Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 2020, Solvent Company assigned specific accounts receivable totaling P5,000,000 as collateral on a P4,000,000 12% note from a certain bank. The

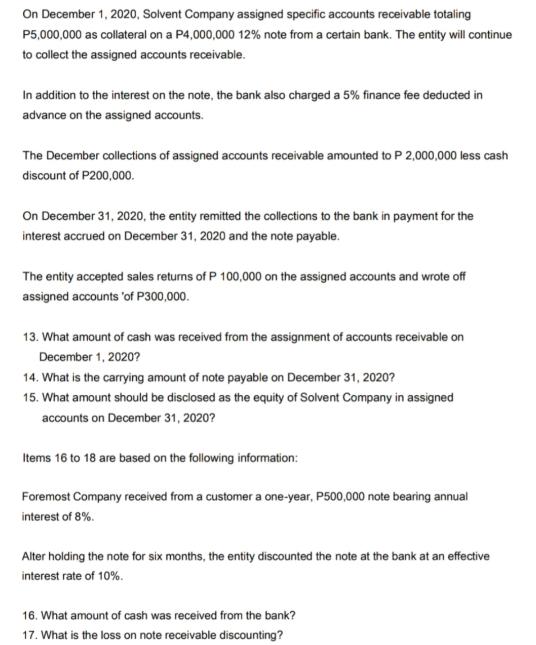

On December 1, 2020, Solvent Company assigned specific accounts receivable totaling P5,000,000 as collateral on a P4,000,000 12% note from a certain bank. The entity will continue to collect the assigned accounts receivable. In addition to the interest on the note, the bank also charged a 5% finance fee deducted in advance on the assigned accounts. The December collections of assigned accounts receivable amounted to P 2,000,000 less cash discount of P200,000. On December 31, 2020, the entity remitted the collections to the bank in payment for the interest accrued on December 31, 2020 and the note payable. The entity accepted sales returns of P 100,000 on the assigned accounts and wrote off assigned accounts of P300,000. 13. What amount of cash was received from the assignment of accounts receivable on December 1, 2020? 14. What is the carrying amount of note payable on December 31, 2020? 15. What amount should be disclosed as the equity of Solvent Company in assigned accounts on December 31, 2020? Items 16 to 18 are based on the following information: Foremost Company received from a customer a one-year, P500,000 note bearing annual interest of 8%. Alter holding the note for six months, the entity discounted the note at the bank at an effective interest rate of 10%. 16. What amount of cash was received from the bank? 17. What is the loss on note receivable discounting?

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

13 To determine the amount of cash received from the assignment of accounts receivable on December 1 2020 we need to consider the total assigned accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started