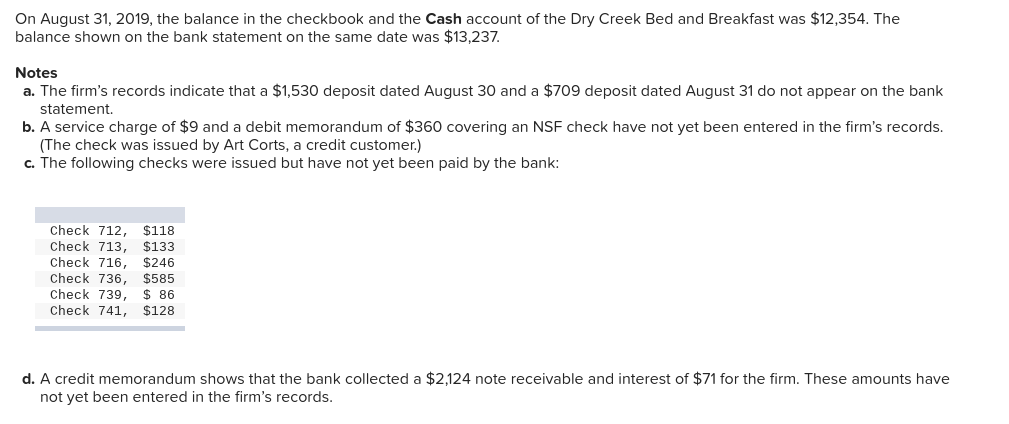

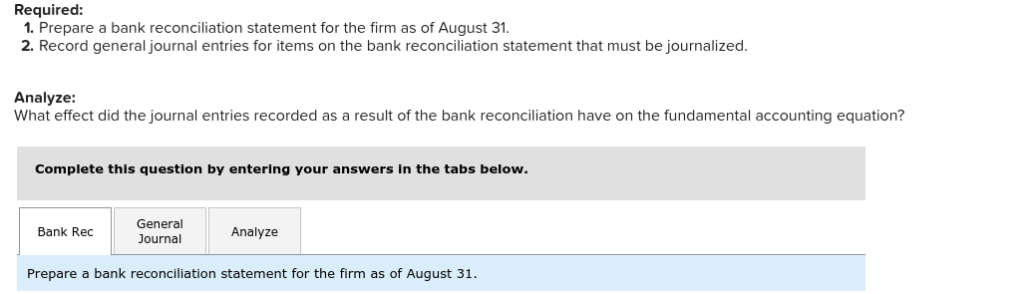

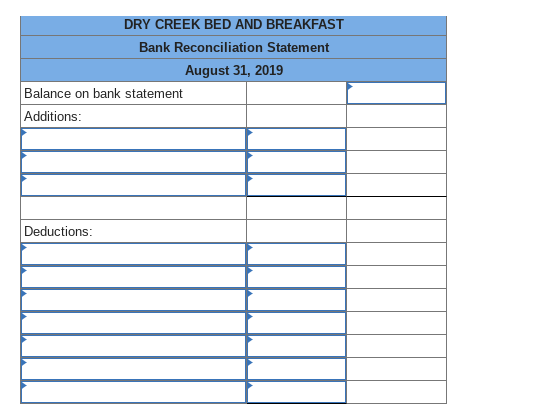

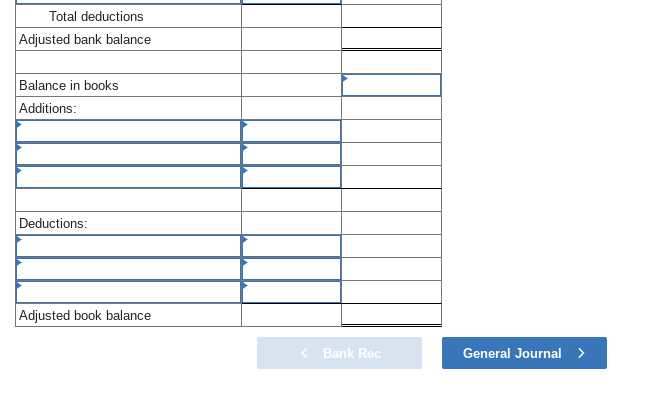

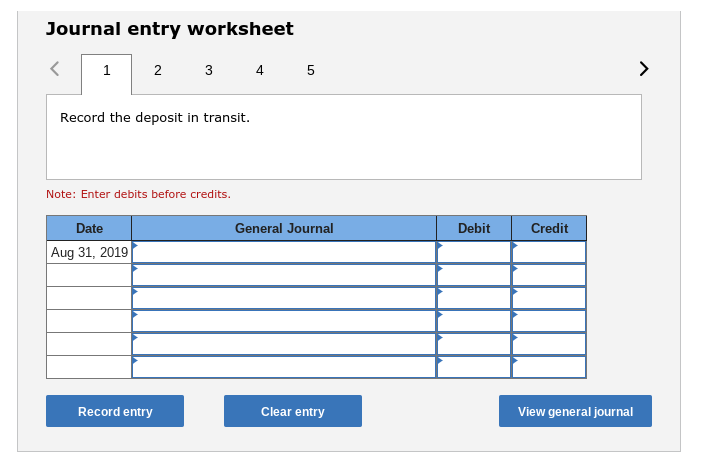

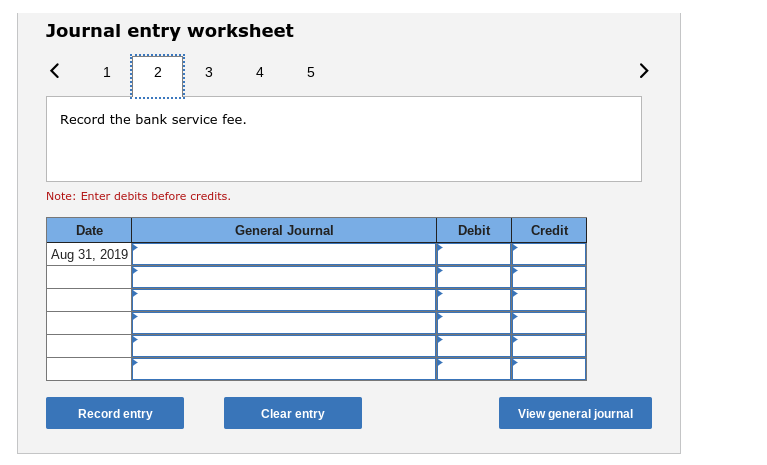

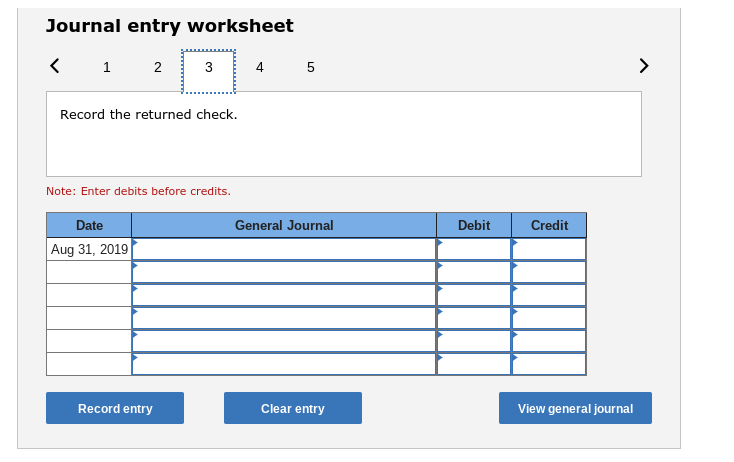

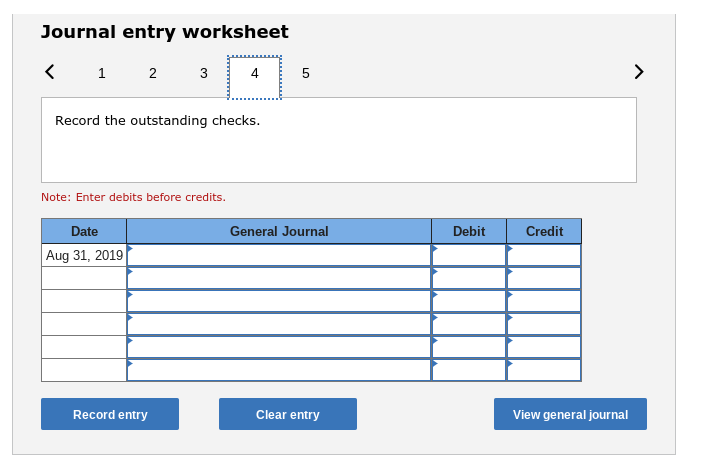

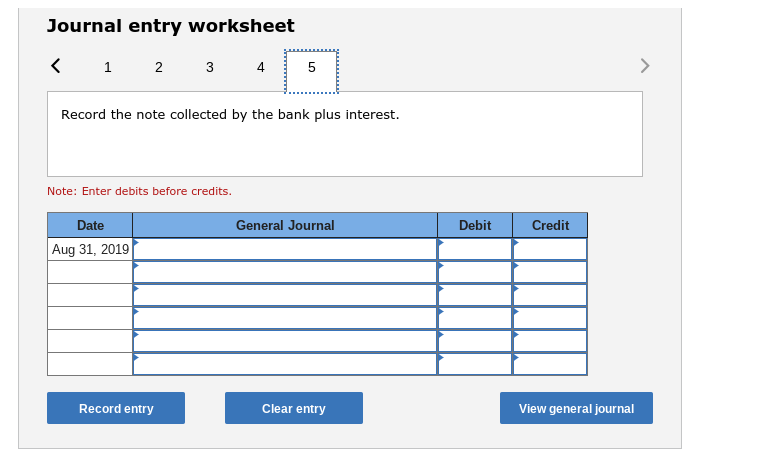

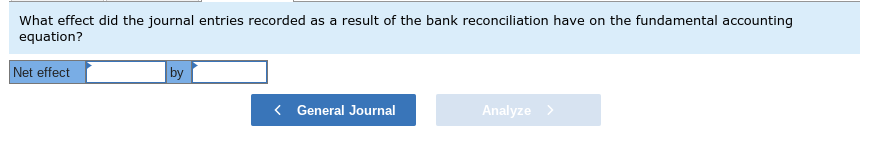

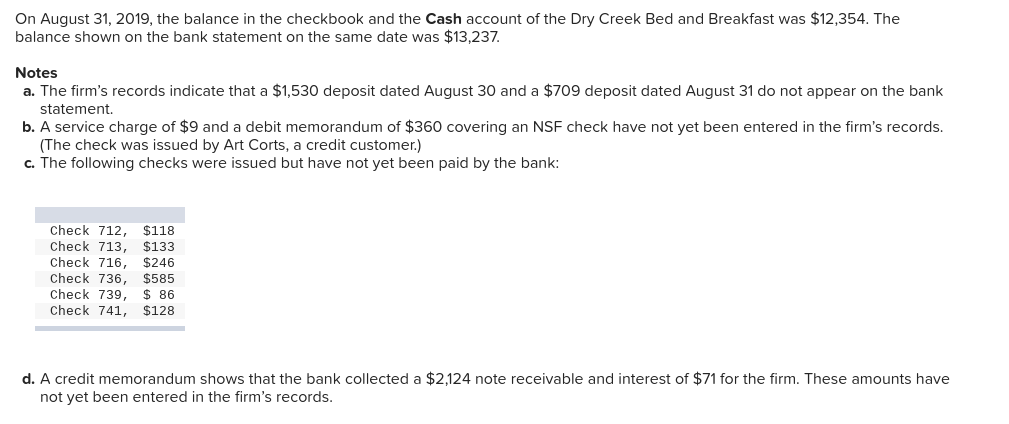

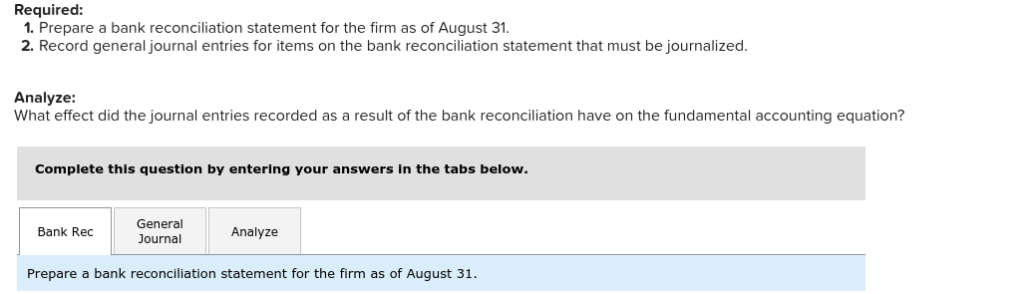

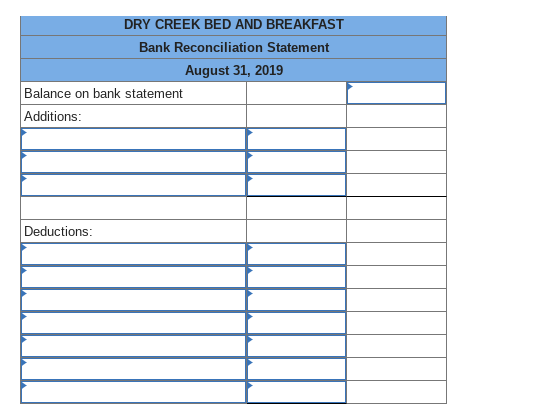

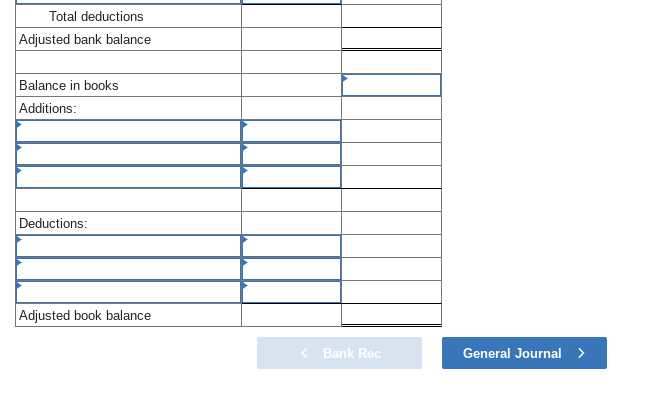

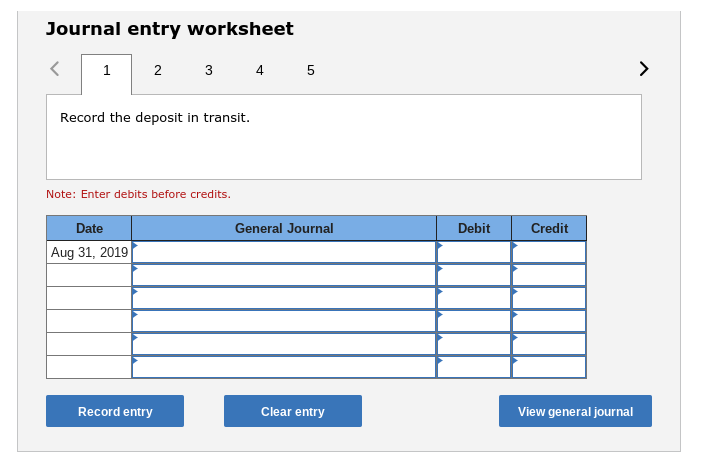

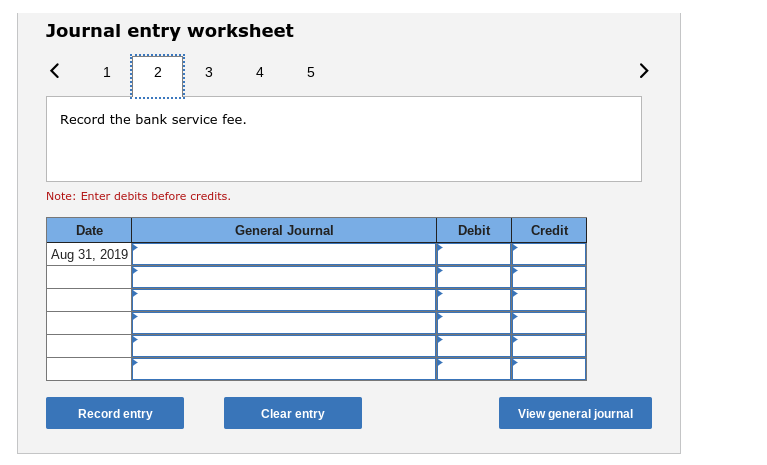

