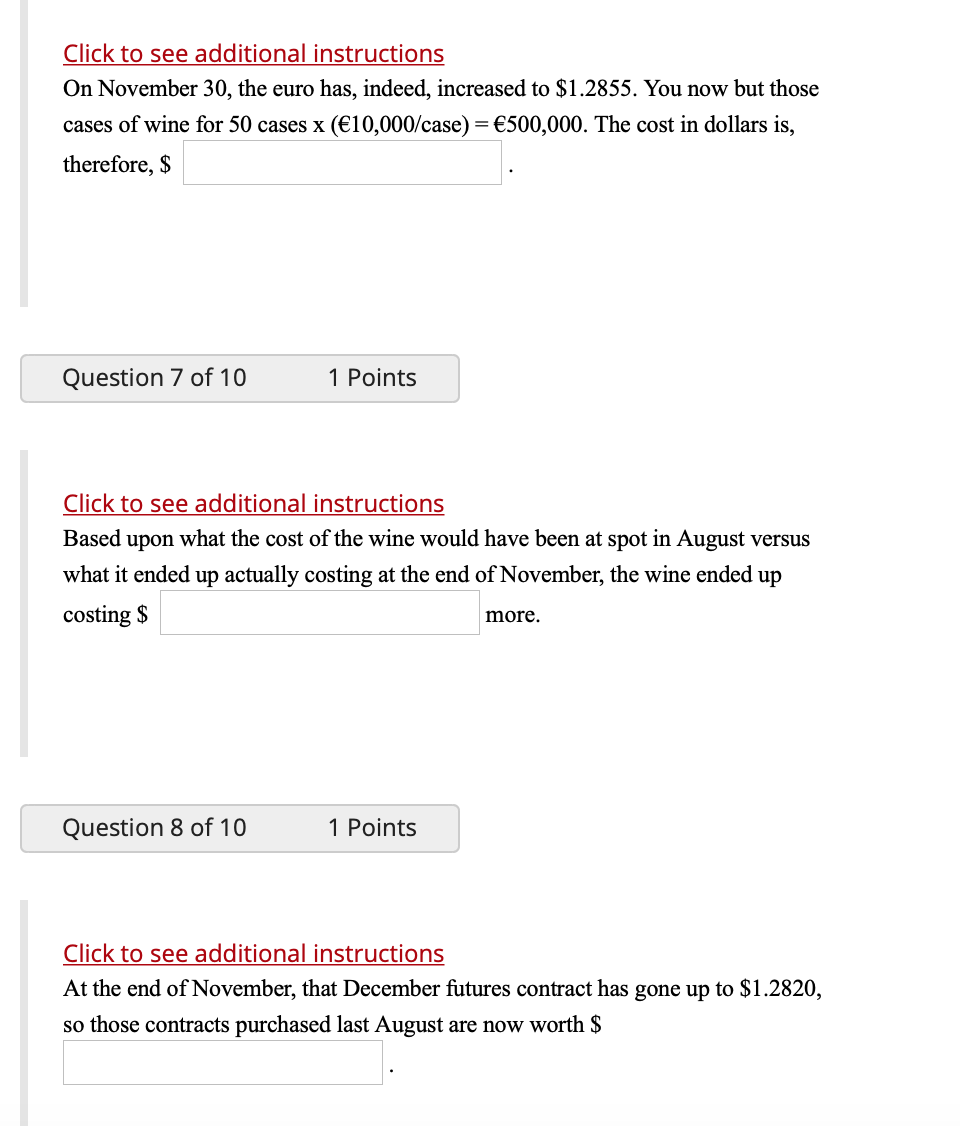

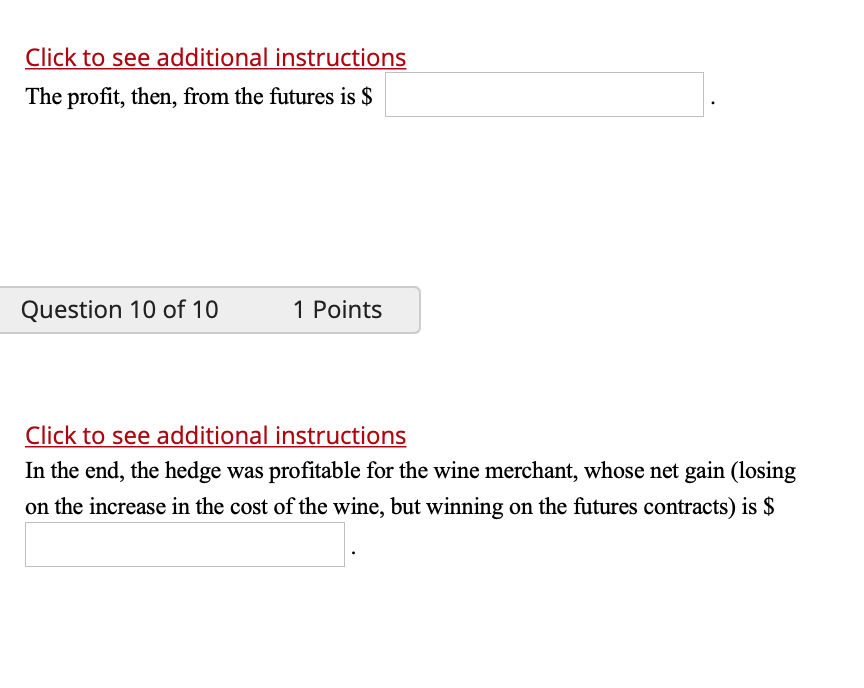

On August 1, an American wine merchant enters into a contract with a French wine export dealer to purchase 50 cases of 1999 Chateau Neuf Derriere wine with payment to be made on November 30. Each case will cost 10,000. Currently, the exchange rate is $1.20 to the euro, but the American wine merchant is convinced that the euro will strengthen against the dollar because of more aggressive anti-inflation monetary policy that will be carried out by the EU than by the U.S. This would make the cases of wine more expensive in dollars at the time of payment. For the problems below, express your answers to the nearest dollar. Click to see additional instructions On November 30, the euro has, indeed, increased to $1.2855. You now but those cases of wine for 50 cases x (10,000/case) = 500,000. The cost in dollars is, therefore, $ Question 7 of 10 1 Points Click to see additional instructions Based upon what the cost of the wine would have been at spot in August versus what it ended up actually costing at the end of November, the wine ended up costing $ more. Question 8 of 10 1 Points Click to see additional instructions At the end of November, that December futures contract has gone up to $1.2820, so those contracts purchased last August are now worth $ Click to see additional instructions The profit, then, from the futures is $ Question 10 of 10 1 Points Click to see additional instructions In the end, the hedge was profitable for the wine merchant, whose net gain (losing on the increase in the cost of the wine, but