Answered step by step

Verified Expert Solution

Question

1 Approved Answer

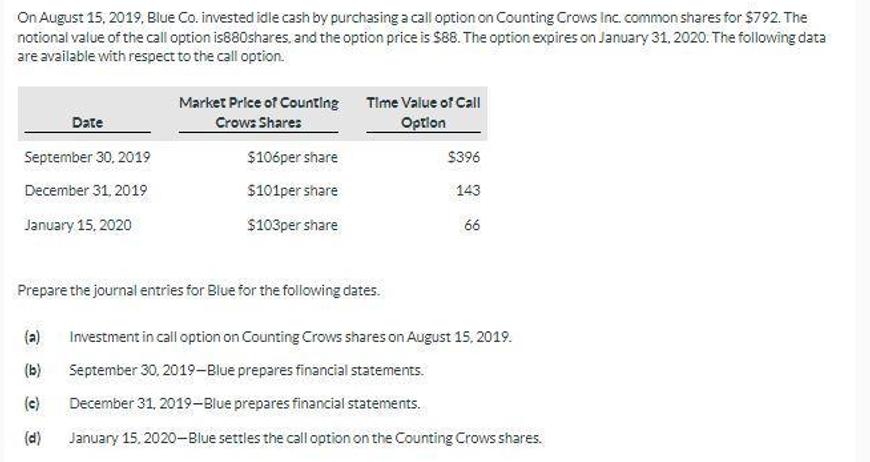

On August 15, 2019, Blue Co. invested idle cash by purchasing a call option on Counting Crows Inc. common shares for $792. The notional

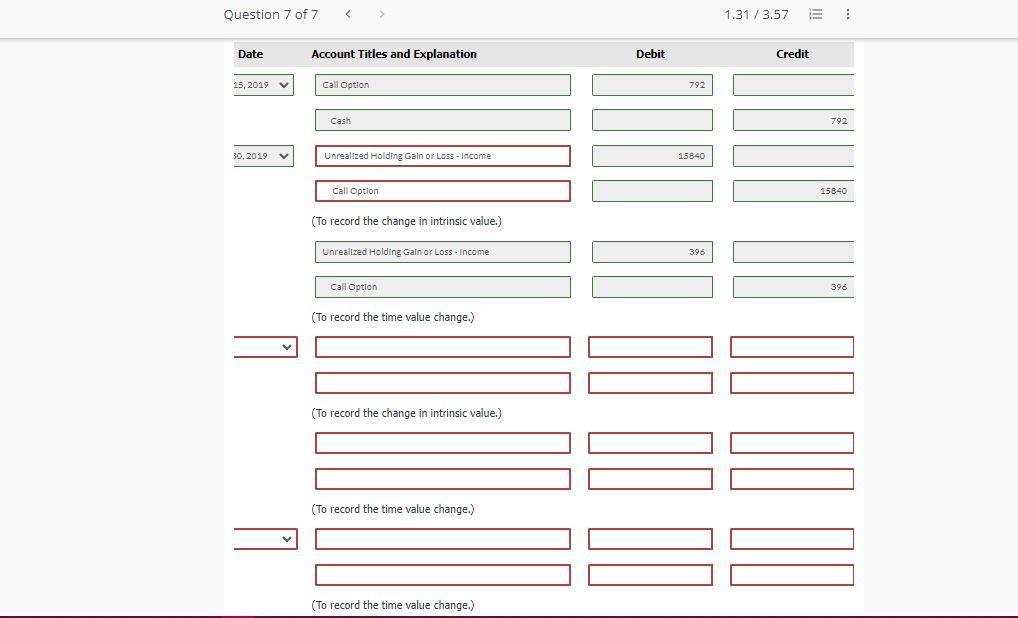

On August 15, 2019, Blue Co. invested idle cash by purchasing a call option on Counting Crows Inc. common shares for $792. The notional value of the call option is880shares, and the option price is $88. The option expires on January 31, 2020. The following data are available with respect to the call option. Market Price of Counting Time Value of Call Date Crow: Shares Option September 30, 2019 $106per share $396 December 31, 2019 $101per share 143 January 15, 2020 $103per share 66 Prepare the journal entries for Blue for the following dates. (a) Investment in call option on Counting Crows shares on August 15, 2019. (b) September 30, 2019-Blue prepares financial statements. (c) December 31, 2019-Blue prepares financial statements. (d) January 15, 2020-Blue settles the call option on the Counting Crows shares. Question 7 of 7 Date Account Titles and Explanation Debit 15, 2019 Call Option Cash 792 30, 2019 Unrealized Holding Gain or Loss - Income 15840 Call Option (To record the change in intrinsic value.) Unrealized Holding Gain or Loss - Income Call Option (To record the time value change.) (To record the change in intrinsic value.) (To record the time value change.) (To record the time value change.) 396 1.31 / 3.57 E Credit 792 15840 396

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started