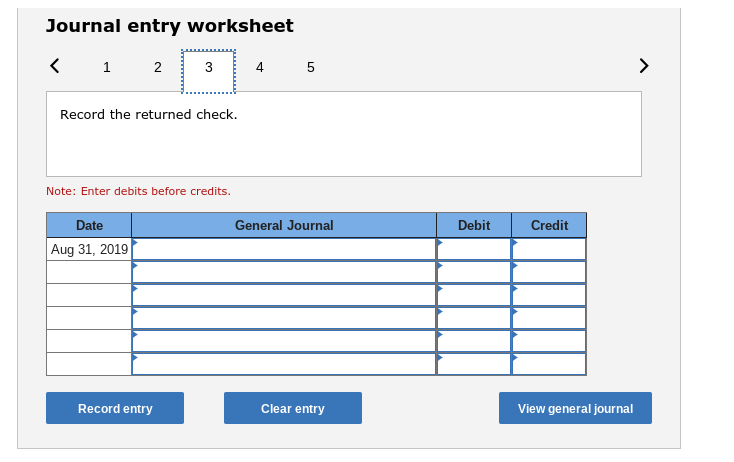

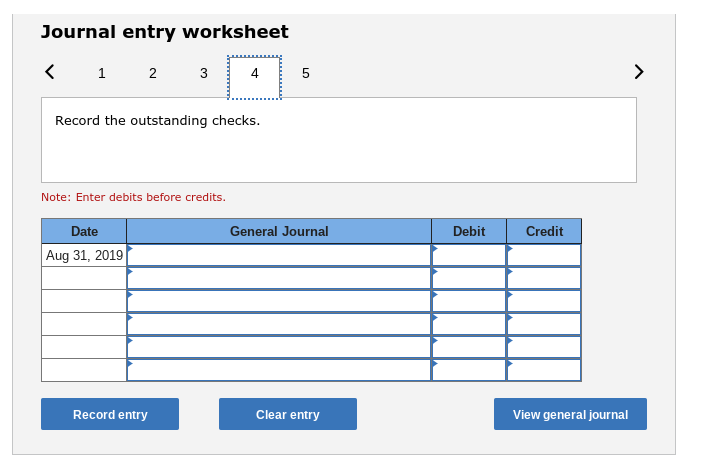

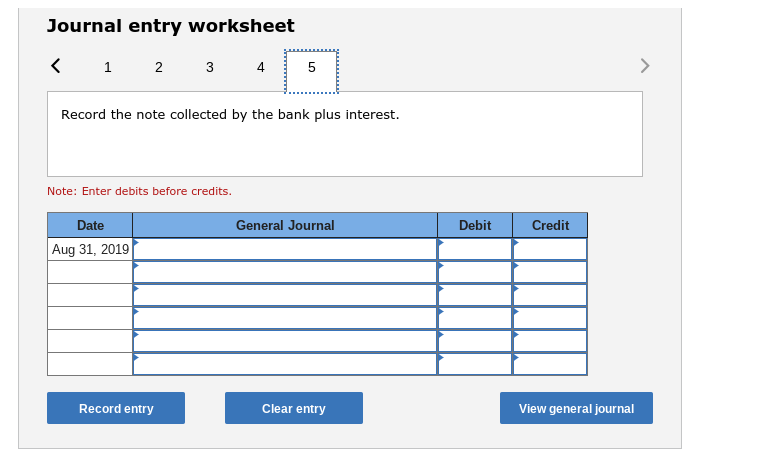

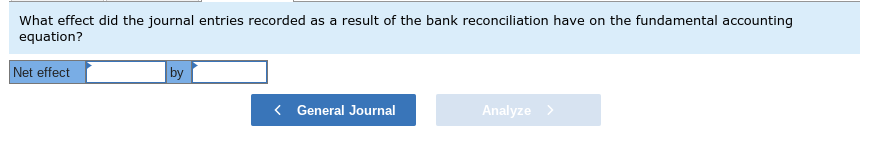

On August 31, 2019, the balance in the checkbook and the Cash account of the Dry Creek Bed and Breakfast was $12,354. The balance shown on the bank statement on the same date was $13,237 Notes a. The firm's records indicate that a $1,530 deposit dated August 30 and a $709 deposit dated August 31 do not appear on the bank statement. b. A service charge of $9 and a debit memorandum of $360 covering an NSF check have not yet been entered in the firm's records. The check was