winning on the futures contracts) is $ On August 1, an American wine merchant enters into a contract with a French wine export dealer to purchase 50 cases of 1999 Chateau Neuf Derriere wine with payment to be made on November 30. Each case will cost 10,000. Currently, the exchange rate is $1.20 to the euro, but the American wine merchant is convinced that the euro will strengthen against the dollar because of more aggressive anti-inflation monetary policy that will be carried out by the EU than by the U.S. This would make the cases of wine more expensive in dollars at the time of payment. For the problems below, express your answers to the nearest dollar. Click to see additional instructions On November 30, the euro has, indeed, increased to $1.2855. You now but those cases of wine for 50 cases x (10,000/case) = 500,000. The cost in dollars is, therefore, $ Question 7 of 10 1 Points Click to see additional instructions Based upon what the cost of the wine would have been at spot in August versus what it ended up actually costing at the end of November, the wine ended up costing $ more. Question 8 of 10 1 Points Click to see additional instructions At the end of November, that December futures contract has gone up to $1.2820, so those contracts purchased last August are now worth $ Click to see additional instructions The profit, then, from the futures is $ Question 10 of 10 1 Points Click to see additional instructions In the end, the hedge was profitable for the wine merchant, whose net gain (losing on the increase in the cost of the wine, but winning on the futures contracts) is $