Answered step by step

Verified Expert Solution

Question

1 Approved Answer

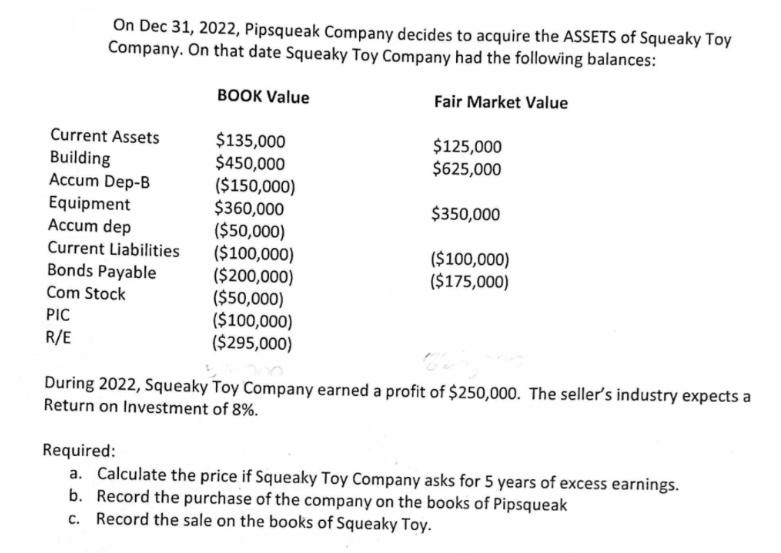

On Dec 31, 2022, Pipsqueak Company decides to acquire the ASSETS of Squeaky Toy Company. On that date Squeaky Toy Company had the following

On Dec 31, 2022, Pipsqueak Company decides to acquire the ASSETS of Squeaky Toy Company. On that date Squeaky Toy Company had the following balances: BOOK Value Fair Market Value Current Assets Building Accum Dep-B Equipment Accum dep Current Liabilities $135,000 $450,000 ($150,000) $360,000 ($50,000) ($100,000) ($200,000) ($50,000) ($100,000) ($295,000) $125,000 $625,000 $350,000 Bonds Payable Com Stock ($100,000) ($175,000) PIC R/E During 2022, Squeaky Toy Company earned a profit of $250,000. The seller's industry expects a Return on Investment of 8%. Required: a. Calculate the price if Squeaky Toy Company asks for 5 years of excess earnings. b. Record the purchase of the company on the books of Pipsqueak c. Record the sale on the books of Squeaky Toy.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

0 Priee i4 squeaky Toy Company aiki for 5years of exces earnings Purchase coneideration AuettL...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started