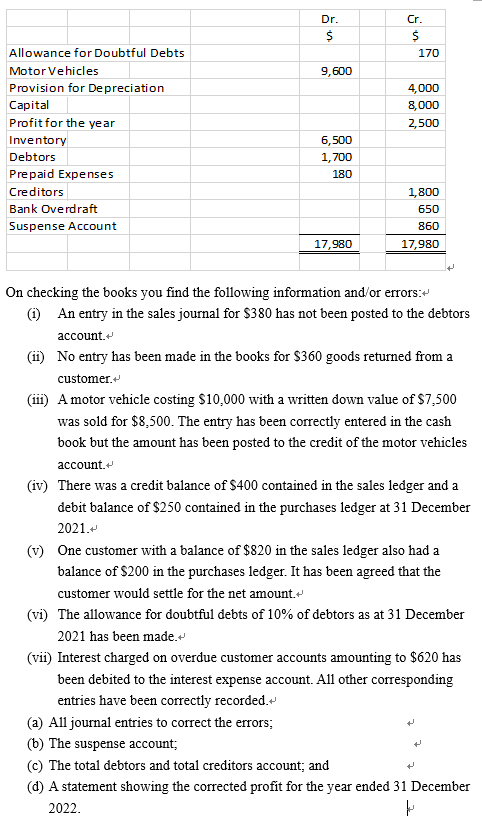

On checking the books you find the following information and/or errors: (i) An entry in the sales journal for $380 has not been posted to the debtors account. (ii) No entry has been made in the books for $360 goods returned from a customer. (iii) A motor vehicle costing $10,000 with a written down value of $7,500 was sold for $8,500. The entry has been correctly entered in the cash book but the amount has been posted to the credit of the motor vehicles account. (iv) There was a credit balance of $400 contained in the sales ledger and a debit balance of $250 contained in the purchases ledger at 31 December 2021 (v) One customer with a balance of $820 in the sales ledger also had a balance of $200 in the purchases ledger. It has been agreed that the customer would settle for the net amount. (vi) The allowance for doubtful debts of 10% of debtors as at 31 December 2021 has been made. (vii) Interest charged on overdue customer accounts amounting to $620 has been debited to the interest expense account. All other corresponding entries have been correctly recorded. (a) All journal entries to correct the errors; (b) The suspense account; (c) The total debtors and total creditors account; and (d) A statement showing the corrected profit for the year ended 31 December On checking the books you find the following information and/or errors: (i) An entry in the sales journal for $380 has not been posted to the debtors account. (ii) No entry has been made in the books for $360 goods returned from a customer. (iii) A motor vehicle costing $10,000 with a written down value of $7,500 was sold for $8,500. The entry has been correctly entered in the cash book but the amount has been posted to the credit of the motor vehicles account. (iv) There was a credit balance of $400 contained in the sales ledger and a debit balance of $250 contained in the purchases ledger at 31 December 2021 (v) One customer with a balance of $820 in the sales ledger also had a balance of $200 in the purchases ledger. It has been agreed that the customer would settle for the net amount. (vi) The allowance for doubtful debts of 10% of debtors as at 31 December 2021 has been made. (vii) Interest charged on overdue customer accounts amounting to $620 has been debited to the interest expense account. All other corresponding entries have been correctly recorded. (a) All journal entries to correct the errors; (b) The suspense account; (c) The total debtors and total creditors account; and (d) A statement showing the corrected profit for the year ended 31 December