Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Dec. 31, 2021, Nation Gym leased a fitness diagnostic machine from Get Fit Corp. Get Fit has the machine in its inventory at

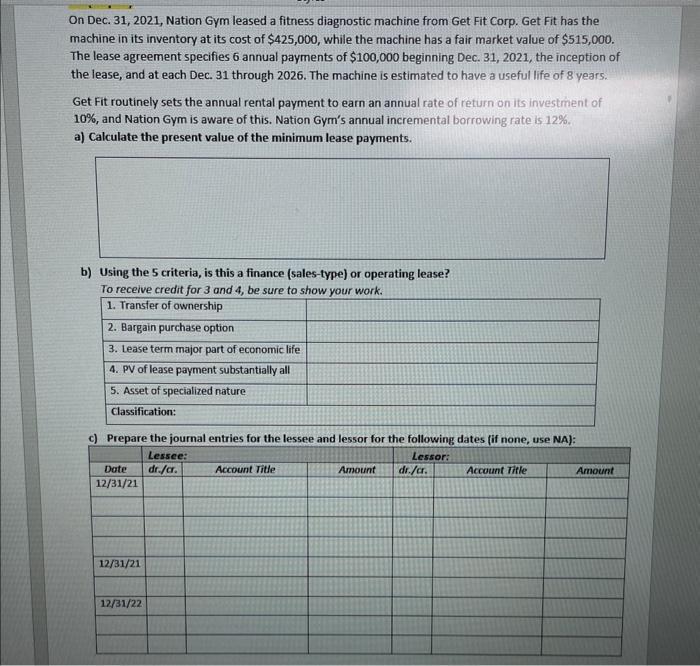

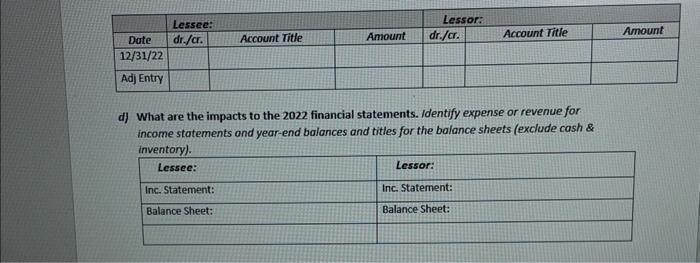

On Dec. 31, 2021, Nation Gym leased a fitness diagnostic machine from Get Fit Corp. Get Fit has the machine in its inventory at its cost of $425,000, while the machine has a fair market value of $515,000. The lease agreement specifies 6 annual payments of $100,000 beginning Dec. 31, 2021, the inception of the lease, and at each Dec. 31 through 2026. The machine is estimated to have a useful life of 8 years. Get Fit routinely sets the annual rental payment to earn an annual rate of return on its investment of 10%, and Nation Gym is aware of this. Nation Gym's annual incremental borrowing rate is 12%. a) Calculate the present value of the minimum lease payments. b) Using the 5 criteria, is this a finance (sales-type) or operating lease? To receive credit for 3 and 4, be sure to show your work. 1. Transfer of ownership 2. Bargain purchase option 3. Lease term major part of economic life 4. PV of lease payment substantially all 5. Asset of specialized nature Classification: c) Prepare the journal entries for the lessee and lessor for the following dates (if none, use NA): Lessor: Date dr./cr. 12/31/21 12/31/21 Lessee: 12/31/22 Account Title Amount dr./cr. Account Title Amount Date 12/31/22 Adj Entry Lessee: dr./cr. Account Title Balance Sheet: Amount Lessor: dr./cr. d) What are the impacts to the 2022 financial statements. Identify expense or revenue for income statements and year-end balances and titles for the balance sheets (exclude cash & inventory). Lessee: Inc. Statement: Account Title Lessor: Inc. Statement: Balance Sheet: Amount

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The question consists of several parts that relate to a lease agreement between Nation Gym and Get F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started