Question

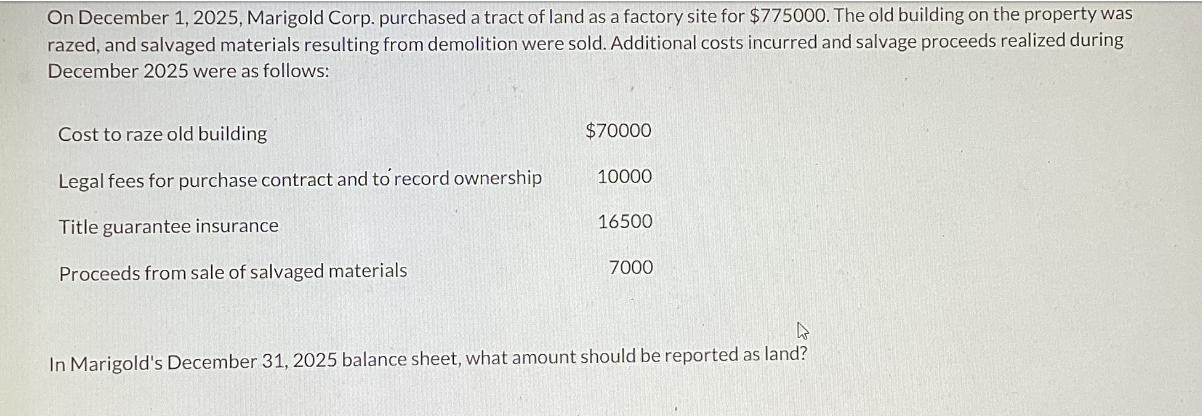

On December 1, 2025, Marigold Corp. purchased a tract of land as a factory site for $775000. The old building on the property was

On December 1, 2025, Marigold Corp. purchased a tract of land as a factory site for $775000. The old building on the property was razed, and salvaged materials resulting from demolition were sold. Additional costs incurred and salvage proceeds realized during December 2025 were as follows: Cost to raze old building $70000 Legal fees for purchase contract and to record ownership 10000 Title guarantee insurance 16500 Proceeds from sale of salvaged materials 7000 In Marigold's December 31, 2025 balance sheet, what amount should be reported as land?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep Cost of land tract of land 77500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App