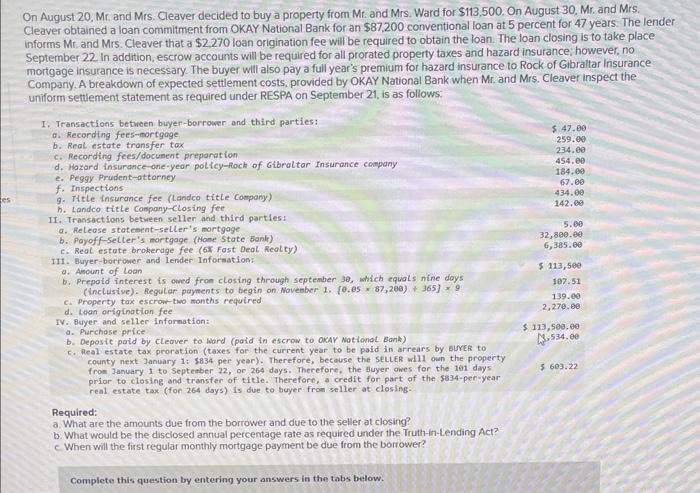

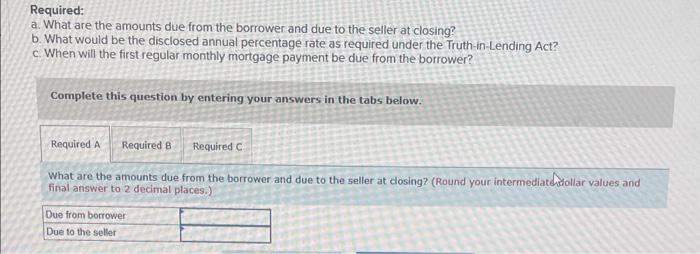

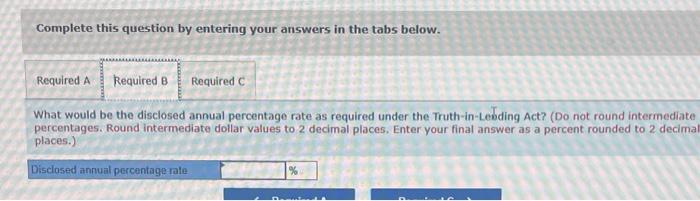

On August 20. Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $113,500. On August 30 , Mr. and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $87,200 conventional loan at 5 percent for 47 years. The lender informs Mr, and Mrs. Cleaver that a $2,270 loan origination fee will be required to obtain the loan. The loan closing is to take place jrance the Complete this question by entering your answers in the tabs below. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at dosing? (Round your intermediatdaxollar values and final answer to 2 decimal places.) Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lebding Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places, Enter your final answer as a percent rounded to 2 decima places.) Complete this question by entering your answers in the tabs below. When will the first reqular monthly mortgage payment be due from the borrower? On August 20. Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $113,500. On August 30 , Mr. and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $87,200 conventional loan at 5 percent for 47 years. The lender informs Mr, and Mrs. Cleaver that a $2,270 loan origination fee will be required to obtain the loan. The loan closing is to take place jrance the Complete this question by entering your answers in the tabs below. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at dosing? (Round your intermediatdaxollar values and final answer to 2 decimal places.) Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lebding Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places, Enter your final answer as a percent rounded to 2 decima places.) Complete this question by entering your answers in the tabs below. When will the first reqular monthly mortgage payment be due from the borrower