Question

On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating leases. The entity incurred legal fees and transfer

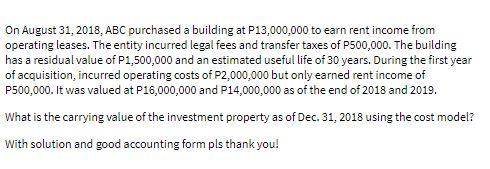

On August 31, 2018, ABC purchased a building at P13,000,000 to earn rent income from operating leases. The entity incurred legal fees and transfer taxes of P500,000. The building has a residual value of P1,500,000 and an estimated useful life of 30 years. During the first year of acquisition, incurred operating costs of P2,000,000 but only earned rent income of P500,000. It was valued at P16,000,000 and P14,000,000 as of the end of 2018 and 2019. What is the carrying value of the investment property as of Dec. 31, 2018 using the cost model? With solution and good accounting form pls thank you!

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Recorded value of the Building P13000000 P500000 Legal f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A Critical Approach

Authors: John Friedlan

4th edition

1259066525, 978-1259066528

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App