Question: You are asked to study the financial viability of a 3-year investment project. After consulting the main suppliers of this type of equipment, this

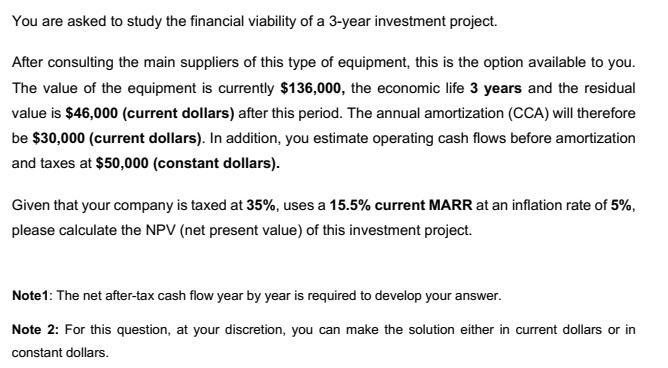

You are asked to study the financial viability of a 3-year investment project. After consulting the main suppliers of this type of equipment, this is the option available to you. The value of the equipment is currently $136,000, the economic life 3 years and the residual value is $46,000 (current dollars) after this period. The annual amortization (CCA) will therefore be $30,000 (current dollars). In addition, you estimate operating cash flows before amortization and taxes at $50,000 (constant dollars). Given that your company is taxed at 35%, uses a 15.5% current MARR at an inflation rate of 5%, please calculate the NPV (net present value) of this investment project. Note 1: The net after-tax cash flow year by year is required to develop your answer. Note 2: For this question, at your discretion, you can make the solution either in current dollars or in constant dollars.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts