Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 15th, 20X3, ABC bank negotiated a 2-year currency swap with TRI Corp that seeks to receive a fixed rate of 6% p.a.

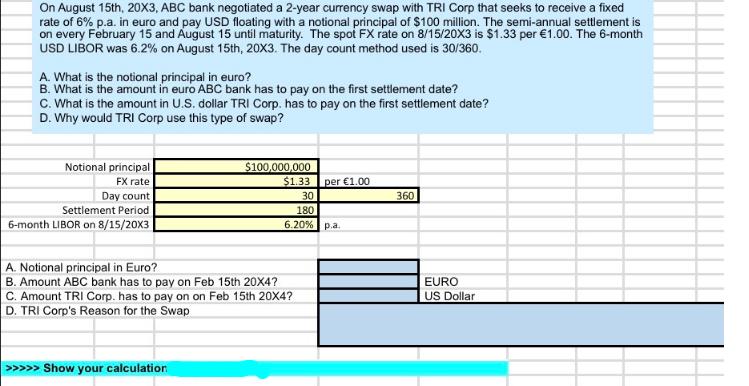

On August 15th, 20X3, ABC bank negotiated a 2-year currency swap with TRI Corp that seeks to receive a fixed rate of 6% p.a. in euro and pay USD floating with a notional principal of $100 million. The semi-annual settlement is on every February 15 and August 15 until maturity. The spot FX rate on 8/15/20X3 is $1.33 per 1.00. The 6-month USD LIBOR was 6.2% on August 15th, 20X3. The day count method used is 30/360. A. What is the notional principal in euro? B. What is the amount in euro ABC bank has to pay on the first settlement date? C. What is the amount in U.S. dollar TRI Corp. has to pay on the first settlement date? D. Why would TRI Corp use this type of swap? Notional principal FX rate Day count Settlement Period 6-month LIBOR on 8/15/20X3 $100,000,000 $1.33 >>>>> Show your calculation A. Notional principal in Euro? B. Amount ABC bank has to pay on Feb 15th 20X4? C. Amount TRI Corp. has to pay on on Feb 15th 20X4? D. TRI Corp's Reason for the Swap per 1.00 30 180 6.20% p.a. 360 EURO US Dollar

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the values requested well use the given information and perform the necessary calculations A Notional principal in Euro The notional principal in USD is 100 million To calculate the notio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started