Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 2016, Vibrant Company, a US firm, sold goods on credit to a retail outlet located in Italy. The transaction was denominated

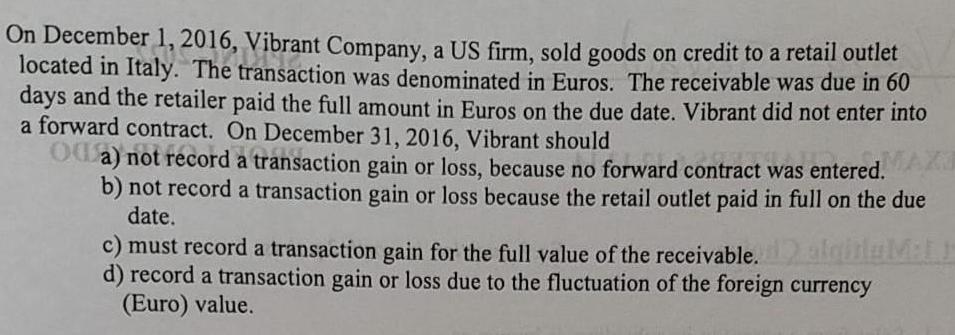

On December 1, 2016, Vibrant Company, a US firm, sold goods on credit to a retail outlet located in Italy. The transaction was denominated in Euros. The receivable was due in 60 days and the retailer paid the full amount in Euros on the due date. Vibrant did not enter into a forward contract. On December 31, 2016, Vibrant should Od a) not record a transaction gain or loss, because no forward contract was entered. b) not record a transaction gain or loss because the retail outlet paid in full on the due date. c) must record a transaction gain for the full value of the receivable. algiuM:L d) record a transaction gain or loss due to the fluctuation of the foreign currency (Euro) value.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A Not record a transaction gain or loss because no forward contract was entered When the forw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started