Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On August 24, 2009, Morgan Stan- ley issued global medium term notes as described in the attached prospectus (see next page). As an analyst

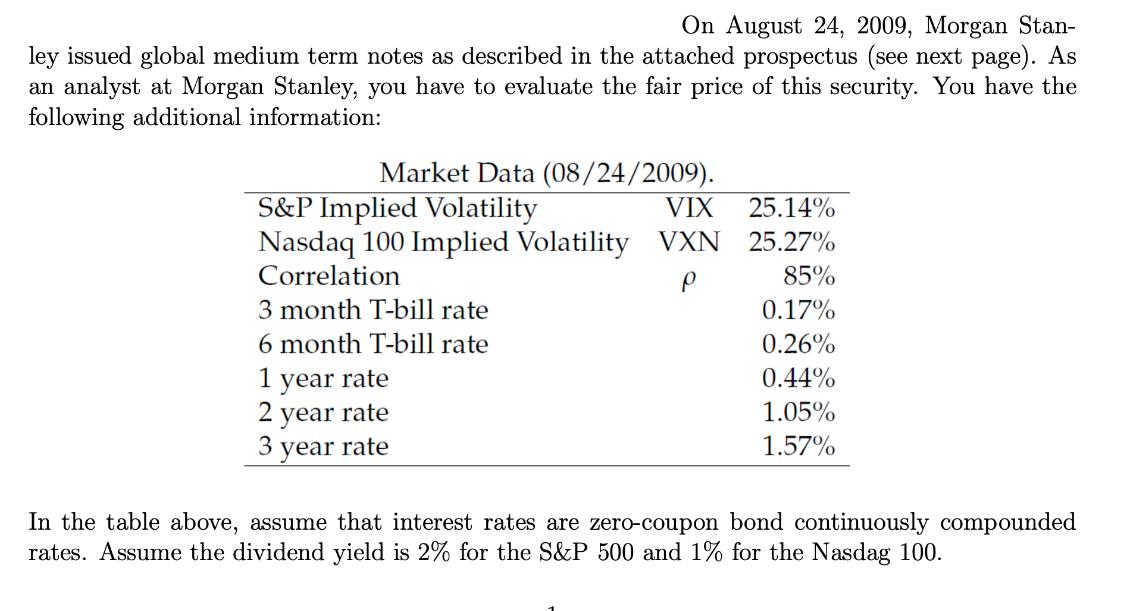

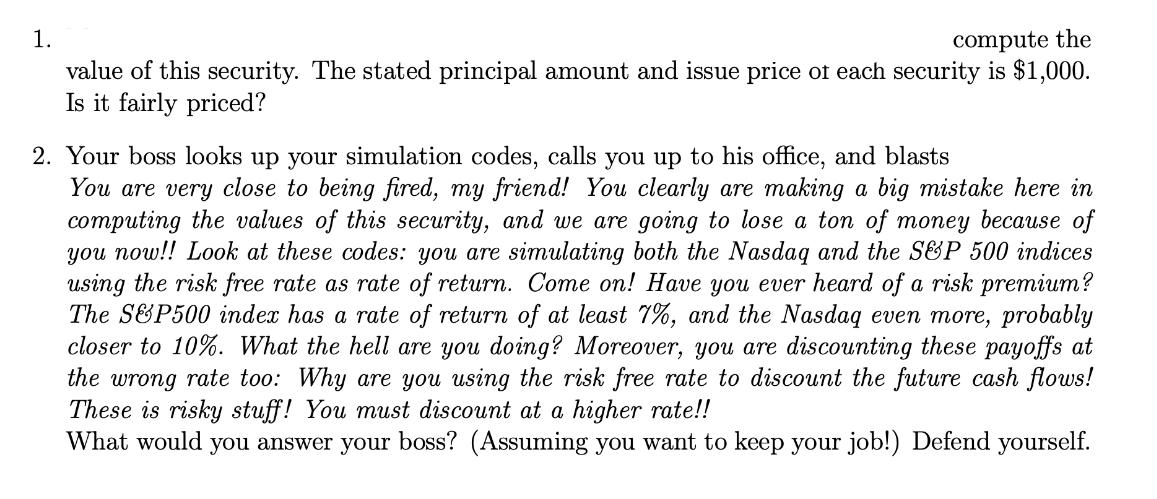

On August 24, 2009, Morgan Stan- ley issued global medium term notes as described in the attached prospectus (see next page). As an analyst at Morgan Stanley, you have to evaluate the fair price of this security. You have the following additional information: Market Data (08/24/2009). S&P Implied Volatility VIX Nasdaq 100 Implied Volatility VXN Correlation P 3 month T-bill rate 6 month T-bill rate 1 year rate 2 year rate 3 year rate 25.14% 25.27% 85% 0.17% 0.26% 0.44% 1.05% 1.57% In the table above, assume that interest rates are zero-coupon bond continuously compounded rates. Assume the dividend yield is 2% for the S&P 500 and 1% for the Nasdag 100. 1. compute the value of this security. The stated principal amount and issue price of each security is $1,000. Is it fairly priced? 2. Your boss looks up your simulation codes, calls you up to his office, and blasts You are very close to being fired, my friend! You clearly are making a big mistake here in computing the values of this security, and we are going to lose a ton of money because of you now!! Look at these codes: you are simulating both the Nasdaq and the S&P 500 indices using the risk free rate as rate of return. Come on! Have you ever heard of a risk premium? The S&P500 index has a rate of return of at least 7%, and the Nasdaq even more, probably closer to 10%. What the hell are you doing? Moreover, you are discounting these payoffs at the wrong rate too: Why are you using the risk free rate to discount the future cash flows! These is risky stuff! You must discount at a higher rate!! What would you answer your boss? (Assuming you want to keep your job!) Defend yourself.

Step by Step Solution

★★★★★

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Dear Dr Kevin Owens I appreciate your feedback and concerns regarding the computation of the value of the security I understand that the issues you ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started