issued by Art Corts, a credit customer.) c. The following checks were issued but have not yet been paid by the bank check 712, $118 Check 713, $133 Check 716, $246 Check 736, $585 Check 739, 86 Check 741, $128 d. A credit memorandum shows that the bank collected a $2,124 note receivable and interest of $71 for the firm. These amounts have not yet been entered in the firm's records. Required 1. Prepare a bank reconciliation statement for the firm as of August 31 2. Record general journal entries for items on the bank reconciliation statement that must be journalized Analyze: What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? Complete this question by entering your answers in the tabs below. General JournalAnalyze Bank Rec Prepare a bank reconciliation statement for the firm as of August 31 DRY CREEK BED AND BREAKFAST Bank Reconciliation Statement August 31, 2019 Balance on bank statement Additions Deductions Total deductions Adjusted bank balance Balance in books Additions Deductions Adjusted book balance Bank Rec General Journal Journal entry worksheet 3 4 Record the deposit in transit. Note: Enter debits before credits. Date General Journal Debit Credit Aug 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 3 4 5 Record the bank service fee. Note: Enter debits before credits. Date General Journal Debit Credit Aug 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 4 Record the returned check. Note: Enter debits before credits. Date General Journal Debit Credit Aug 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 4 5 Record the outstanding checks Note: Enter debits before credits. Date General Journal Debit Credit Aug 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 4 Record the note collected by the bank plus interest. Note: Enter debits before credits Date General Journal Debit Credit Aug 31, 2019 Record entry Clear entry View general journal What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? Net effect by