Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 2019, Karin Company declared property dividends of equipment payable on February 28, 2020. The carrying amount of the equipment on December

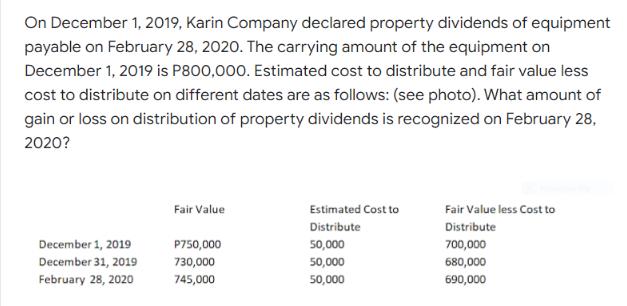

On December 1, 2019, Karin Company declared property dividends of equipment payable on February 28, 2020. The carrying amount of the equipment on December 1, 2019 is P800,000. Estimated cost to distribute and fair value less cost to distribute on different dates are as follows: (see photo). What amount of gain or loss on distribution of property dividends is recognized on February 28, 2020? December 1, 2019 December 31, 2019 February 28, 2020 Fair Value P750,000 730,000 745,000 Estimated Cost to Distribute 50,000 50,000 50,000 Fair Value less Cost to Distribute 700,000 680,000 690,000

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the gain or loss on the distribution of property dividends on February 28 2020 yo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started